Has Biotechnology Bottomed Out?

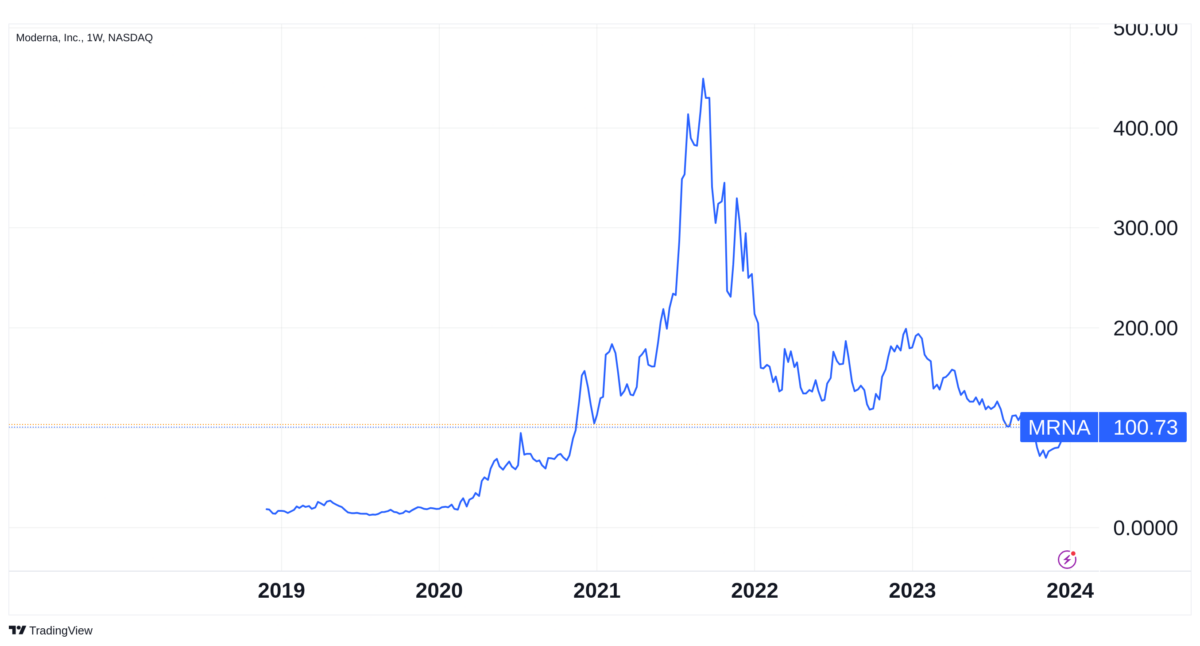

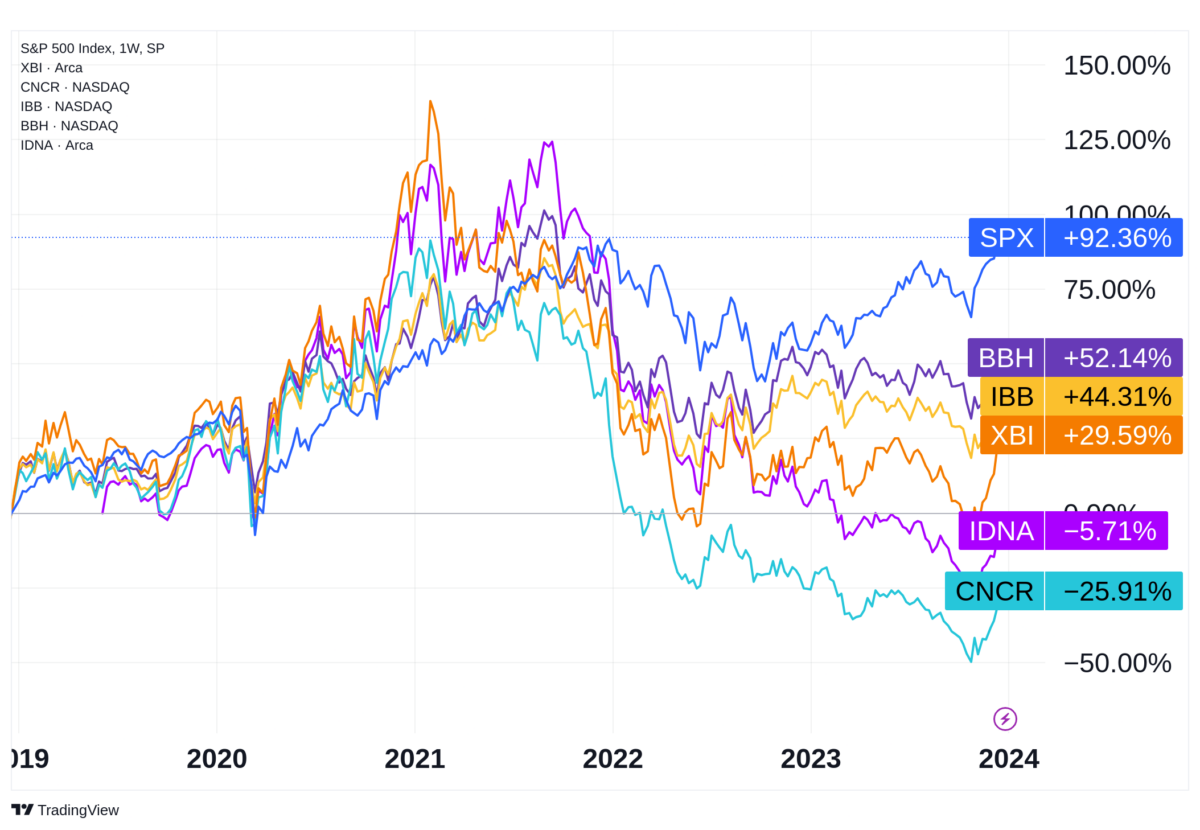

While the S&P 500 and the technology sector as a whole are soaring, there’s at least one industry that’s lagging behind – biotechnology – which benefited from a pandemic surge in mRNA development, but then suffered a huge fall. Looking at the SPDR S&P Biotech ETF (XBI), for example, which serves as a proxy for the industry, the fund is up 11% year-to-date, less than half the 25% gain for the S&P 500 and a quarter of the 45% gain for the Nasdaq index. Even on a five-year basis, the sector is struggling in relative terms, with the XBI up 30% compared with 92% for the S&P 500 and 129% for the Nasdaq. There’s no doubt that the biotech industry offers promising long-term returns. However many of these companies have no real revenue streams and don’t expect to have a marketable product from their pipeline for years. They are exposed to a lot of speculation, and from time to time, investor enthusiasm drives prices very high, only for them to crash. The COVID-19 pandemic was one of those moments, with investors overestimating the future revenues from the development of the COVID-19 vaccine. A very good example of this buying frenzy is Moderna (MRNA). Back in 2019, this stock was worth around $20. During the pandemic, the share price was heavily inflated, reaching $450 by August 2021, only to fall just as spectacularly to less than $70 two months ago. Moderna, like many other biotech stocks, is now recovering. The big question for investors is whether this is a good opportunity to re-enter the market or whether further weakness is to be expected.

The first thing to say is that while investor enthusiasm is certainly an important part of the explanation for prices, it’s not the only reason for the collapse we’ve seen since 2021. Biotech stocks are a type of growth stock, with no current revenues and high expectations of future profits. As such, they are more exposed to