How to grab a slice of emerging markets

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Emerging and frontier markets still offer value for investors, writes Filipe Costa. Here’s how to play them using a passive approach.

Equity markets have rocketed over the last few years. After being decimated during the global financial crisis of 2007-2009, equities entered a golden period. Depressed share prices, low interest rates and bold quantitative easing paved the way for a stunning decade of returns. One hundred units invested on the S&P 500 10 years ago, would by now be worth 293 units − a spectacular annual increase of 11.3%.

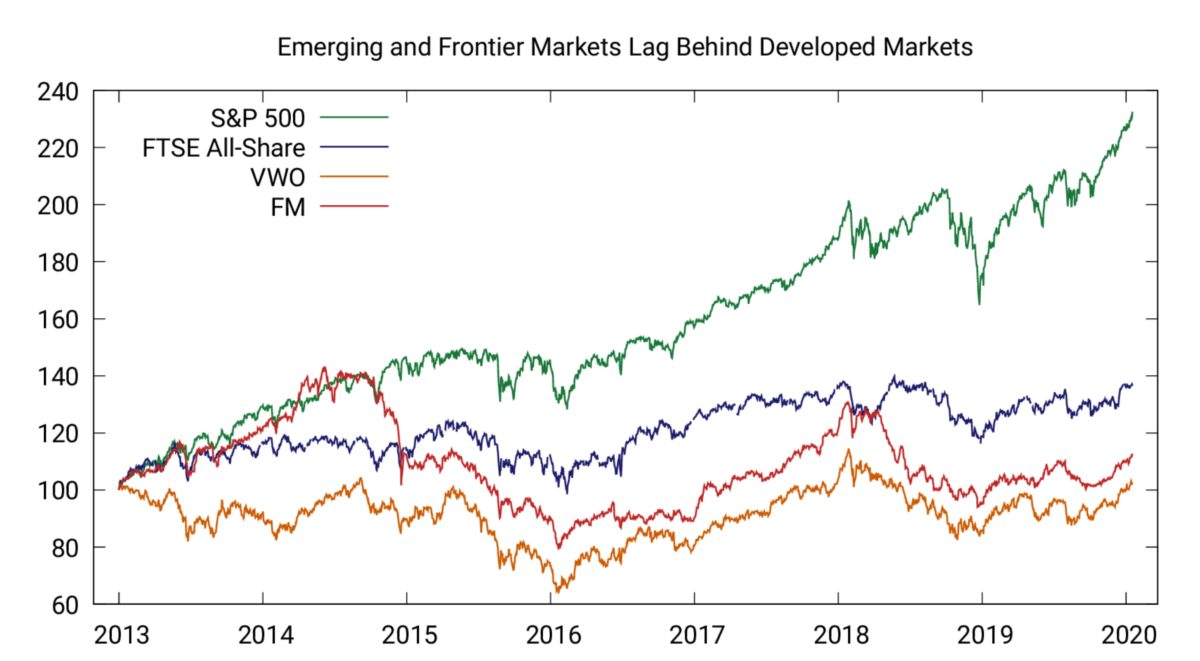

But these fortunes haven’t been replicated the world over. An investor in the FTSE All-Share index has seen profits accumulate at the much softer rate of 4.3% per year. Most European markets have lagged behind, as have emerging and frontier markets. But now that we’re in a late-cycle phase, the picture may change in favour of Europe and emerging economies, as investors reassess the highly valued US market. Declining interest rates, higher currency values and low valuations are attractive factors, justifying an exposure to emerging markets at this juncture.

