Are these the best technology funds in town?

Nick Sudbury uncovers some of the best funds and trusts for investors to gain exposure to the technology sector.

It is hard to think of a more dominant sector of the market than technology. Innovative companies that develop or make the best use of key advancements are able to grow astonishingly quickly, often becoming global leaders in the space of a decade, something that was previously unheard of.

Technology is now an integral part of everyone’s daily life and affects almost everything we do. At its best, it can completely change established business models and processes, transforming whole industries and creating brand-new market leaders.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The problem at the moment is that many feel that the sector is somewhat on the expensive side, with the technology-laden NASDAQ back near its all-time highs. Unfortunately, it is a difficult area to value, as these high-growth companies often have little in the way of visible earnings or profits until their true potential is actually realised.

Adrian Lowcock, head of personal investing at Willis Owen, says that most of the high valuations are attributed to a few large companies that are seen as the ‘only game in town’ in their area of operation, such as Amazon and Facebook:

“The risk with these is that new investors are effectively being asked to pay a hefty premium for tomorrow’s profits, which usually means that returns in the future will not be as attractive as those we have already seen.”

Recent initial public offerings (IPOs) from the likes of Lyft and Uber have been disappointing, yetsome of the giant technology companies still appear to be fairly good value, using traditional metrics.For example, Apple’s P/E ratio is around 16, which is below the S&P 500 at about 20 times earnings, whilst Microsoft is slightly above, at 28 times. This is not cheap, but is not all that unreasonable for a technology company.

Darius McDermott, managing director of Chelsea Financial Services, says that in the short term they would be wary of investing a lot of money in the sector, but over the long term they think it is still very exciting:

“Long-term trends such as artificial intelligence and virtual reality could see technology transform very quickly again, but there are some near-term worries like the US-China trade war where a ban like Google suspending its links with Huawei, and its effect on 5G could do some real damage.”

Open-ended technology funds

Ben Willis, head of portfolio management at Chase de Vere Independent Financial Advisers, says that many people are still nervous about the prospect of investing in technology after the dramatic boom and bust at the beginning of the millennium:

“This lives long in the memory of investors, many of whom suffered significant losses after investing near to the top of the market and then watching as prices went into freefall. However, today’s technology funds are more likely to be filled with established companies such as Apple, Microsoft, Alphabet and Samsung, than many of the dot-com companies and other fledgling firms from back then.”

If you want to benefit from this sort of exposure, there is a handful of specialist technology funds to choose from, although it is worth bearing in mind that other equity funds in your portfolio will already be investing in the sector:

“Most investors will be gaining exposure to these companies through global and US-equity funds in particular. This is because the technology sector is heavily focused towards the US and is a big component of the US-equity market, making up about 20% of the S&P 500, while the US-equity market also makes up about 50% of global benchmark indices,” explains Willis.

The Investment Association’s Technology and Telecommunications sector contains only 15 funds, the majority of which are actively managed and invest in technology companies from around the world. Most of these businesses are listed in the US, so even the more diversified funds such as Fidelity Global Technology and Polar Capital Technology have 61% and 70% respectively invested in the country.

Lowcock says that the technology sector is full of promising ideas, but many of these businesses end up as commercial ‘dead-ends’ or don’t fully realise their potential:

“Fundamental analysis is probably even more important here than in any other market. Technology stocks are potentially high growth, but require a lot of investment to achieve that growth, so the fund managers who operate in the sector need to understand the business, the management team and the risks before they support a company by investing in it.”

Top picks

McDermott and Willis both like the £684m AXA Framlington Global Technology fund that benefits from having an experienced manager in Jeremy Gleeson, who has been running the fund for more than a decade.

Gleeson looks for new technology with proven commercial viability and avoids the blue-sky companies with good ideas, but zero income and burgeoning development costs.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

“We think his level-headed commitment to finding new opportunities with strong commercial potential, and ignoring yesterday’s winners, coupled with his and his team’s vast experience, may make the fund an appealing option for investors seeking technology exposure,” explains McDermott.

The manager has put together a concentrated 63-stock portfolio with the 10 largest positions accounting for 39% of the assets. These are mainly the mega caps like Alphabet, Apple, Cisco, Visa and Facebook that dominate the sector. The fund has ongoing charges of 0.82% and over the last 10 years has returned 534%.

