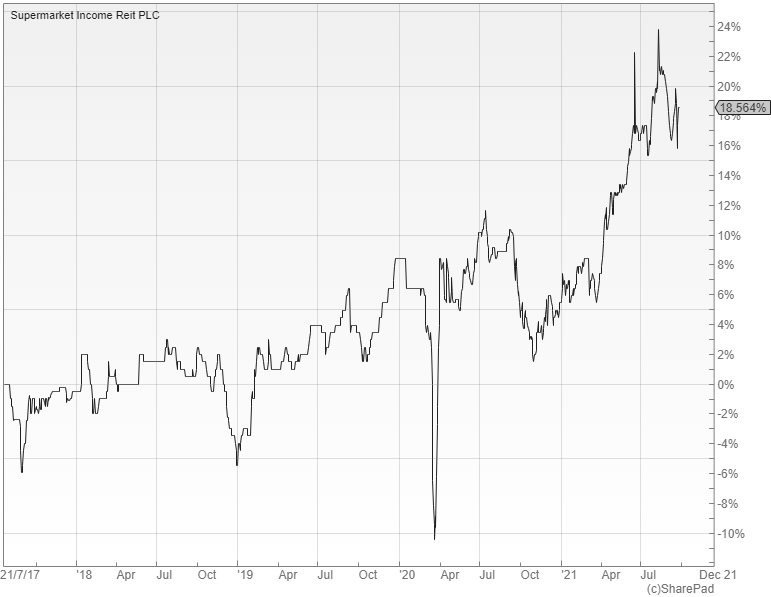

Earn an attractive five-percent yield from the Supermarket Income REIT

It has been a good year for this specialist property fund, which pays a hard-to-beat level of income that is attracting more investors to the sector.

The Supermarket Income REIT (LON: SUPR) is a unique, real-estate investment trust that holds a portfolio of supermarket properties worth around £1.2bn. It aims to use these assets to generate a long-dated, secure, inflation-linked stream of income with the potential for capital growth over the longer term.

In its annual results for the year to the end of June, the fund made an excellent net asset value (NAV) total return of 12.7%, including the four quarterly dividends of 1.465 pence. These were fully covered by earnings and have since been increased to 1.485p, which gives the shares an attractive prospective yield of five percent.

It was a busy year for the trust with two over-subscribed share placings raising a total of £353m, highlighting the growing demand for these types of assets. The fresh capital was used alongside existing funds to buy a further 20 supermarket properties and increase the investment in a joint-venture stake in its Sainsbury’s portfolio.

Growing portfolio

The company has a directly held portfolio of 35 stores that are mostly located in England. At the end of June, they had a weighted-average, unexpired lease term of 15 years. In aggregate the properties have a total annualised rent roll of £64.9m.

In addition to the direct portfolio the trust also has a 50:50 joint venture with BA Pension Trustees, which holds a 51% stake in a portfolio of 26 Sainsbury’s stores. Sainsbury’s has options to repurchase all of these properties when the current leases expire in 2023. Post year-end it has exercised this option over 13 premises, with the option to reacquire a further 10 becoming available in December 2021.

At the end of June, the company had borrowings of £413m and cash of £19.6m giving it an easily manageable 34% net loan-to-value ratio. Since then it has increased its debt financing by £93.1m to provide additional resources for further potential acquisitions.

A good option for income investors

The healthy NAV total return was largely due to the like-for-like valuation growth of 8.5% achieved during the year. This was mainly driven by the weight of investor demand, rather than rental uplifts, as these types of assets that offer a long income stream with strong rent cover are pretty hard to find in the current environment.

Sainsbury’s decision to exercise its option to reacquire assets from the joint-venture portfolio will also add further NAV upside given that the disposal price will be based on the assumption of a new 20-year lease. The exact timing and amount of the uplift is still to be determined, but with the shares trading on a 10 percent premium to NAV it looks like investors have already priced it in.

Supermarket Income REIT’s future prospects will depend to a large extent on whether the management team is able to continue to find acquisitions at high enough yields to support the company’s dividends, although the indexation of leases in the current inflationary environment should result in stronger rental uplifts. If you expect inflation to remain high and interest rates to stay low it could be a good option for income investors.

Comments (0)