Unbalanced performance

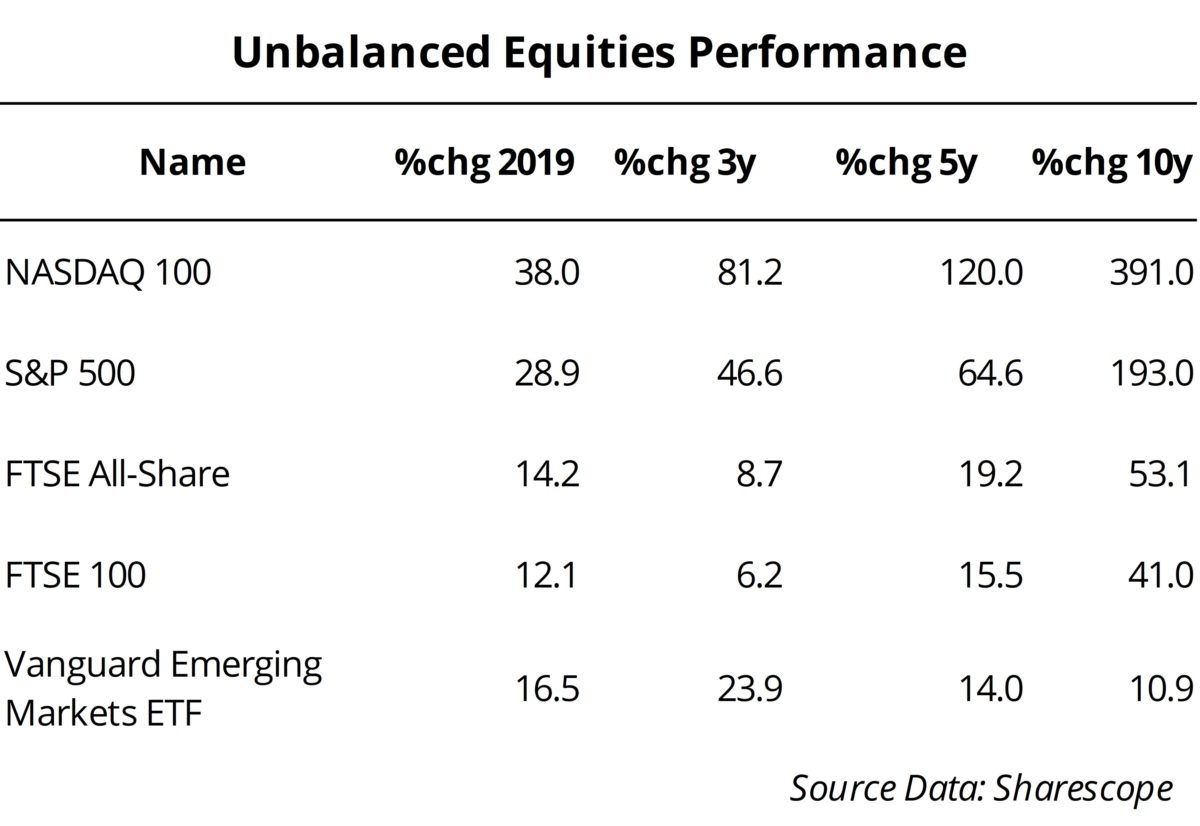

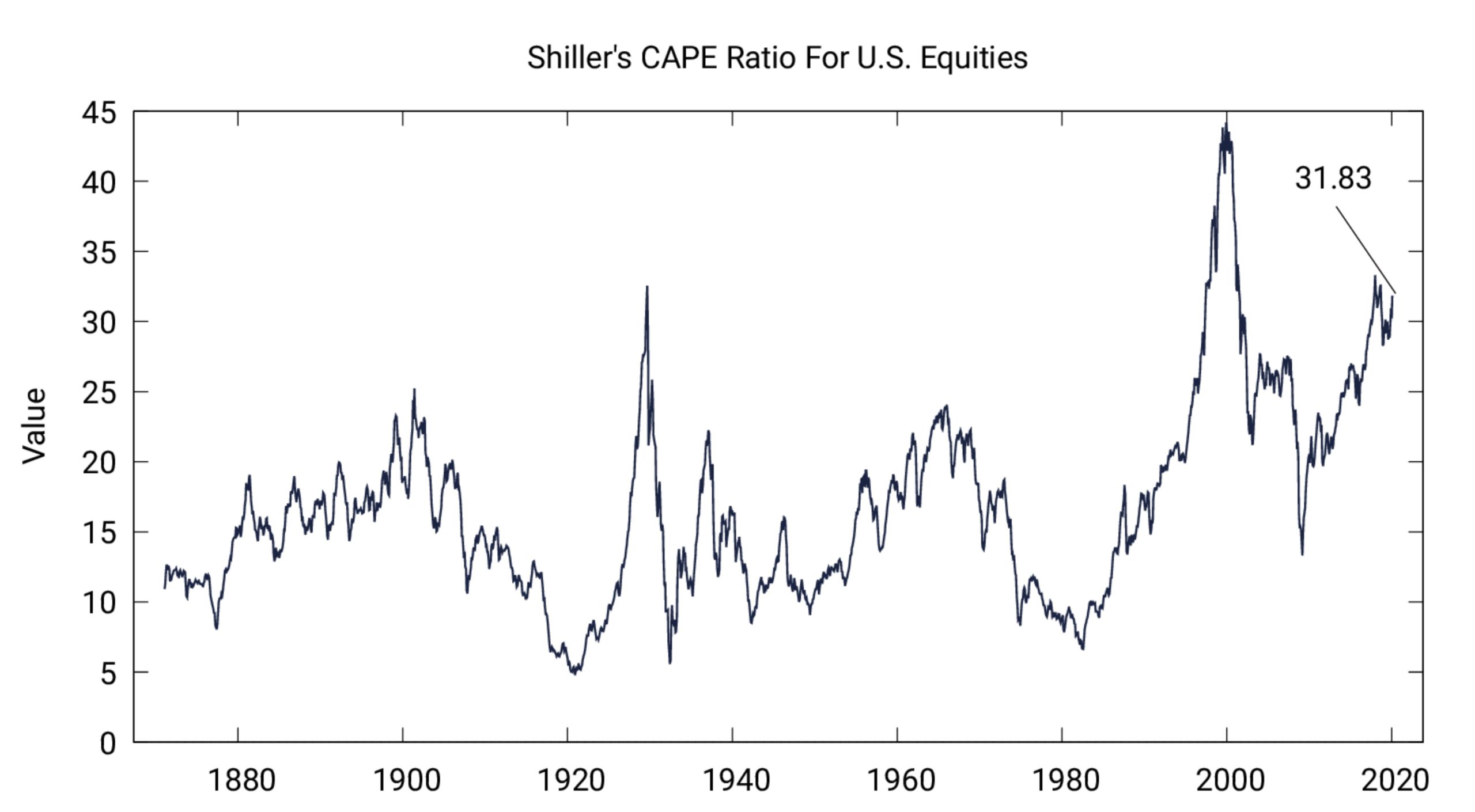

It’s a fact that markets are rising. But it’s also a fact that such rises have been distributed unequally across the globe and across equities. The performance of US markets has been stunning since the global financial crisis. over the last decade, the S&P 500 nearly tripled its value and the Dow Jones Industrials trailed this performance closely. But if we look at Europe, we see a less rosy picture, as the FTSE All-Share rose 53% and the FTSE 100 just 41%. Technology stocks seemed unstoppable. The Nasdaq 100 index almost quintupled in value. At the other extreme, emerging markets rose just 10%. To some extent, this unbalanced performance reflects different circumstances around the globe. The uncertainties surrounding Brexit and sluggish growth across the EU certainly weighed unfavourably for British and European stocks. But the Schiller CAPE index is currently hovering around 31.8x, a value only surpassed during the skyrocketing valuations of technology companies during the formation of the Nasdaq bubble. Thus, to some extent, the rally may have gone too far in the US. Valuations in Europe and emerging markets are a lot more conservative, which opens up good opportunities for investors.

Why invest in emerging markets?

While interest rates seem to have reached a low for most of the developed world, they are still declining for most of the emerging-market world. The official rate in Brazil just reached a historical low after being cut several times over the last three years. From a level of 14% in 2016, the central bank was able to cut the country’s key rate to its current 4.5% without incurring an acceleration in inflation. In Russia, the key interest rate has also been cut several times, to its current level of 6.25% after peaking at 17% by the end of 2014. In India, the central bank also managed to drive its key rate from 8% in 2015 to a current level of 5.15%. Even Mexico, a country that struggled to keep its currency tight and inflation under control with the advent of Donald Trump as US president, has been able to recently cut rates four successive times to a level of 7.25%.