changes in interest rates than value stocks, similar to the relationship between long-term bonds and money market funds. A longer duration leads to greater exposure to interest rates. However, biotech stocks are also directly exposed to interest rates because these companies borrow heavily to fund their research and development expenses. Higher interest rates mean higher interest expenses, a drag on profits or, more accurately, a pumping up of losses. The current tightening cycle has been very steep, with no direct comparison to any other in this century. As soon as the Federal Reserve changed its stance on interest rates, the biotech bubble burst.

After bottoming out in October, most biotech stocks are now recovering. The XBI ETF bottomed out at $64 in late October and is now trading at $90, up 40%. However, this is still a long way from the $166 level of 2021. My view is that the Federal Reserve will reverse policy in 2024 as inflation and growth cool. The entire biotech industry benefits from lower interest rates because it reduces their costs. At the same time, current prices are relatively low and many larger pharmaceutical companies may be tempted to target these smaller companies. Because of the very high idiosyncratic risk involved in picking one or a few companies in such a volatile industry, the best option is always to buy a dedicated ETF. I have selected a few for this purpose.

iShares Biotechnology (NASDAQ:IBB)

The iShares Biotechnology ETF (IBB) is one of the largest biotechnology ETFs, with $7.6 billion in assets under management (AUM). The fund tracks the NASDAQ Biotechnology Index and holds 227 stocks, with a focus on large-cap companies. IBB has an expense ratio of 0.45% and its top holdings include Vertex Pharma, Amgen, Gilead Sciences Regeneron and Iqvia Holdings. While 80% of IBB is dedicated to biotechnology, the fund is not focused on small, emerging companies. As a result, its performance is closer to that of a healthcare ETF than a pure growth play.

