Is this a buying opportunity for private equity?

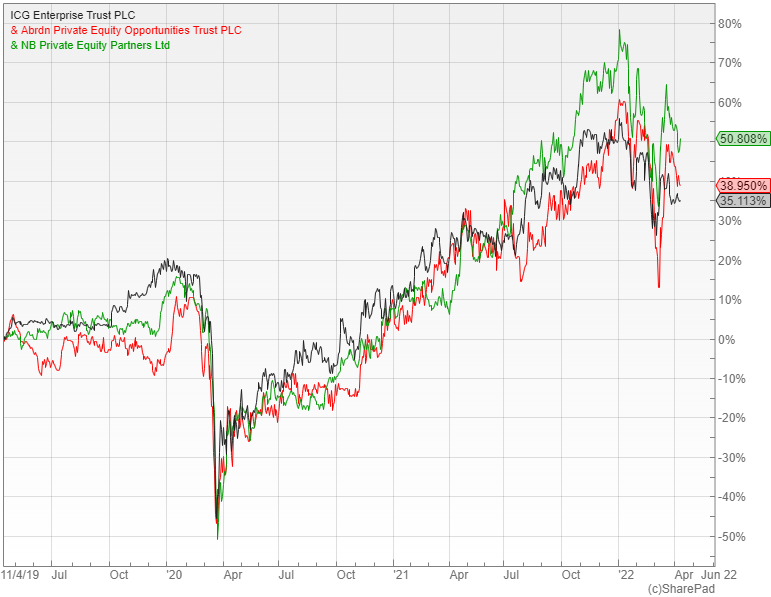

A number of listed private equity funds have recently reported impressive results for 2021, yet their share prices have fallen as volatility has increased, creating an attractive potential entry point.

A recent report by the broker Winterflood has highlighted an opportunity that has opened up in the private equity sector. These funds invest in unlisted companies, many of which are high growth businesses whose valuations are being heavily discounted by the market due to the sharp rise in government bond yields.

The strongest performance last year came from the likes of HarbourVest Global Private Equity (LON: HVPE), the Hg Capital Trust LON: HGT) and NB Private Equity (LON: NBPE) with NAV returns of 50%, 44% and 42% respectively. Despite these excellent numbers the average share price fall in the sector year-to-date is nine percent, while the peer group average discount has widened from 15% at the start of the year to 21% the end of March.

Winterflood believe that the share price falls have been overdone and think that the sector represents an attractive opportunity. They point out that most listed private equity funds currently possess strong balance sheets with plenty of cash generated from realisations, while the outstanding commitments appear manageable.

Change in fortune

2021 was a golden year for private equity with the strong returns driven by: the growth in revenues and earnings by the underlying portfolio companies; the rise in comparable earnings multiples by their listed peers; and the strong uplift in the valuations of the realisations. It has been a very different story year-to-date with rising bond yields undermining growth stocks right across the board.

In the first quarter of 2022, 16 of the 21 listed private equity funds delivered a negative share price return, while a further three lagged behind the increase in the FTSE All-Share index. Discounts have widened as a result with 14 of the funds priced 15% or more below their net asset value (NAV).

Winterflood believe that the long-term drivers of investment activity remain strong, namely: the relatively cheap debt, the liquidity available for new investments and the abundance of cash-rich trade buyers. They say that this underpins the current valuation levels, which are fairly modest, with uplifts on disposals expected as and when the number of deals picks up.

Recommendations

The broker has three preferred funds in the sector, the first of which is the £1.1bn ICG Enterprise Trust (LON: ICGT) that is currently trading on a 30% discount to NAV. At this level Winterflood believe that it offers compelling value given its excellent long-term performance record.

Their second selection is the one billion pound Abrdn Private Equity Opportunities (LON: APEO) that was formerly Standard Life Private Equity and is available on a 25% discount. They like its fund-of-funds approach that involves investing in the ‘best in class’ managers.

The other option they highlight is the £1.2bn NB Private Equity (LON: NBPE) that is available on a 29% discount. They think it is hard to justify this sort of pricing given the potential that exists in the portfolio and the pedigree of its investment manager.

Comments (0)