The US Federal Reserve made a late-cycle adjustment, cutting key rates three times in 2019. But that has not been the norm across the developed world. Sweden, Norway and the UK’s central banks have hiked rates a few times. The very low rates helped to push equity prices all the way up, in particular in the US, just as they helped businesses finance their operations and pushed investors from fixed income towards equities.

Central banks from developed economies have no firepower left while the margin for further interest-rate cuts in emerging economies is still wide. The two-digit rates of the recent past along with a rising dollar prevented equities in emerging markets from experiencing the same kind of returns experienced in the US. While the S&P 500 is up 65% and 193% over the last five and 10 years respectively, the Vanguard Emerging Markets ETF (here representing emerging markets) is up 14% and 11% in the same period. In general, emerging-market equities underperformed US equities since the global financial crisis. But declining interest rates are helping governments and corporations to service their debts, which should help equity values. While interest rates are already low in emerging economies, there’s still plenty of room for them to go even lower, as they are still much higher than in the developed world. The lower rates should also lend support to improving economic conditions. With valuations in the US too stretched, I expect a growing number of investors to seek out value elsewhere, with the UK, Europe and, in particular, emerging markets being on the receiving end.

Other factors also provide support for a bull market in emerging economies. After significant international turbulence, with Trump pressing trading partners into conceding more favourable trade deals for the US side, it seems there is a truce between the US and China. As 2020 is an election year, I expect Trump to ease a little on that front, in particular to avoid the US economy being hurt, which would prove fatal to his re-election ambitions. This paves the way for stronger emerging-market currencies to support further interest-rate cuts.

