If global inflation picks up could Japan be the big winner?

Japan’s economy has struggled for decades to escape from a spiral of low growth and deflation that has left the Nikkei 225 languishing more than 20% below its 1989 peak. The stimulus and reforms introduced by former Prime Minister Abe have helped to rejuvenate the market, but it might take the return of inflation in the west to complete the process.

It has been a long road back for Japan. The main Nikkei 225 stock market index peaked at an all-time high of 38,957 in December 1989 during the country’s asset price bubble, yet the six-fold increase in the decade was followed by a collapse that saw it decline to a low of just over 7,000 in March 2009.

Japan has endured years of low growth and deflation that former Prime Minister Shinzo Abe addressed with his program of reforms during his second tenure that ran from 2012 to 2020. Under his leadership there was massive monetary and fiscal stimulus, as well as radical improvements to corporate governance.

It remains to be seen what his legacy will be, although a number of important companies certainly did well during his time in charge. His replacement, Yoshihide Suga, has recently announced his resignation after just a year in the post due to his unpopular handling of the pandemic.

Darius McDermott, MD of Chelsea Financial Services, says that Japan is home to some world leading companies that are often overlooked and even though the market has struggled, active investors have actually been very successful.

“Japan also has stable politics, which is beneficial. Despite the fact that PM Suga has recently announced he is stepping down, the move has been seen as positive as he was unpopular and his removal makes it more likely that his party − which the market likes − will have a strong mandate in the next election.”

Could the return of global inflation be the solution?

The global economy has experienced years of low inflation and low interest rates since the 2008/09 financial crisis, but it finally looks as though the unprecedented levels of monetary and fiscal stimulus have kick started a new era. Inflation is increasing in many countries and although central banks are keen to dismiss it as transitory, the evidence suggests that it is anything but.

If inflation takes hold, Japan could be a major beneficiary as the stock market is heavily weighted in favour of sectors that outperform in periods of rising prices. Automakers, machinery companies and producers of consumer durables all have a historically high positive correlation with inflation.

In previous inflationary periods, Japanese manufacturers operating in these areas have been able to retain their pricing power and pass on the higher costs to their customers around the world. If they can do so again it should help to propel the relevant share prices higher.

Ryan Hughes, head of active portfolios at AJ Bell, says that Japan has a diverse mix of industries, but its prevalence in manufacturing high value goods puts it in a good place given the current bout of inflation around the world.

“These companies have the pricing power to push the increased costs of manufacture onwards and maintain their margins. If the current pickup in inflation is here to stay for longer, then it could place them in a very strong position to drive profitability in the coming years, which should result in strong share price performance.”

Higher interest rates may be beneficial

All the indications are that the world’s central banks will try to keep inflation in check by tapering their bond buying programmes. This is likely to result in an increase in yields, yet interest rates will also need to rise with some countries having already started the process.

Japan has the lowest level of corporate borrowing of all the major economies with many companies sitting on piles of cash. In an era of low interest rates this lack of leverage has acted as a drag on returns, but if rates were to rise the low debt-servicing costs would be a major advantage with corporates able to use the cash to increase dividends or buyback more shares.

Ben Yearsley, a director at Shore Financial Planning, has been a Japan bull for many years because of the cheap valuations and financially sound, world beating companies.

“The problem has been mixing the macro environment, which is almost always dire, with company prospects that are and have been good. Companies are well placed to outperform and we’ve seen a bit of that in 2021. I think it can continue.”

The structural reforms introduced by Abe should also continue to bear fruit with regulators and institutional investors carrying on their efforts to unlock value through the improvement of capital allocation and corporate governance.

A bit of an enigma

Japan has been a curious market with global investors tending to prefer the faster growing options in Asia, which was the right call given how much the Topix has lagged over the last 20 years. It has been a different picture over the past decade though with Abe’s reforms enabling the domestic market to outperform both Asia and the emerging markets.

Hughes says that with Abe gone and his replacement Suga already announcing that he is standing down, there is hope that the political backdrop will become more stable and that this can push economic and market reform even further.

“From a valuation perspective, Japan is on a PE ratio of around 17x which makes it cheaper than the US, but more expensive than the UK, although the market gives access to some interesting companies that are benefiting or driving technological change. The likes of Toyota are well placed to benefit from their experience in electric vehicles, while companies such as Sony and Softbank are highly exposed to the technology space.”

