Does This UK Small Cap Trust Offer A Compelling Valuation Opportunity?

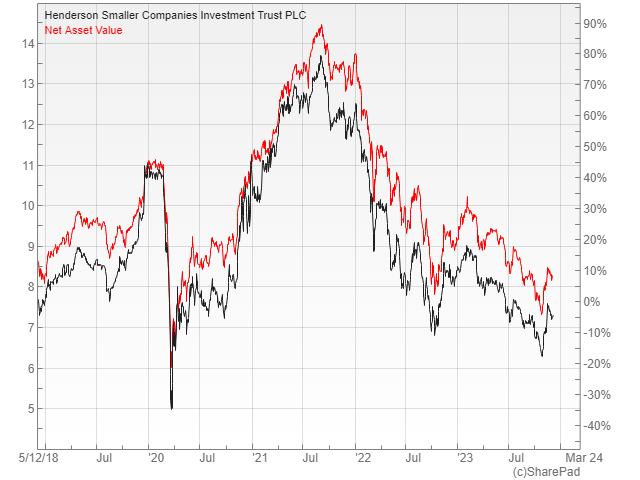

It has been a tough time for UK small-cap stocks with the Numis Smaller Companies ex ICs index down 16% since the start of 2022, well behind the four percent rise in the FTSE All-Share. Some of the investment trusts operating in this area have been even weaker with their shares sliding to double digit discounts to net asset value.

One such is Henderson Smaller Companies (LON: HSL), which has seen its NAV lose 36% over the same period due to its growth bias. This is obviously pretty dire for existing investors, but the broker Numis believes that the underlying portfolio now offers a compelling valuation opportunity.

They say that although sentiment is weak, history suggests that small-cap shares start their recovery before economic conditions improve. The fact that interest rates may now have peaked leaves this part of the market well-placed to re-rate.

Sticking To His Guns

Despite the recent underperformance, manager Neil Hermon is sticking to his strategy of Growth at a Reasonable Price (GARP) on which he has built his track record. He believes that the earnings outlook for most of his largest holdings remains positive, with the share price declines being largely multiple driven.

Hermon operates a bottom-up investment approach that is focused on stock selection and building a diversified portfolio. The process has not changed since he took the helm in November 2002 and involves an assessment of: the business model, the management and the company’s finances, as well as its ability to deliver positive earnings surprises.

Despite the clear focus on growth, the manager will only invest at what he considers to be the right price. In order to assess this he uses a range of valuation measures, in an effort to find companies where the full earnings growth has not been factored in by the market.

The largest positions at the end of October included the likes of: housebuilder Bellway; the construction giant, Balfour Beatty; the scientific instrument maker, Oxford Instruments; as well as restaurant chain Mitchells & Butlers. Most are performing in what is described as a robust manner.

Cheap As Chips

It has been well documented that the UK stock market looks cheap relative to history and its global peers, with the index trading at a 42% discount to the MSCI AC World and a 50% discount to the S&P500. This looks excessive, especially considering that around half of the FTSE 250 constituents’ revenue comes from overseas.

HSL’s portfolio is currently valued on a forward PE ratio of 9.6x, compared to a five-year average of 13.6x and is even trading at a discount to the index, which is unusual given its growth bias. There is also further value on offer, as the shares are available 12% below their NAV.

Hermon’s disciplined approach has enabled him to build up an exceptional long-term track record over the course of several economic cycles. Since he was appointed manager in November 2002, the fund has produced NAV total returns of 986%, which is well ahead of the 632% from the index, outperforming the benchmark in 16 out of the last 20 years.

The shares bounced back 13% in November, largely due to falling inflation and the potential for lower interest rates, which shows how quickly prices can react to changes in sentiment. Despite this they are still about 45% below their September 2021 peak and Numis believe that there is additional upside, given the potential for a further recovery in the small caps.

Comments (0)