On the US-dollar front, a few factors point to weakness for the dollar. The US runs a twin deficit that will hardly be solved in a year of elections. If Trump is going to put a brake on expenses, that won’t happen in the short term. Besides, in trade-weighted terms the US dollar is also seen as being overvalued. This sentiment is even corroborated by Trump, who has often complained to European and other countries about their role in dollar strength, which hurts US trade. Over time, the pressure is on the downside for the dollar. Only a full-blown crisis and/or an increase in volatility would temporarily reverse that trend. But I’m not foreseeing a hard landing for the US, just a late-cycle economy growing at a limited pace, which is positive for emerging economies.

Where to put your money

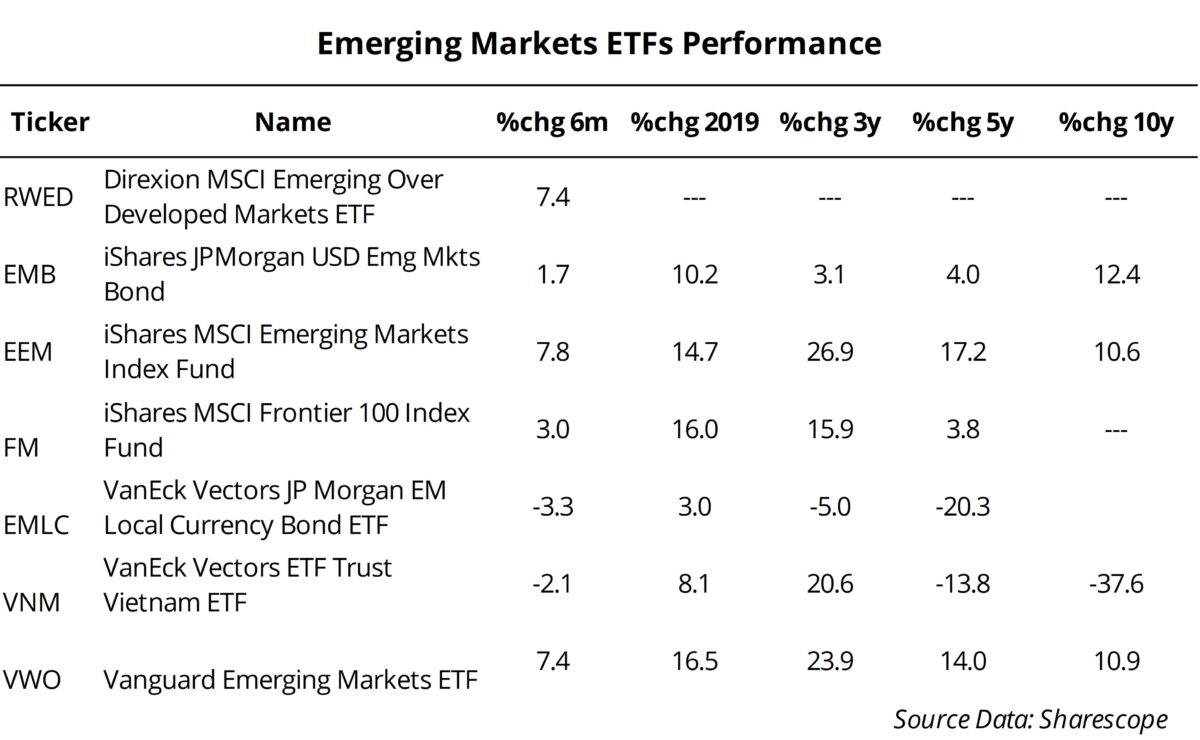

While there is a huge ETF offer to play the emerging-markets theme, I’m looking at seven ETFs that I believe cover different angles, and that are well managed and from established providers. I will start with two broad-based options: the Vanguard FTSE Emerging Markets ETF (NYSEARCA:VWO), which is the largest ETF by assets under management, and the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM), which is the most traded. For investors looking for the smaller, but fast-changing frontier markets, the iShares MSCI Frontier 100 ETF (NYSEARCA:FM) may be a more tailored option. Or, following in Jim Mellon’s footsteps (Master Investor, Issue 58, January 2020, p. 6-8), investors may like to consider an even more targeted investment through the VanEck Vectors Vietnam ETF (BATS:VNM). For a different kind of bet, the Direxion MSCI Emerging Over Developed Markets ETF (NYSEARCA:RWED) offers the option to explore differences between developed and emerging markets. Lastly, the VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (NYSEARCA:EMLC) and the iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) are good options for those who want to add a fixed income layer to their portfolios.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Vanguard FTSE Emerging Markets ETF