SPDR S&P Biotechnology (NYSEARCA:XBI)

The SPDR S&P Biotech ETF (XBI) is another popular biotechnology ETF with $13.6 billion in AUM. Unlike IBB, XBI is an equal-weight ETF, meaning it holds equal amounts of each stock in the fund. This approach gives more weight to smaller companies, which can lead to higher volatility but also higher potential returns. XBI has an expense ratio of 0.35%, which is relatively low given that it has much higher costs than, for example, IBB due to the need to rebalance. This fund invests in 125 companies and is closer to a growth play than IBB. For those who want a more focused bet on biotech and are prepared to take on more risk, this fund is better than IBB.

Vaneck Biotech ETF (NASDAQ:BBH)

The Vaneck Biotech ETF (BBH) is a smaller biotech ETF with AUM of $480 million. The fund tracks the MVIS US Listed Biotech 25 Index and holds 25 biotech stocks with a focus on mid-cap and large-cap companies. BBH has an expense ratio of 0.35%, the same as XBI. Top holdings in BBH include Amgen, Vertex Pharma, Gilead Sciences, Regeneron and Moderna. Unlike IBB and XBI, this ETF is highly concentrated, with only 25 holdings and its top holding accounting for 17% of the fund. Nevertheless, Vaneck is always a good option as one of the cheapest ETF providers.

Range Cancer Therapeutics (NASDAQ:CNCR)

The Range Cancer Therapeutics ETF (CNCR) is a newer biotech ETF, launched in 2015 with just $14 million in AUM. The fund focuses on companies developing cancer treatments and therapies, and includes 84 holdings using an equal weighting approach. Although biotech valuations have come down somewhat, this fund specialises in a niche market that will continue to attract the most attention. This niche market is at the forefront of public attention and technological advances. For investors looking for a more focused bet on biotech, this one of the best options. However, it is also the smallest and riskiest. For broad exposure, look at the other three options, especially XBI and BBH. CNCR has an expense ratio of 0.79%, which is the highest in this list. CNCR’s current top holdings include Immunity Bio, Revolution Medicines, Autolus Therapeutics, Macrogenics and Immunogen. However, after the scheduled rebalancing, the holdings are evenly spread across the fund.

iShares Genomics Immunology and Healthcare ETF (NYSEARCA:IDNA)

Launched in mid-2019, the iShares Genomics Immunology and Healthcare ETF (IDNA) seeks to track the investment results of an index composed of developed and emerging market companies that could benefit from long-term growth and innovation in genomics, immunology and bioengineering. Key holdings include Moderna, Revolution Medicines, Incyte, Sarepta Therapeutics and Exelixis. IDNA is concentrated in the US, which accounts for almost two-thirds of the fund, but it also offers exposure to other countries, including Germany, France and Japan. The fund has an expense ratio of 0.47% and $133 million in AUM, spread across 52 holdings. This fund’s performance is highly correlated with CNCR but with the advantage of being more liquid, larger and coming from one of the most respected fund issuers – BlackRock.

Final Words

Overall, each of these biotech ETFs has its merits. IBB and XBI are larger funds and are diversified across a greater number of holdings. However, IBB appears to be the less volatile of the two, while XBI is a more targeted bet for those seeking biotech exposure. Although BBH holds only 25 stocks, it is a large fund and ultimately less risky than XBI as it focuses on larger companies. For investors looking for a highly targeted bet within genomics and immunology, CNCR and IDNA are the best options. With the progress made since the pandemic and the bubble bursting in 2021, companies dedicated to genomics and immunology offer great potential. With the Federal reserve now in retreat mode, this may prove a good entry point in the biotech industry.

Happy New Year and Excellent Investments!

Comments (0)