Japanese companies typically have much stronger balance sheets than their peers in the west, with many sitting on net cash and this is helping to drive an increase in dividend growth. The broad market has seen the dividend yield double over the past 15 years and with average pay-out ratios lower than the UK and Europe, there is scope for the dividend yield to grow materially, which would help to underpin future returns.

Jon Cunliffe, CIO of Charles Stanley, says that Japan trades at a 25% discount to the US based upon next year’s earnings and is even cheaper on a price to book basis.

“Global investors’ allocations to the market have been steadily falling in recent years, so there is plenty of upside for contrarians to bet on a more stimulative policy mix once PM Suga’s replacement is appointed.”

Reasons to be cautious

The most obvious drawback with Japan is its ageing population and bad demographics. These are difficult issues to resolve and act as a massive anchor on growth ambitions, although they also provide opportunities as the country looks to overcome them with investment in robotics and other innovative solutions.

“It is projected that the population could go below 100m by 2050 having been over 120m in 2010, while the percentage of the population in retirement will significantly increase. Given that Japan operates with very low inward migration, this presents a serious long-term headwind to the economy,” warns Hughes.

A more general point to be aware of is that the stock market is the primary source of out of market liquidity. This means that when a crisis hits overnight, it is the only major market open and therefore becomes the place where a lot of investors trade in order to manage risks elsewhere. Because of this it tends to be more volatile than many of its peers.

“Another issue is the very high government debt, which is bad for growth. However, this is contrasted by low corporate debt, as overall there is net cash on company balance sheets,” notes McDermott.

The lack of domestic inflation is a major issue as it robs companies of the opportunity to increase prices, although the flip side is no wage pressure for corporates to have to deal with.

The best investment trusts

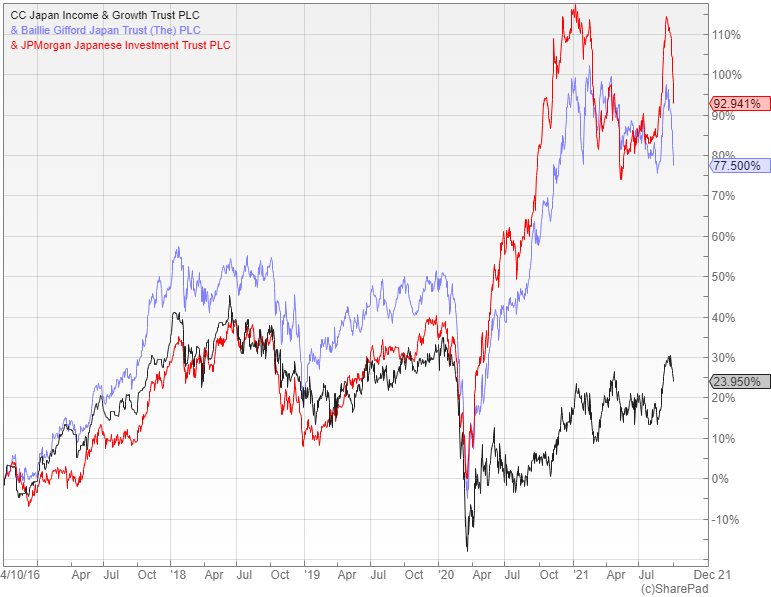

Hughes recommends the £274m CC Japan Income & Growth investment trust (LON: CCJI) that is managed by the experienced Richard Ashton and has a clear focus on dividends.

“The portfolio is concentrated on Japanese companies that have strong cash flows, shareholder friendly management and the ability to pay dividends over the long-term. It currently yields three percent, which is a healthy premium to the market and has the bulk of the assets in dividend growth opportunities,” he says.

Alternatively he suggests the £1.1bn Baillie Gifford Japan investment trust (LON: BGFD) that focuses on growth companies like the rest of the firm’s funds.

“Lead manager Matthew Brett has worked on the strategy for many years and is backed by a strong team, which includes the smaller companies’ expertise of Praveen Kumar. While the trust will invariably have periods of underperformance when the value style is in favour, the long run focus on growth sits well with the technology-oriented market in Japan.”