The Vanguard Emerging Markets ETF is the largest ETF dedicated to emerging markets. Its largest investments are made in China, Taiwan, India, Brazil and South Africa (73% of the fund’s assets), but it invests in hundreds of stocks across several countries. This ETF is a preferred option for long-term investors seeking the growth prospects offered by rapidly evolving emerging markets. Apart from the good diversification offered, one very good reason for this ETF to be considered is its very low annual charge of 0.12%. This is, in my view, the best broad and diversified option for investing in emerging markets.

iShares MSCI Emerging Markets ETF

This ETF is similar to the Vanguard offer, as it targets the same emerging-markets index. But EEM is the most traded of the lot because there is an options market targeting this fund, which allows investors to use more refined strategies in the short term. Unfortunately, EEM comes with a very high expense ratio of 0.68%. For a long-term investor or someone looking to get plain ‘vanilla’ short-term exposure to emerging markets, VWO is the best option. For someone looking for more complex strategies, EEM could be a better option.

iShares MSCI Frontier 100 ETF

If the growth prospects for emerging economies are good, they are even greater for frontier economies. Some of these frontier economies will eventually replace emerging economies like China in their manufacturing role, for example. The iShares MSCI Frontier 100 ETF targets economies like Kuwait, Vietnam, Morocco, Nigeria and Romania, among many others. It invests in the 100 largest companies from those economies, giving investors great growth potential over time. However, FM invests in countries that have higher geopolitical and economic risks, which makes it more volatile. At the same time, while it invests in the largest companies from frontier markets, it is not as diversified as VWO or EEM, which invest in several hundred different assets. Its expense ratio is also not favourable, at 0.79%.

VanEck Vectors Vietnam ETF

Vietnam is capturing foreign investment at a fast pace, as companies are looking for alternatives to China to manufacture their products. Investors looking for direct exposure to the country’s fortunes may opt for the VanEck Vectors Vietnam ETF instead of investing in broader funds. It invests in securities of publicly traded companies that are incorporated in Vietnam or that are incorporated outside Vietnam but have at least 50% of their revenues/related assets in Vietnam.

Direxion MSCI Emerging Over Developed Markets ETF

For those looking for a long-short product, the Direxion MSCI Emerging Over Developed Markets ETF may be the solution. Instead of investing directly into emerging markets, the fund gives investors a relative exposure. It targets the EAFE IMI 150/50 Return Spread Index, which measures the performance of a portfolio that has a 150% long exposure to the MSCI Emerging Markets IMI Index and 50% short exposure to the MSCI EAFE IMI Index. In summary, this fund is long emerging markets and short developed markets. This has the advantage of being more market-neutral than other funds. However, its expense ratio is a bit high at 0.58% and trading volumes are low.

VanEck Vectors J.P. Morgan EM Local Currency Bond ETF

My last two options feature a different asset class − fixed income. All other ETFs reviewed target equities. Some investors may feel more comfortable with fixed income. With interest rates being so low throughout the developed world, investors are unable to get a decent yield unless extending the duration of their portfolios or jumping into high yield. A good alternative is to invest in investment-grade bonds − but from emerging markets.

As interest rates are declining in emerging economies, bond values should increase (as yields and prices are inversely related). The VanEck Vectors J.P. Morgan EM Local Currency Bond ETF mainly targets government bonds denominated in local currency, which means investors are also betting against the dollar. Brazil, Mexico, Indonesia, Thailand and South Africa are the largest exposures, but the fund is well balanced, as it invests in many other countries.

iShares J.P. Morgan USD Emerging Markets Bond ETF

For those looking for a US-dollar exposure to bonds of emerging economies, the iShares J.P. Morgan USD Emerging Markets Bond ETF is a good alternative. In this case, the ETF only invests in bonds that are issued in US dollars. From the perspective of an investor from a developed country, currency risk is much lower. Still, if the dollar rises by much, it may degrade the ability of issuers to service debt and contribute towards eroding the returns of the ETF.

Final thoughts

While the uptrend in equities seems exhausted, investors need to look for value where it still exists. US markets look ‘frothy’ when compared to Europe and emerging economies, and valuations are stretched with the CAPE ratio now at levels only seen during the technology bubble. But, at a time when a trade deal between the US and China is regaining life and global volatility is declining, emerging markets offer good value to investors. The declining interest rates are helping economic growth and there’s still room for further cuts.

Comments (0)