Challenging period for RIT Capital

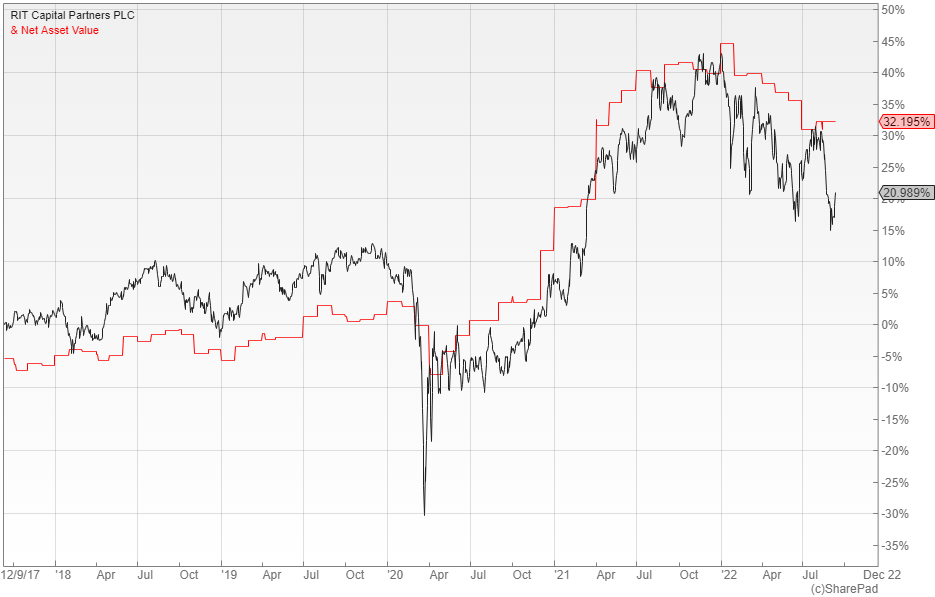

It has been a difficult few months for investors in RIT Capital (LON: RCP), the £4.4bn trust that aims to protect and enhance shareholders’ wealth over the long-term. According to the interim accounts, the NAV was down 8.8% in the first half of the year, which was better than its MSCI World benchmark, but well behind the 6.2% absolute return target of CPI plus three percent.

Despite this the longer term record is still exceptional with the trust participating in 76% of monthly market upside and only 40% of the market declines. It has generated an average share price total return of 11% per annum since its inception in August 1988, which is substantially ahead of global equity markets.

RIT provides exposure to a diversified global multi-asset portfolio that includes both quoted and unquoted investments, with some of the cash allocated to external managers. The main weightings at the end of June were: quoted equity, via long-only funds 18.7%, direct holdings 5.3% and hedge funds 11.6%; private investments, with 30.3% in third-party funds and 12.7% in direct holdings; with the balance in absolute return and credit.

A unique portfolio

The quoted equity allocation was the lowest in a decade, yet it was still responsible for most of the loss in the first half of the year. This was mainly because of the exposure to growth stocks and Chinese equities, although it’s a balanced portfolio with a mixture of growth, cyclical/reflationary and defensive names.

Two of the fund’s core long-term structural themes are China and biotech with the managers retaining their positive outlook on both of these areas despite the recent difficulties. The former has suffered as a result of the zero-Covid policy, property sector clampdown and geopolitical tensions, with most of the risks now priced in, while the latter benefits from some attractive valuations and high levels of innovation.

The private investments, which represent the largest allocation at 43% of net assets, were responsible for 1.7% of the decline over the first six months. This is another area that has struggled as interest rates have risen with technology and Chinese stocks being the main detractors. There could be further downside here as the accounts were based on a mixture of quarter four and quarter one valuations.

Strong long-term record

RIT is differentiated from most investment trusts by being self-managed and also by its active management of both equity and currency exposure. Although the recent 8.8% loss will be disappointing to investors, it was still materially better than the 14.7% fall in the MSCI World benchmark and demonstrates how the trust has been able to build up its long-term record of outperformance.

The broker Numis has RIT as a core recommendation in the global sector as they think that its emphasis on capital protection fits well with the risk tolerance of many private investors. They believe that the investment team, supported by its connections to leading third-party managers, is well-placed to exploit opportunities that arise across a range of asset classes.

RIT is currently trading at around a nine percent discount to the latest published NAV at the end of July, which is unusually wide and reflects the recent loss and question marks over the valuations of the private investments. The average net equity exposure year-to-date is a lower than usual 39%, so the portfolio offers a decent level of downside protection.

Why in the current climate would any fund manager invest quite heavily in China. If anything remotely happens regarding Taiwan then the fund, and any other investing in China would be in free fall . Way too much risk in my view