Is now the time to buy into China?

The Chinese stock market has been on a rollercoaster of a ride, rising strongly after the initial pandemic-inspired sell-off, only to give back all of the gains following the government’s new interventionist approach. Premier Li’s zero Covid policy has also been a major drag, but recent developments suggest that the worst could now be over.

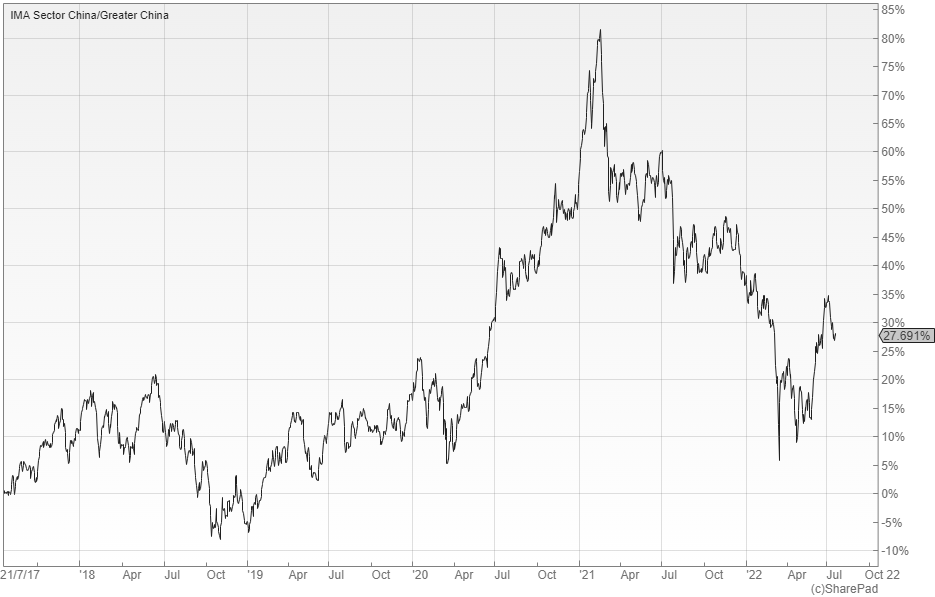

The Investment Association’s China/Greater China sector was the worst performing area of the open-ended funds market in the year to the end of April with an average loss of 24.4%. Since then however there has been a sharp turnaround with a gain of 10.75% in June alone.

Ben Yearsley, a director at Shore Financial Planning, says that the fund managers who operate in China are saying that they can now see the light at the end of the Covid tunnel.

“The next five year Congress, scheduled for this autumn, will coincide with the ending of their zero Covid policy. China is also on a different fiscal and monetary path with easing happening rather than tightening.”

Significant fiscal support measures have been announced over the last few months, a process which gathered momentum after the nationwide teleconference of Premier Li on May 25. Since then many ministries and local governments have rushed to roll out more stimulus to help stabilise economic growth.

The impact of these policies can already be seen in the usual areas like infrastructure projects, as well as other parts of the economy such as the automotive sector. Even China’s troubled property market has started to benefit.

Just as significant is the apparent shift in the focus of the Chinese leadership away from the zero Covid policy ‘at any price’, to a more balanced view, in favour of economic goals. The regulatory environment for tech companies has also begun to improve.

PLEASE INCLUDE CHART ONE

What prompted the sell-off?

Rob Morgan, spokesperson and chief analyst at Charles Stanley, says that the Chinese stock market came under pressure last year as authorities moved to clamp down on regulatory concerns and certain business activities.

“The Chinese government has become more interventionist towards listed companies, looking closely at issues such as competition, data protection, consumer rights, employee’s rights and wellbeing. Large profitable corporates have been told to make substantial charitable donations to boost domestic improvements for the not-so-well-off.”

The technology sector in particular has faced tougher regulation. Some of the harshest new measures include restrictions on raising capital and listing in the US, as well as on anti-competitive behaviour.

At the same time the authorities have been trying to reduce the overall levels of borrowing, with worries about the credit worthiness of the property sector in particular. This part of the market has seriously overheated and one of the big companies − Evergrande − has defaulted on some of its foreign bonds.

Ryan Hughes, head of active portfolios at AJ Bell, says that the lingering impact of Covid has continued to provide a strong headwind to the Chinese market as a series of lockdowns has constrained economic growth.

