Buying opportunity for Round Hill Music

Round Hill Music Royalty (LON: RHM) has just released its maiden results covering the period from the IPO in November 2020 to the end of December 2021. These reveal an impressive NAV total return of 17.6% for the ordinary shares.

Since the launch, it has made considerable progress and has successfully constructed a highly diversified portfolio of music copyrights. At the end of the reporting period it had amassed 49 separate catalogues containing over 122,000 songs for around $400m.

This process has continued post year-end with the acquisition of the publishing, master rights and master royalties for the catalogue of David Coverdale, as well as a significant majority of the publishing, masters and neighbouring rights for 94 compositions and 159 recordings from the rock band Alice in Chains. These now sit alongside hits from the likes of Yes, Pearl Jam, Supertramp and Rage Against The Machine.

Licensing opportunities

The broker Investec says that music is now being consumed and monetised in more ways than ever before and this presents new licensing opportunities and revenue sources for owners of music copyrights. It is interesting to note that Round Hill has been able to secure a sizeable settlement from the platforms Roblox and Twitch covering previous unauthorised usage, which follows earlier similar successes with TikTok and Triller.

The investment manager believes that Facebook (now Meta) will require greater rights than it currently has licensed as it expands its Metaverse platform. Round Hill is also currently in discussions with its digital licensing administrator, Audiam, regarding further new licensing opportunities, including: SNAP (short-form video platform); Singa (karaoke platform); and WithInVR (virtual reality fitness app).

One of the main risks is that the sharp increase in inflation will erode people’s disposable income with the result that they will cut back on their streaming subscriptions. This has already had a massive impact on the likes of Netflix, although as yet there is no evidence of declines in pure music service subscriptions.

Buy rating

Investec like the manager’s focus on acquiring older vintages, which they believe provide more predictable earnings than newer catalogues. The fund’s holdings represent a diversified mix of income streams, while the exposure to master recordings − 27% of income per the accounts − offer much higher growth than music publishing rights.

The broker believes that Round Hill has an important role to play in diversifying portfolio returns given the lack of correlation between the underlying cash flows and broader markets. It is targeting an annualised dividend of 4.5 cents, which gives the shares a prospective yield of 4.2% and they are currently available on a four percent discount to NAV with Investec rating the fund as a buy.

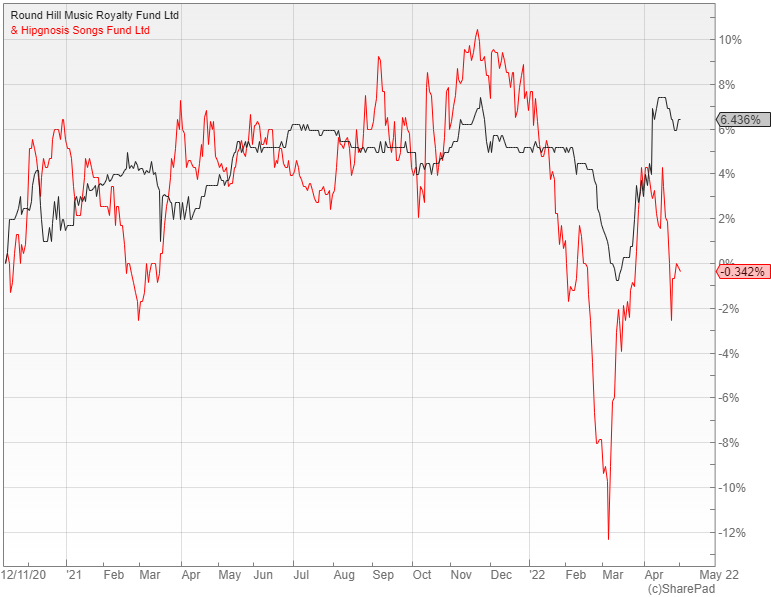

Its main competitor is Hipgnosis Songs (LON: SONG), which is significantly bigger with total assets of two billion pounds versus £370m for Round Hill. Following recent share price weakness it is yielding 4.4% and trading on a 7.5% discount.

Comments (0)