Huge upsurge in the value of index-linked bond funds

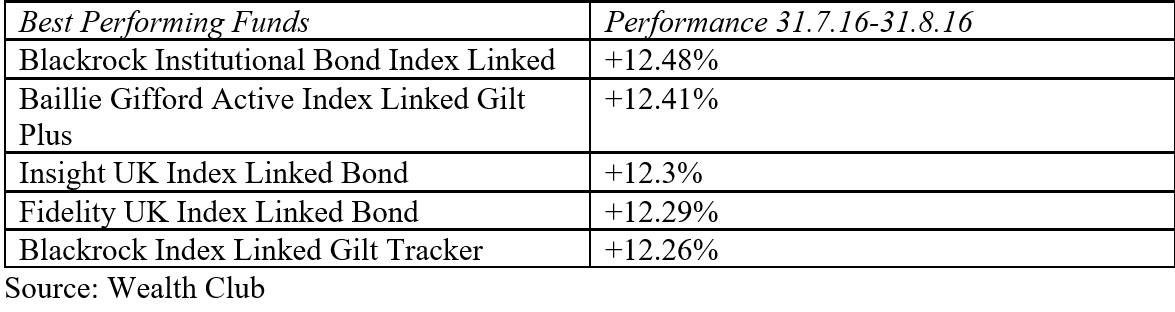

Recent analysis by the Wealth Club showed that the best performing area of the market in August was the UK Index-Linked Gilt sector with an average return of 10.52%. This was home to the five best performing funds, which all rose by more than 12% in the month.

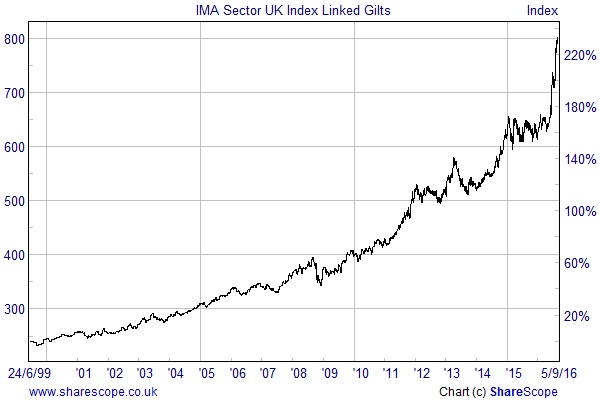

The jump in value in August enabled the UK Index-Linked Gilt sector to be the second strongest area of the market over the last 3 months with an amazing gain of 20.9%. It had also done well previously and has become the most successful part of the fixed income universe over 5 years with a gain of 67.4% – despite the persistent lack of inflationary pressures in the UK.

It is likely that the recent surge was a result of Brexit, as the sharp fall in the value of the pound will make imports more expensive when translated into sterling, although this assumes that the exchange rate will not bounce back. The subsequent reduction in interest rates by the Bank of England and the resumption of Quantitative Easing to help stimulate the economy was also a significant factor.

The longer term performance could be due to the fact that professional investors have bid up their value to protect themselves against the return of inflation, even though there are no real signs that this is imminent. There is a school of thought that the monetary easing by the central banks will eventually result in rising prices, but the high level of debt will make it extremely difficult for them to increase interest rates to get things back under control.

It has recently been suggested that the Fed may need to increase its 2% inflation target – some say to 4% − or replace it with an alternative to fight the next downturn. This shows how desperate the debt laden Western economies are to get some inflation back into the system.

With a normal bond, the coupon and the principal are fixed in nominal terms, so you know exactly how much cash you will receive if you hold it to maturity. An index-linked bond is rather different as the coupon and the principle will rise (or fall) in line with inflation. This means that index-linked bonds – sometimes referred to as linkers – are the purest way of protecting the real value of your portfolio, although other asset classes like gold also tend to work well, albeit in a less mechanistic way.

Index-linked bond funds

There is plenty of choice if you want to invest in this area as there are 14 open-ended funds operating in the UK Index-Linked Gilts sector. The best performer over the last 5 years was the £235m AXA Sterling Index-Linked Bond fund with a gain of 75.2%.

It was launched in September 2004 and aims to provide income and capital growth, with the objective of reducing the negative effect of inflation over the long-term. Most of the portfolio is invested in UK index-linked gilts, although there is some exposure to US treasuries and sterling-denominated corporate bonds. The ongoing charges are 0.78%.

There are also several passive alternatives. The £900m iShares Barclays Capital GBP Index Linked Gilts (INXG) ETF has ongoing charges of 0.25% and is up 46% over the last 5 years. It provides exposure to 29 UK index-linked gilts that it uses to replicate its Barclays UK Government Inflation-Linked Bond Index.

The Lyxor FTSE Actuaries UK Inflation-Linked Gilts UCITS ETF (GILI) is much smaller with £22m in assets under management. It has a net expense ratio of 0.07% and has recently changed its benchmark to the FTSE Actuaries UK Index-Linked Gilts All Stocks Index.

Another option would be to invest in a global inflation-linked bond fund that has freedom to take advantage of the different inflationary conditions around the world.

A good example is the Standard Life Investments Global Index-linked Bond fund, which aims to provide long-term growth from a portfolio of sovereign-issued and corporate inflation-linked bonds. The £1,157m fund was launched in May 2004 and is up 20% in the last 5 years. Just over 40% is invested in the US with a further 32% in the UK and the ongoing charges are 1.02%.

A cheaper option is the passively managed iShares Barclays Capital Global Inflation-Linked Bond ETF (IGIL), which has ongoing charges of 0.25%. The $488m fund was launched in August 2008 and uses a sampling technique to replicate the returns from its Barclays World Government Inflation-Linked Bond benchmark. It has 139 underlying holdings with the two main geographic exposures being the 44% in the US and the 29% in the UK. Over the period since inception it has generated a modest annualised average return of 2.44% per annum from a US dollar perspective.

The only way that heavily indebted governments can service their debts is by adopting policies that will generate enough growth and inflation to make them less of a burden. If the measures already taken are not sufficient to achieve this we could see further reductions in interest rates, more Quantitative Easing, or other accommodative strategies. Eventually I would expect this to result in higher inflation, with index-linked bonds being one of the best ways to protect the real value of your capital. The recent surge in performance is unlikely to be repeated, but they deserve a place in most people’s portfolios.

Comments (0)