“Add in the very real fears, particularly from overseas investors, that the government will continue its tough line towards companies making what it judges to be excess profits and its clear why capital has shifted away from Chinese equities over the past year.”

Inflation, growth and Covid

The reason that China is able to ease monetary policy when the rest of the world is tightening is because inflation in the country appears muted. Unlike the US, where the cost of living is rising at an alarming rate, in China annual CPI inflation is only 2.1%.

The gap between the two countries can largely be attributed to the nature of China’s pandemic policy. Stimulus targeted the corporate sector to boost supply through investment, rather than by ramping up consumer demand, as was the case in the US.

China is also experiencing less inflation from supply chain bottlenecks, which suggests that Beijing policymakers have more room to ease policy without the risk of driving up inflation than their American counterparts.

The Chinese government has set a target for the economy to grow by around 5.5% in 2022 in real terms, which is highly unlikely given the uncertainty around Covid, so there is a good chance that interest rates will be cut further.

There has been an increase in local cases across the country this year and lockdowns in major cities, such as Shanghai and Shenzhen, which have proved economically damaging. This is probably why the government is moving to a more dynamic ‘zero Covid’ policy, which incorporates mass testing and quick lockdowns to reduce the disruption. It is a subtle shift, but one that suggests that they have accepted the need to find a way of living with the disease.

Looking ahead

Morgan says that while the problems related to Covid and the property sector will likely pass, the trend of state intervention is somewhat uncertain and could continue to cast a shadow over Chinese equities going forwards.

“It is clear that private firms are the engine of China’s growth and job creation, so excessively punishing the entrepreneurs who can innovate and create more jobs is unwise. However the risks of greater government intervention and increased costs of compliance are likely to mean that investors continue to demand a significant valuation discount.”

The recent performance of Chinese equities could indicate that some people are beginning to believe that the worst of the problems are now over. Covid restrictions have started to be eased, which should boost economic activity, while the government has tried to reassure investors that its crackdown, particularly on the technology sector, has come to an end.

“For some investors, fears of further government action will likely see them remain cautious for the foreseeable future, particularly given how they wiped out the private education sector at a stroke. For others, the easing headwinds will no doubt provide an opportunity to take another look at this key market,” notes Hughes.

It certainly seems as though things have started to improve on several different fronts. If that view gains traction then investors will eventually be drawn by the attractive valuations.

“Government intervention will always be a risk in China, but many commentators make the point that some of the things the government is trying to do – like making education fair and accessible to all and reducing monopolies in some sectors – are positive moves. Investors just need to be aware of these risks when investing in the region and decide if they are comfortable with them,” explains Darius McDermott, MD of FundCalibre.

Time to buy?

The long-term argument for allocating to China is clear given that it remains on course to become the world’s largest economy by 2030. It is hugely under-represented in global benchmarks at around four percent, with MSCI looking to gradually increase the weighting to the domestic Chinese market, which will ultimately result in global investors increasing their allocation.

Hughes says that this structural tailwind provides an attractive backdrop for investors looking for reasons to invest in the market.

“The Chinese economy continues to go through a period of transformation, moving from an export and manufacturing model to one focused on domestic consumption. The A shares are particularly focused on the domestic market and allow investors to gain exposure to this theme.”

Economic stimulus in the form of interest rate cuts and other measures, as well as a tweaking of zero Covid policies to reduce disruption, all suggests that a positive re-rating may be on the cards.

There are still plenty of problems though, most notably the huge amount of bad loans in the banking sector including from overseas infrastructure investments. China’s construction industry is another important area that is suffering with thousands of homebuyers withholdings mortgage payments on unfinished properties.

Morgan is cautious and is not minded to increase exposure to mainland China due to the risks associated with the uncertain business environment.

“We prefer to harness the positive Chinese trends of rising middle class wealth and consumption growth through related markets in the Asia Pacific region, or companies in the developed world that have significant economic exposure there,” he says.

