British Empire Trust has further upside potential

The latest annual report from the British Empire Trust suggests that there is significant potential for further strong long-term returns. Here’s why…

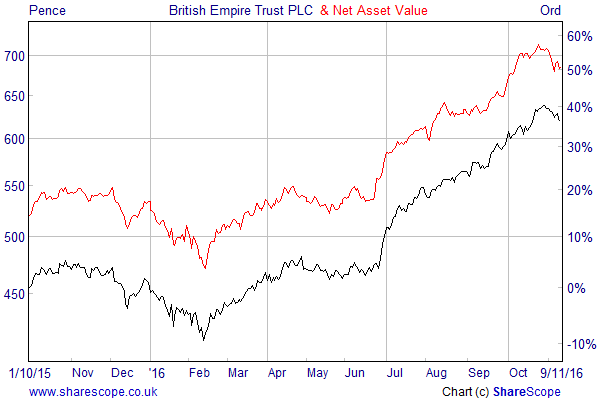

A few weeks ago I wrote about the improvement in performance at the British Empire Trust (LON:BTEM), which can be traced back to when Joe Bauernfreund took over as lead manager in October 2015. The investment trust has just released its annual accounts for the year to the end of September and they are well worth a closer look as they provide a useful insight into the strategy and major holdings.

BTEM was created in 1889 and aims to generate capital growth by investing in a focused portfolio with a particular emphasis on companies and closed-ended funds whose shares trade at a discount to their underlying net asset value (NAV). It has a market value of around £770m.

In the year to 30 September the investment trust made a total NAV return of 31%, which was 3% ahead of its MSCI World ex-US benchmark. Half of this was due to the strong NAV growth of the underlying funds, with the overseas holdings also benefiting from the fall in the value of the pound post Brexit.

Since Bauernfreund took over he has made the portfolio more concentrated with the top 20 positions now making up just over 90% of the NAV. This has allowed him to focus his attention and resources on the investments with the most upside potential.

The key holdings

Some funds tend to be fairly reticent about their largest holdings, but that is not the case with BTEM, which provides snapshots of its 10 biggest positions that make up about half of the NAV. These consist of high quality, undervalued assets and show what a diversified portfolio the manager has put together.

A good example is AP Alternative Assets. The investment company now holds just one position: a stake in Athene Insurance, an unlisted retirement services company that issues, reinsures and acquires retirement savings products. AP trades on a 43.5% discount to NAV and makes up 6% of BTEM’s portfolio, but the position should soon be realised as Athene is expected to float on the New York Stock Exchange before the end of the year. If it does it should generate a healthy profit.

Another major investment is Wendel, a French-listed holding company with exposure to a diverse range of industrial sectors. Its main business lines include industrial certification and inspection services, building material production and mobile telephone infrastructure. The company is valued at £50m and trades at a 32% discount to its estimated NAV.

The Vietnam Phoenix fund is an Irish-listed closed-ended fund that invests in listed and unlisted Vietnamese companies. It has recently approved restructuring proposals that will result in the listed assets being moved into an open-ended fund and the private equity assets being spun-off into a separate realisation vehicle.

This sort of position shows the potential of some of BTEM’s holdings, as it was up 28% over the year due to the strength of the Vietnamese market. Vietnam Phoenix has increased by 80% in sterling terms since the fund first invested and there is further upside to come as the 19% discount should more or less disappear once the restructuring has been completed.

JPEL Private Equity is a London-listed closed-end fund that invests in private equity primarily in the US and Europe. Its portfolio is well-balanced between mature legacy funds, which generate substantial cash flows that will be distributed to shareholders, and more recent secondary direct investments. The latter are mainly high growth companies bought at attractive valuations that have produced compelling NAV growth. It is trading at a 26% discount to NAV.

Investment philosophy and outlook

BTEM invests in listed companies that own high quality assets such as publicly traded securities, properties, cash or other businesses and that are trading at a wide discount to the estimated NAV of these underlying holdings. The fund will only invest if there is a good chance of the assets appreciating in value and where there is a catalyst for the discount to narrow.

In the annual accounts they highlight the significant risks facing investors including the big unknowns such as the impact of Brexit and the election of Donald Trump. The way they counter this is by investing in high quality assets that are genuinely good value. These should produce good long-term returns, although with all these sorts of vehicles you need to be able to accept the shorter term volatility.

It is interesting to note that despite the strong performance over the last 12 months the fund’s weighted average discount was 32% at the end of September, up from 28% the year before. This suggests that there is considerable scope for further outperformance.

BTEM shares trade at an 8% discount to their NAV, which is on top of the underlying discounts, although it has narrowed due to the strong performance and the active use of share buybacks. They are yielding around 1.9% with ongoing charges of 0.89%.

The British Empire Trust had a few quiet years under the previous manager, but Bauernfreund has given it a new energy and focus. He has added considerable value by concentrating on his highest conviction ideas and having the courage to top-up positions during periods of market weakness. Investors need to be mindful of the boost from the fall in the value of the pound, which could potentially reverse in the coming months, but the fund offers an unusual exposure and has decent upside potential.

Comments (0)