JLEN Environmental Assets: a six percent yield with high inflation linkage

JLEN Environmental Assets (LON: JLEN) invests in a portfolio of environmental infrastructure projects with the aim of generating a sustainable financial return.It currently owns 37 different assets located around the UK and Europe including: onshore wind, solar, waste and wastewater processing plants, hydro and anaerobic digestion plants, low carbon transport and battery storage.

The broker Winterflood says that the portfolio is diversified by technology, revenue source and geography, which they believe would be difficult to replicate. They like the fact that it has been able to access less competitive areas of the market and evolving areas of environmental infrastructure, which in their opinion will produce higher returns.

Since the IPO in March 2014 the fund has generated an annualised total shareholder return of 7.4% per annum, which is broadly in line with its objective. It has recently made its first divestment of two French wind farms at a 25% uplift to their carrying value, which provides some comfort for the validity of the valuations.

Benefitting from higher power prices and inflation

During the financial year to the end of March the investment manager observed a 200% increase in electricity prices, while gas was up by a staggering 400%. This enabled the fund to fix higher prices across the wind, solar and anaerobic digestion assets and to replace expiring Power Price Agreements at higher levels in excess of previous assumptions.

JLEN actively fixes energy prices out to three years to reduce exposure to power price volatility and protect the dividend cover that is comfortably over 100%. Currently 53% of the portfolio has fixed price arrangements to the end of March 2024, which gives the income a certain defensive quality.

The fund’s earnings are highly correlated with inflation due to revenues from PFI assets, green benefits for renewable energy and most operational costs being directly linked to an inflation index. Overall approximately 62% of the portfolio by value benefits from inflation linkage.

Large, diversified portfolio

The fund now has a generating capacity of 360MW, a 16% increase on the year before and has locked in the current high power prices across more than half of the portfolio by value. It has grown from just eight assets at launch to 37 worth a collective £800m and these are diversified both by type and geography with most being fully owned.

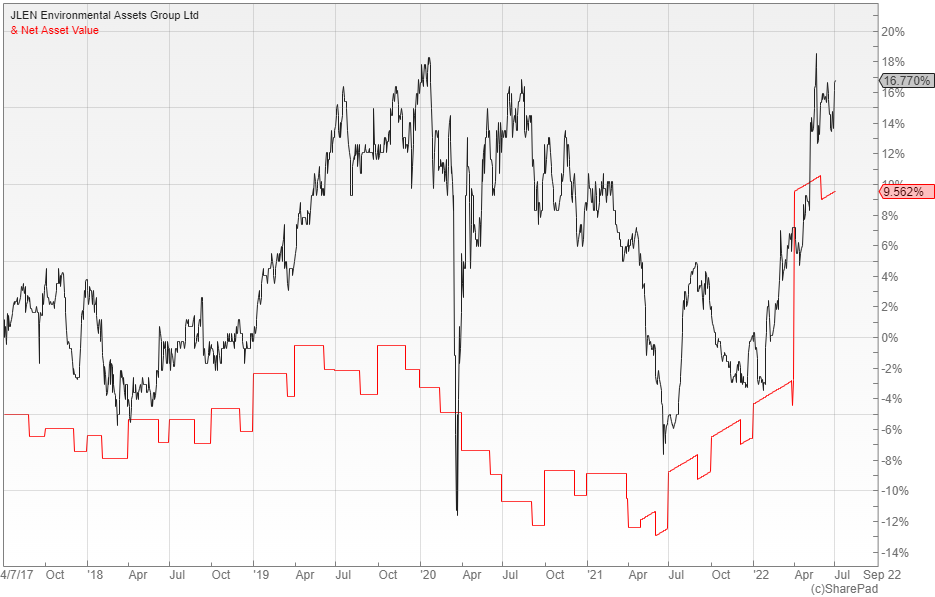

Since the IPO JLEN has increased its dividend by around two percent per annum with the target pay-out now standing at 7.14 pence per share. This gives the fund a prospective yield of around six percent with quarterly distributions, which is one of the highest in its peer group, yet the six percent premium to NAV is towards the lower end of the sector.

Environmental infrastructure is one of the few asset classes that enables investors to benefit from high power prices and to provide a degree of protection against inflation. The yield is extremely attractive and the premium fairly modest given the high income, so it is no surprise that Winterflood have added it to their model portfolio.

Comments (0)