Murray International: solid performer with a 4.3% yield

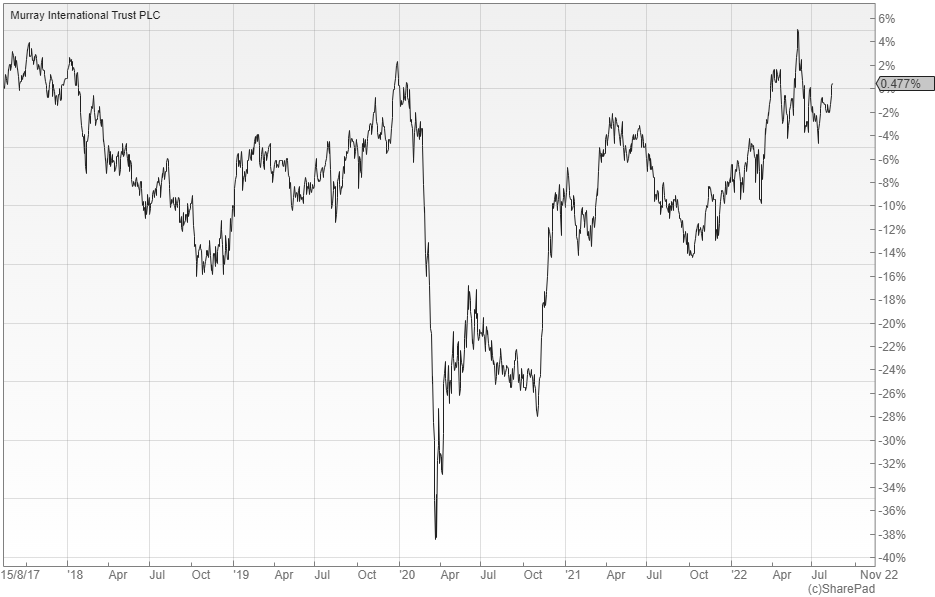

It has been a tough start to the year for the global sector with most of the major indices falling in unison, yet Murray International (LON: MYI) was still able to carve out a positive return. The £1.7bn investment trust increased its NAV by 3.8% in the six months to the end of June compared to a 10.5% decline in the FTSE All-World benchmark, while its shares rallied 9.5% as the discount narrowed.

Manager Bruce Stout aims to achieve an above average level of income, with long-term growth in dividends and capital ahead of inflation, by investing in a global portfolio of quality companies. The portfolio has a bias towards Asia and emerging markets relative to global indices, as this is the area that he thinks has the most scope for positive cyclical surprises.

Stout looks for high quality businesses with competitive moats and attractive industry dynamics, as well as strong financials, management teams and ESG credentials. He will only then invest when the companies are trading on appropriate valuations based on earnings, free cash flow and dividend yields.

The underlying portfolio

The largest weighting at the end of June was Asia Pacific ex Japan, which made up 28.4% of the portfolio, followed by the US at 28.2%, Europe 22.1%, Latin America and emerging markets 14.1% and the UK 6.2%. Most of the exposure took the form of equities, although there was also an eight percent allocation to fixed income.

During the six month reporting period its US stocks made a positive contribution despite the decline in the S&P 500, largely as a result of the exposure to defensive names, while the Canadian pipeline operators performed well amidst the strong demand for gas. Defensive holdings also did well in Asia, including various companies in the telecoms sector, yet the standout performer was Latin America with a 24.1% total return from the region.

Profits were taken in Asian growth names such as Taiwan Semiconductor and Samsung Electronics at the start of the year and this meant that there was no additional investment in the region over the six months, although the current exposure is expected to be maintained given the strong prospects of dividend growth and attractive absolute valuations. The largest change to the asset allocation was in Europe where the manager took advantage of the volatility to add another four percent to his existing holdings in the area.

Outlook

Stout believes that the investment environment is likely to remain extremely challenging, but says that the portfolio remains focused on both geographical and sector diversification, with real assets and quality balance sheets. The shares are currently available at a two percent discount to NAV and yield an attractive 4.3% with quarterly distributions.

Murray International was a resilient performer in the 2008/09 financial crisis, but since then the lack of exposure to US technology stocks has really hurt it until the start of this year. In the period since June, when tech has rallied sharply, the fund has once again fallen behind with a NAV total return of 3.1% versus a 9.1% gain in the FTSE All-World index.

The broker Numis says that the recent performance highlights the value of the fund as a diversifier of returns and the benefits of retaining exposure to a mix of vehicles with a range of different risk/return profiles. They believe that it remains an attractive option for more defensively minded investors looking for yield, particularly given the uncertain macro-economic backdrop.

I sold my holding last year. My worries, Asian exposure with Asia sagging under Chinese lockdown policy with no end in sight, Europe (big exposure) with geopolitical risk including has shortage for industry, UK inflation problems, big exposure to south America (history of defaults) worried me and in the bond holding there were copious South American bonds.

All of this concerned me so I sold the lot which I had held for 7 years with positive results. I thought the world had changed post COVID and gospodin Putin, and the trust me was not positioned for the change.

Buyer beware imo

Murray International total returns over 1 year 21%. Next best in the sector is Henderson International on 6%. Tolle your timing could not have been worse!