Fidelity China Special Situations

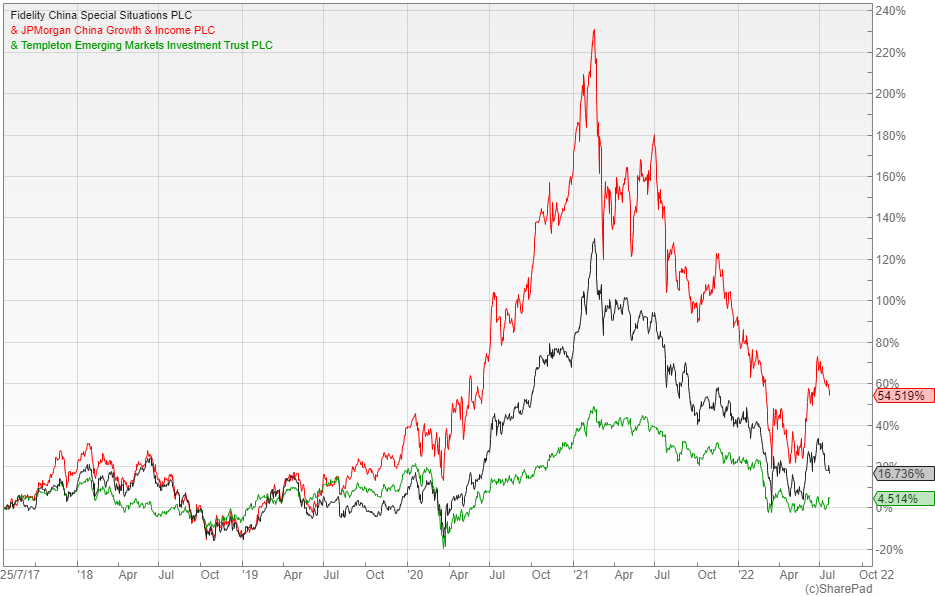

When looking at the available investment trusts, he recommends the £1.9bn Fidelity China Special Situations (LON: FCSS). This is a higher risk option within the area, with significant concentration at the stock level and gearing of around 25%, which magnifies the gains and losses on the underlying portfolio.

“Manager Dale Nicholls makes full use of the investment trust flexibility. He will gear when deemed appropriate, but also take short positions (to benefit from price falls) in individual stocks and indices. The trust also invests in private companies to a maximum of 10% of NAV,” says Morgan.

FCSS is benchmarked against the MSCI China index and represents a domestic Chinese investment with exposure to some of the lesser-known smaller and mid-sized companies.

Hughes is also a fan and says that the trust benefits from a very experienced manager who has the backing of significant resources on the ground in China.

“It is currently 40% underweight the largest companies in the benchmark and 40% overweight smaller companies, so it will be volatile, but it has proven that it can deliver significant outperformance when the conditions are right.”

Other investment trust options

McDermott prefers the £430m JPMorgan China Growth & Income Trust (LON: JCGI) that invests in ’Greater China’ companies that are quoted on the stock exchanges of Hong Kong, China, and Taiwan, including the A shares listed in Shenzhen and Shanghai.

“The performance of this trust has been nothing short of exceptional in recent years and it is currently geared to about 18%, which means it has done very well in the recent bounce.”

If you are looking for a broader regional exposure Morgan suggests the £2.1bn Templeton Emerging Markets (LON: TEM) that currently has about a quarter of the portfolio invested in China.

“It is the largest emerging markets investment trust by some distance and is now managed by Chetan Sehgal and Andrew Ness alongside a team with considerable industry experience. Well diversified by country and sector, it is a solid option for core emerging market exposure.”

You don’t tend to think of China as a source of income, yet some of these investment trusts have decent yields. For example, FCSS is currently paying 2.2%, JCGI 5.7% and TEM 2.5%, with the latter available at a 10% discount to NAV.

