New infrastructure fund provides global diversification

Infrastructure investment trusts have the potential to deliver steady, inflation beating returns, but most are heavily biased towards UK-based assets that are dependent on the local economy and political zeitgeist. When Global Diversified Infrastructure (LON: GDIV) floats on the London Stock Exchange later this month it will provide exposure to a number of different countries and enable investors in the sector to spread their risk.

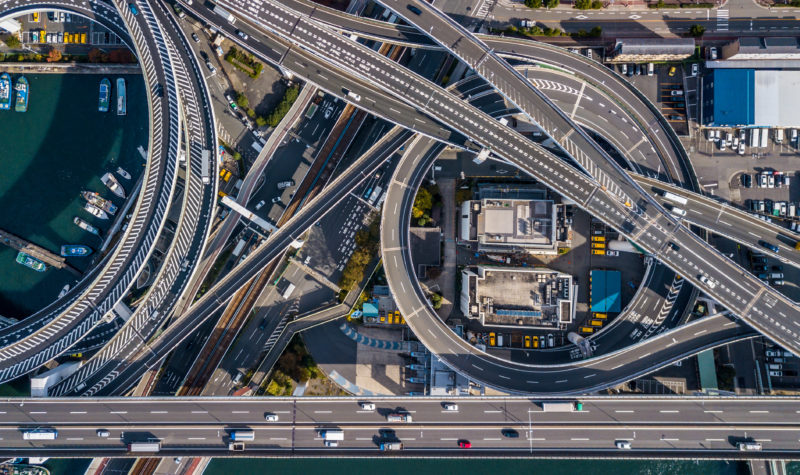

GDIV will mainly invest in the sort of private (unlisted) infrastructure funds that are normally inaccessible to retail investors. The underlying projects will primarily be located in the US, Canada, Europe and the UK and will consist of a range of different assets including wind farms, toll roads to airports, schools and healthcare accommodation.

These types of projects have built up a good track record. Private infrastructure funds launched between 2004 and 2014 have delivered an attractive median net internal rate of return of 10% per annum. There are now more than 1,250 of these funds for the managers to choose from and between them they provide exposure to over 28,000 different assets.

The new vehicle will be managed by Gravis Capital Management, which already advises on funds worth £2.3bn. Most of this consists of specialist infrastructure mandates including the investment trusts: GCP Infrastructure (LON: GCP), GCP Student Living (LON: DIGS) and GCP Asset Backed Income (LON: GABI). The management fee will be 0.65% of NAV and there will be no performance fee, although there will be additional charges on the underlying funds.

The typical stake in each fund is expected to be £10m to £20m and it is likely that the initial capital will be substantially committed for investment within 8 months of the IPO. Once fully invested it will provide exposure to more than 100 underlying projects and these will be fairly evenly divided between energy generation, accommodation, transportation and regulated utilities.

Public sector infrastructure projects financed by private capital have become a controversial area in the UK following the announcement by the Labour party that they would be looking at bringing them back in-house if they form the next government. Elsewhere though there is a massive demand for this sort of arrangement. For example, President Trump’s $1.5 trillion infrastructure spending plan only includes $200bn of public finance with private investment making up the balance.

Global Diversified Infrastructure will take advantage of these opportunities and will aim to generate attractive total returns via a combination of capital growth and sustainable, growing distributions over the long-term. It is targeting returns of 8% to 10% per annum.

The issue price will be 100 pence per share and Gravis are hoping to raise a total of £200m. If all goes to plan they will pay a dividend of 3p in year one, followed by 4.5p in year two and then will increase the distributions over time.

According to data from Winterflood Securities, infrastructure investment trusts have generated an average share price total return of 58% in the last 5 years and they are now yielding an average of 5.1%. Global Diversified Infrastructure will add international exposure and provide a way to reduce the risks associated with the UK economy and political landscape.

If you want to invest from the outset you will need to get your application in to your broker by the 26th of March. The shares will then be admitted to the stock market on April 3rd.

Comments (0)