In the eye of the storm: the investment trusts most exposed to Russia

The crisis in the Ukraine is obviously dreadful for all those caught up in it, yet the retaliatory sanctions imposed by the west are also having a major impact on retail investors with money in Russia.

There have been sanctions on Putin’s regime for some time, but the new measures introduced since the invasion are on a different scale and seem to be aimed at putting the country into financial isolation. One of the knock-on consequences is that investment trusts with significant exposure to Russia have experienced hefty write-downs, with the locally listed shares suspended and trading disrupted in the equivalent American or Global Depositary Receipts (ADRs/GDRs).

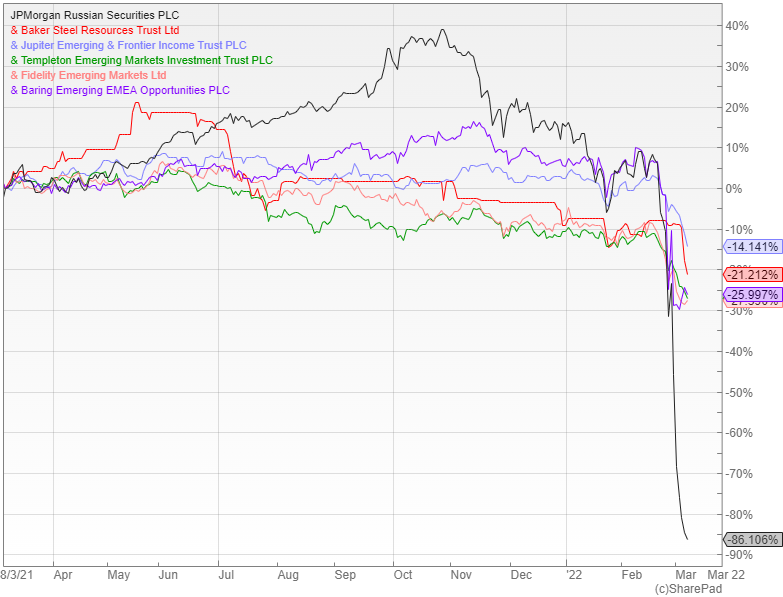

By far and away the worst affected is JPMorgan Russian (LON: JRS) that has all of its money invested in the country. Its shares have fallen from just over 600p in early February to around 90p at time of writing.

The board has decided to keep calculating and publishing the daily NAV, but will use the Russian Depository Index as a proxy for fair value against all its investments held on the Moscow Exchange that are suspended, while continuing to use the latest available price to value its ADRs and GDRs. It has announced that the final and first interim dividends of 10p and 15p respectively will be paid on 11 March, but no further distributions will be made until circumstances permit.

Significant exposure

A less obvious casualty is Baker Steel Resources (LON: BSRT) that at the end of January had just under eight percent of its assets in Polar Acquisition, a private company that holds a royalty over the Prognoz silver project in Russia. Since the invasion it has written down the value of this holding by 50% and its shares are now trading at an 18% discount to NAV at a time when commodity stocks are among the best performers in the world.

Jupiter Emerging & Frontier Income (LON: JEFI) had around a seven percent exposure to Russian-listed securities at the end of January, but that is now down to 0.4% as a result of falling share prices and sales. It is a similar picture at Templeton Emerging Markets (LON: TEM) that had an allocation of just over six percent, which has now been written down to 0.65% of NAV.

Luckily Fidelity Emerging Markets (LON: FEML) reduced its overweight position in the country before the invasion so by February 25 its net exposure was just 1.95%, although this has since been written down to virtually zero. The impact was much more severe for Barings Emerging EMEA Opportunities (LON: BEMO) that has lost about a quarter of its value in the last few days.

Wider ramifications

If Putin has ambitions in other neighbouring countries it could spell trouble for FEML and BlackRock Frontiers (LON: BRFI) that have allocations of 4.6% and 5.4% to Kazakhstan. There is also a possible risk to Georgia Capital (LON: CGEO) that has sold off sharply, although it has almost no ethnically Russian population and nothing of any significant economic or strategic value for Russia to take.

These are still early days and investors need to keep on their toes. There are likely to be many other ramifications in the weeks ahead that could affect companies with Russian assets such as BP and Shell, but it is impossible to say how it is going to play out.

One possible consolation for any affected investors is that although the trusts mentioned above have been badly impacted, at least the holders have been able to sell their shares if they want to. The same is not true for anyone with money in any of the 10 or so open-ended funds with exposure to Russia that have had to suspend dealing due to the impossibility of accurately valuing their underlying assets.

Comments (0)