Chinese open-ended funds

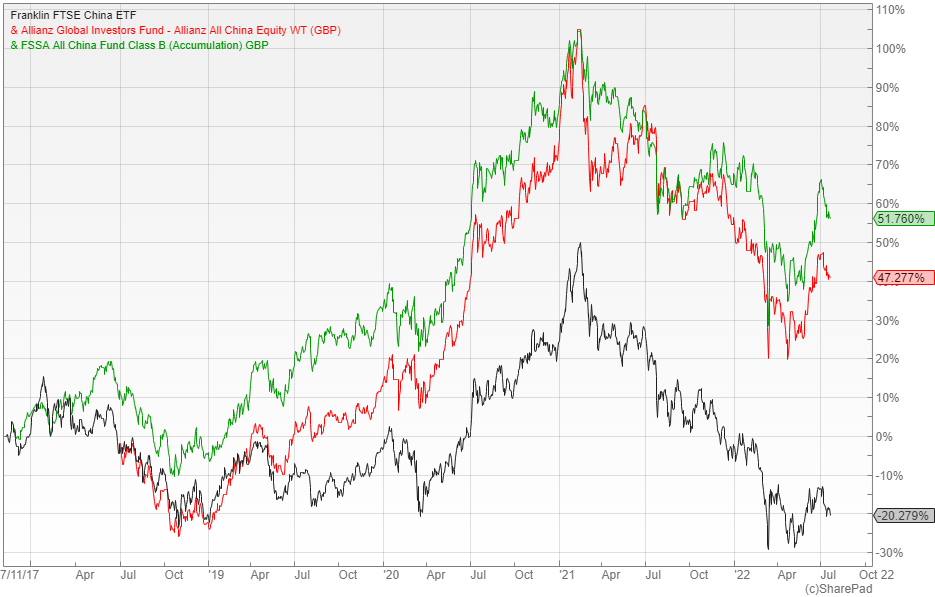

Given that many investors will be underweight the Chinese market, a simple passive exposure might be a useful starting point. If you want to go down this route Hughes suggests the Franklin FTSE China ETF that provides exposure to the core Chinese equity market of over 900 securities for just 0.19% per annum.

For those who would prefer an actively managed alternative he recommends Allianz All China Equity, which is run by a firm that has an excellent pedigree in the country, with strong resources in the region that benefit from an experienced team of managers and analysts.

“The managers are happy for the fund to look different to the benchmark and will invest across the range of different elements of the Chinese markets, having particular expertise in the A share market.”

Morgan likes First Sentier Greater China Growth thatinvests in high-quality companies in China, Hong Kong and Taiwan, with the manager prioritising well-run businesses that can deliver consistent growth in earnings over time.

“Asian equity veteran Martin Lau has been the fund’s lead manager since its 2003 launch and has been successful in keeping up with the dynamic and evolving opportunity set. He can draw upon a large Asian equity team based out of Hong Kong and Singapore.”

McDermott singles out FSSA All China, which unlike many open-ended Chinese equity funds invests across the whole market including the vast A share market that is often ignored by many international investors.

“The managers invest in long-term, sustainable growth opportunities, with a heavy emphasis on finding high quality businesses and management teams. The team is based on the ground in Hong Kong and has an incredible track record of investing in Chinese equities.”

Regional funds

When it comes to the broader regional mandates McDermott likes the Ninety One Asia Pacific fund that currently has about 37% invested in Chinese stocks. It has a concentrated high conviction portfolio that consists of quality growth companies.

“More than 55% of its value is in its top ten holdings and the total portfolio only comprises around 30 stocks, most of which are larger companies. The fund’s emphasis is on finding exceptional businesses through detailed fundamental research. It typically ignores more cyclical and lower quality parts of the market such as energy, materials, telecoms, and utilities.”

Alternatively he suggests GQG Partners Emerging Market Equity, a relatively new fund that has had a good start and that benefits from an experienced lead manager. It has a concentrated portfolio of high quality companies with durable earnings with about 17% invested in China.

“We like the fact that the investment team also includes an accounting specialist and analysts with a background outside of finance, including former investigative journalists. This gives it insights outside the traditional Wall Street sell side model and allows the team to see potential risks others may miss,” he says.

At the tail end of last year, the team correctly identified that higher inflation would be here for longer and that there was a false sense of sustainability. Because of this they became more valuation sensitive, positioning the fund into more defensive companies, selling out of some of the winners and going into areas that had struggled like the energy sector.

I personally don’t trust the Chinese Government or anything to do with the Country. Investing in China to me is an insult to any of the minorities persecuted over there and the basic lack of freedom of speech they endure, The World should be boycotting their goods and services if they are able to, but unfortunately they are scared of the repercussions China would impose. It’s a sad world when countries like China think it’s OK for them to bully every other country

The government’s intervention in almost all areas of the economy is In stark comparison to the pre xie years. His Marxist tendencies should be enough to scare of the switched on investor but add in the huge debt pile, the massive property bubble being kicked down the road and the dumbest most arrogant covid policy and you have a recipe for disaster that ain’t even got started yet. Imagine Aoc on steroids and in the top job. Oh and a little bit of corruption in that pie….

This one will run until the wheels fall off, not if but when and its unlikely to see a meaningful recovery. Like a recession that ain’t technical – it’s still a recession, just change recession to melt down.