Infrastructure can yield strong long-term returns

The protracted period of low interest rates triggered by the 2008 financial crisis has pushed up the value of many reliable, income-generating parts of the market to the extent that their valuations have become considerably overstretched.

One area where there are still some pockets of value is infrastructure. The companies operating in this sector provide essential services such as airports, railways, energy storage facilities and toll roads. In many cases they have high barriers to entry and are able to pay a steady inflation-linked stream of income.

A good example is First State Global Listed Infrastructure, which was launched in October 2007 and by the end of August 2016 had attracted assets under management of £1.64bn.

The managers, Peter Meany and Andrew Greenup, invest in infrastructure companies rather than the actual underlying assets, which is the normal approach taken by open-ended funds operating in this area. This means there is plenty of liquidity, which makes it easy for them to buy and sell as and when they need to.

Their strategy is to invest in high quality companies that have an attractive long-term outlook. By doing this they are able to focus on capital preservation, especially as they are only allowed to have a maximum weighting of 20% in the emerging markets.

The upshot is a more concentrated portfolio than many of their peers with just 42 holdings at the end of August. Their ‘best ideas’ usually account for upwards of 4% of the fund, with ‘strong buys’ typically in the 2% to 4% range.

At the end of August the 10 largest weightings made up 45% of the fund. The biggest were: the PG&E Corporation at 6.4%, a US-based energy holding company; Transurban Group Ltd at 5.3%, a toll road operator in America and Australia; and the East Japan Railway Company at 4.9%.

Infrastructure can be divided into several sub-sectors including: toll roads, railways, airport services, ports, oil and gas storage, and electric utilities. They each cater to different areas but are all essential to the operation of a modern economy.

At the end of August the 3 main sub-sector exposures were: Electric Utilities 28.8%, Highways & Railways 15.9% and Oil & Gas Storage and Transportation 12.6%. Almost half of the fund was invested in companies listed in the US with all of the other country exposures coming in at less than 10%.

Attractive characteristics

Infrastructure companies tend to have high barriers to entry and strong pricing power, which helps them to generate an inflation-linked stream of dividends and strong capital growth over the medium to long-term.

Meany and Greenup currently favour toll roads, freight rail and ports, as they believe that these areas contain mispriced, high quality companies in secure market positions that are trading at attractive valuations. They are more cautious about US utilities and airports where the valuations have become stretched.

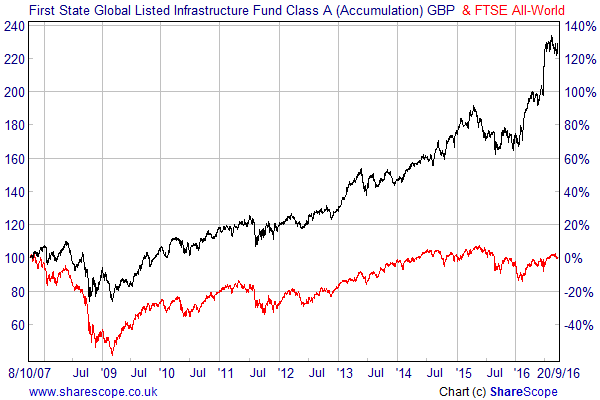

First State Global Listed Infrastructure has an excellent performance record with the accumulation shares up 124.5% between the launch in October 2007 and the end of August 2016.

It has done especially well this year due to the fall in the value of the pound against the dollar and the fact that interest rates look as though they will stay lower for longer, but it has powered ahead of the FTSE All-World global index, which is basically unchanged over the last 9 years.

Some people claim that infrastructure is a fairly defensive asset class, but that applies more to funds that hold the underlying assets rather than infrastructure companies. This particular fund is rated at 5 on the provider’s risk/reward profile that goes from 1 to 7, with 7 being the highest risk category on the scale.

It is available in both income and accumulation units, with the former yielding 2.8%. This is much less than some of its peer group such as the Legg Mason RARE Global Infrastructure Income fund that pays 5%.

First State Global Listed Infrastructure has ongoing charges of 0.83% for the clean fund share class, which is about what you would expect, although the transaction costs within the fund will add to this as the portfolio has a surprisingly high turnover rate of 77%.

The fund has benefited from the low global interest rates and weak pound, but despite the increase in valuations the managers still believe that the fundamentals support a yield of 3%-4% and earnings growth of 5%-6%. This is still pretty attractive, especially in view of the fact that the companies operate regulated business models backed by tangible assets that are essential to the world economy.

Comments (0)