Cunliffe says that the Japanese market has been a happy hunting ground for good growth investors such as the JPMorgan Japanese investment trust (LON: JFJ) with its long-standing manager Nick Weindling. “It is high risk, with plenty of gearing and a concentrated portfolio of growth stocks, but we have confidence that he will continue to uncover exciting Japanese growth opportunities.”

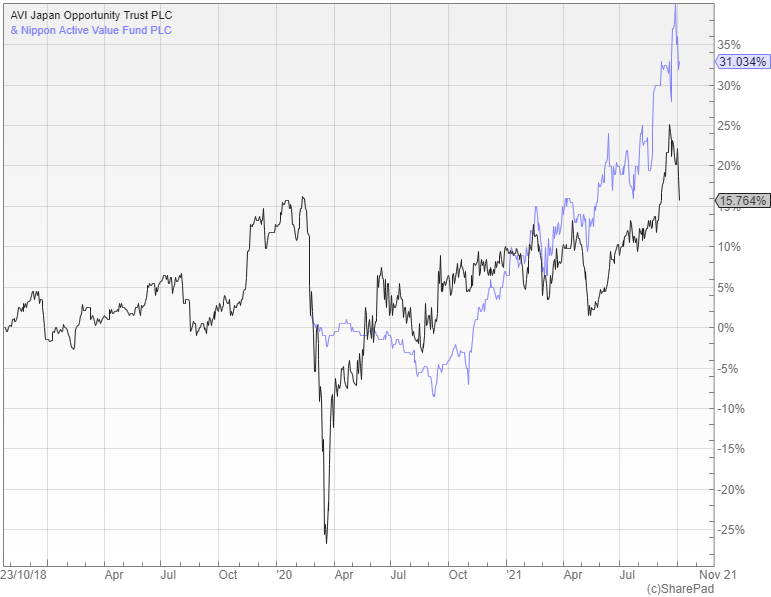

Yearsley likes the £180m AVI Japan Opportunity Trust (LON: AJOT) that invests in a focused 27-stock portfolio of over-capitalised small-cap Japanese equities with cash on the balance sheets.

“There are mid and small-sized Japanese companies valued at little more than their cash and other realisable assets, a strange quirk of the market and one that the AVI team are hoping to profit from through active engagement, often encouraging the return of capital through buy backs and dividends. We like the fact that this can create idiosyncratic sources of alpha that should be uncorrelated to the wider market,” explains Cunliffe.

It follows the same approach as the £136m Nippon Active Value fund (LON: NAVF) that is attempting to capitalise on the improvements in corporate governance and greater focus on shareholder returns as a result of the government’s reforms.

The top funds

Hughes likes the Jupiter Japan Income fund which has been run by manager Dan Carter for over a decade and targets businesses that are experiencing strong earnings growth and that offer an attractive dividend yield.

“The focus is typically on companies that are more financially stable and higher quality than the index. It is an approach that has proved to be very consistent and delivered steady outperformance of the broader market.”

McDermott suggests AXA Framlington Japan, which invests in Japanese stocks of varying sizes, but tends to have a slight bias towards smaller companies so it can really take advantage of opportunities not covered by the wider market.

“Although it favours growth, its valuation discipline means it is less extreme in terms of style than some of its peers. We also like the fact that the team identifies themes in which to invest, like ageing populations, automation and the increased use of electronics in cars.”

Another option that he likes is Comgest Growth Japan. It is a more concentrated offering, but the managers have a great stock-picking track record and a process that has been proven over time.

“Baillie Gifford Japanese is one of the firm’s oldest offerings and has a bias towards medium-sized companies so offers something a little different. It has been one of the most consistent funds in its sector and has proven itself in many different market environments,” he says.

Yearsley prefers the passively managed Fidelity Index Japan, which he says is cheap and gives a broad exposure to large-cap Japanese stocks. It has £713m in assets under management, tracks the MSCI Japan benchmark and has ongoing charges of just 0.1%.

Japan has been dogged by low growth and next to no inflation for decades, although former Prime Minister Abe’s reforms have started to bear fruit. If the current bout of inflation in the west takes hold it could provide the extra impetus that the country has been looking for and propel the market higher.

Comments (0)