Is the bond market giving a clear signal about inflation or is it too distorted to tell?

The key debate for investors is whether the increase in inflation is transitory or permanent, but using the bond market as a guide could be misleading.

It all seemed so simple in the first quarter of the year with government bond yields rising in line with inflation and economic growth in textbook fashion. Since peaking at 1.77% at the end of March however, the benchmark 10-year US Treasury has slipped back below 1.30% despite the strong economic recovery and CPI figures coming in at multi-year highs.

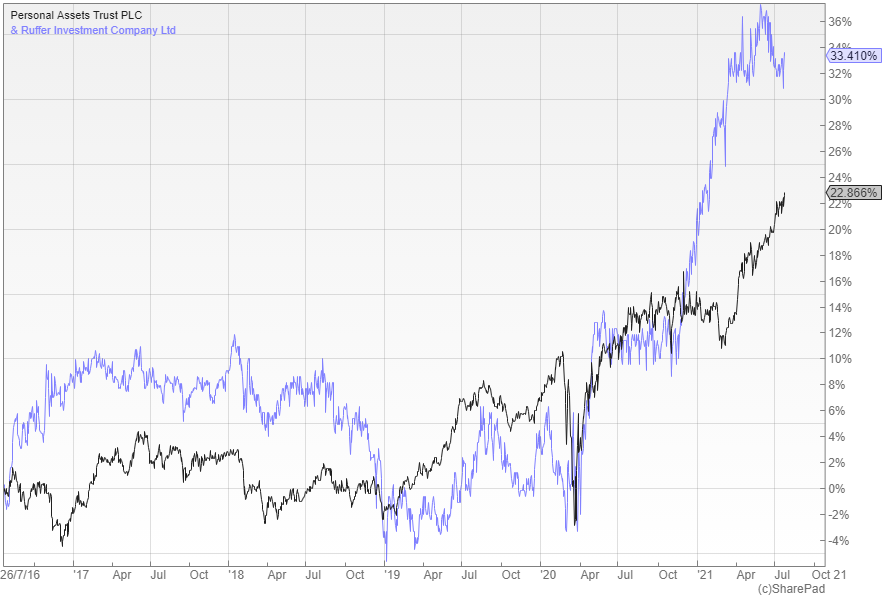

There is now a massive debate about what is going on with two of the managers that I most respect having slightly different views on the matter. The team at the Ruffer Investment Company (LON:RICA) said recently in their year-end review, “Our conviction in the long-term inflationary endgame has never been higher but we are cognisant of the fact that the journey to that point will not be direct and the timing is uncertain.”

Sebastian Lyon, the manager of the Personal Assets Trust (LON:PNL), is not so sure and said that the bond market might be giving us a reasonable indicator that perhaps inflation may this time not be as sticky as potentially accepted. “There is definitely a risk of higher inflation and higher nominal yields. But at the moment we’re open-minded.”

Why have yields declined and why does it matter?

Analysts have been speculating about why yields have been falling, with one suggestion being that peak growth has already been achieved with the recovery being undermined by the more contagious delta variant. Other possibilities include fading hopes of further stimulus and the waning impact of fiscal benefits that were introduced during lockdown.

Or it could just be that more investors have accepted the Fed’s argument that the increase in inflation is transitory and will settle back once the distortions from the pandemic work their way through the system. This will certainly have an effect, but it is impossible to know how much things will quieten down.

If inflation and yields have peaked and we return to the low growth, low inflation environment that we have become accustomed to, it would tend to favour growth stocks rather than value, with some of the commodity prices potentially settling back. There is however another potential explanation.

Could it be the Treasury?

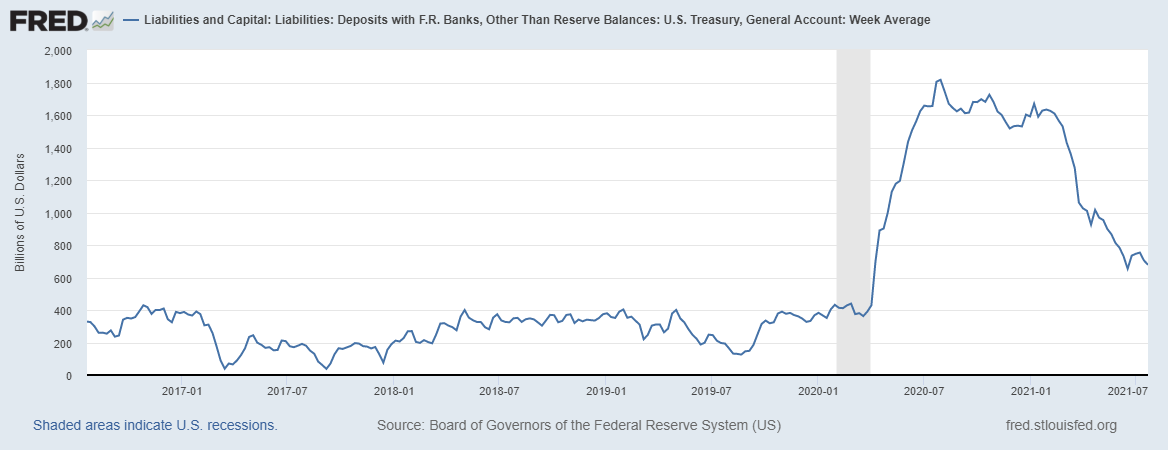

There is no secret about the fact that the Fed is buying $80bn a month of Treasuries and $40bn of mortgage-backed securities, as part of its quantitative easing programme, which is keeping a lid on yields, but the US Treasury could also have played a significant role in recent months through its General Account that is held at the Fed. This is essentially the chequing account for the federal government.

Last year it had accumulated a balance of around $1.8 trillion, but it said it wanted to reduce this to about $450bn by the end of July when Congress will have to approve a new deal to allow the government to go on borrowing money. It was concerned that it could be accused of stockpiling cash ahead of the deadline, but the upshot is that more than a trillion dollars of liquidity has flooded the system in recent months with some of it ending up in the Fed’s overnight reverse repo facility and some of it no doubt ending up in Treasuries.

Only time will tell if the extra liquidity has resulted in a misleading signal from the bond market or if inflation truly is transitory, but either way, Ruffer and Personal Assets should both do well. Each of these defensive multi-asset trusts are positioned for an ongoing period of financial repression where interest rates are held below inflation, a scenario that should hold true regardless of the final inflation numbers.

10 year Italian govt bonds yield just 0.7% but Italy is on life support from the ECB as it has a 3 trillion euro debt and is unlikely to be able to pay it back. Personally I would not lend Italy money. One wonders how long this situation can persist with German hawks getting restless about ECB largesse in continually buying up Italy’s bonds. The two dangers are the ECB pulling the plug, or global inflation and interest rates rising which would render the 0.7% yield inadequate and a sell off in Italy’s bonds

Passive flows in US markets represent 55% of trades. They use an algo to allocate cash based on the way the yield curve wobbles. The big tax inflows fooled the algo into buying TLT etc. Add that to the need for less issuance of bonds + the fact that QE is still in progress ( a process where probably no attention is paid whatsoever to price paid for the bonds!!)

This likely explains part of the contradiction that markets are displaying.