Lowcock prefers the £2,650m Polar Capital Global Technology fund, which is the best performer in the sector over 10 years with a return of 587%. He says that the managers, Nick Evans and Ben Rogoff, believe that they can add value by investing in companies that offer new, disruptive technologies:

“This is a process that combines thematic analysis, to identify the growth areas of the industry, with rigorous company analysis. The managers have proved themselves able to implement it with discipline, combining adept stock picking with thoughtful consideration of the broader market.”

Evans and Rogoff have put together a 71-stock portfolio and although the largest holdings include the likes of Microsoft, Alphabet and Alibaba, there is a definite bias towards smaller-cap companies with strong growth prospects. This inevitably means that the volatility is higher than that of some of their peers, although long-term investors have been well-rewarded for the extra risk.

One of the main downsides is that it is very expensive, with ongoing charges of 1.65%. There is also a performance fee that is applied to the outperformance of the benchmark, the Dow Jones Global Technology Net Total Return Index.

A passive alternative

In theory, this is an area where a decent fund manager should be able to add considerable value via their stock-selection skills, but if you prefer a cheaper, passive alternative there are a couple of index trackers as well as various ETFs.

Willis likes the £356m Legal & General Global Technology Index Trust thattracks theperformance of the information-technology sector of the FTSE World Index. This consists of 177 stocks, but is dominated by the US technology giants Apple, Microsoft, Alphabet and Facebook, that account for 41.6% of the portfolio. Over the last 10 years the fund has returned 424% after deduction of the ongoing charges of 0.7% per annum.

It could hardly be more different to the£38m Close FTSE Techmark that invests in UK technology companies in the FTSE techMARK All-Share Index. Over the last five years the fund has returned just 73% − partly due to the weakness in the domestic stock market – but over 10 years the figure rises to a more impressive 290%.

McDermott says that for a technology fund, avoiding the losers is just as important as picking the winners, because some companies have good ideas but can’t make a profit, so an index fund isn’t always the best place to be:

“Also, some of the technology stocks are so big – the top five holdings in the Legal & General fund are 40% of the portfolio – that you have to be sure the big companies will do well.”

Investment trusts

There are only four specialist investment trusts that concentrate on the technology sector, with the largest being the £1.9bn Polar Capital Technology (LON:PCT) investment trust. Lead manager Ben Rogoff, who has been running it since May 2006, has put together a more diversified 115-stock portfolio than his open-ended fund, with the largest positions including the likes of Microsoft, Alphabet, Apple, Facebook and Tencent.

Rogoff believes that the continuing emergence of the next technology cycle is having a disruptive effect on many of the sector’s existing large-cap incumbents. This explains why he has an underweight position in large-cap stocks relative to the benchmark and has a zero weighting in many of the companies viewed as legacy providers. At 0.99%, the ongoing charges are much cheaper than his open-ended fund, yet the performance has been very similar in recent years.

Over the last 10 years, the Polar Capital Technology investment trust has returned an impressive 602%, which is well ahead of both the Dow Jones Global Technology benchmark and the peer group. However, the analysts at Winterflood believe that the manager’s benchmark awareness might limit the returns relative to a less constrained approach − such as that taken by the fund of the month, Allianz Technology Trust (LON:ATT) − given thefast-paced dynamic nature of the sector and the fact that it is undergoing significant change.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

If you are looking for a different type of exposure there is the £1,052m Herald Investment Trust (LON:HRI) that invests in smaller quoted companies in the areas of communications, multi-media and technology. The fund has a global mandate, although over half of the portfolio (53%) is currently in stocks listed in the UK.

Small-cap technology stocks are under-researched relative to the mega caps and can be inefficiently priced, although the onus is on the fund manager to be able to pick them out. There is also the added attraction that they might be snapped up by their larger peers, especially as many of the US technology giants are holding substantial amounts of cash on their balance sheets.

Herald has ongoing charges of 1.15% and has delivered a 10-year share-price return of 432%, yet the shares are currently trading on a hefty discount of 14%.

A more specialised option is Augmentum Fintech (LON:AUGM), a relatively new £103m fund that invests in a concentrated portfolio of fast-growing, unquoted fintech businesses in the UK and Europe. Around £25m of the cash raised at the IPO in March 2018 is yet to be committed and more shares are to be issued, to take advantage of an exciting pipeline of new opportunities.

The fund’s largest investments include holdings in Zopa, a well-established peer-to-peer lending platform that is well on the way to launching a next-generation bank; Interactive Investor, which will soon be the country’s second-largest direct-to-consumer stockbroker; and Monese, which mainly provides banking services to those who work abroad and need a local bank account.

Each new deal is typically in the range of £2m to £6m and the holdings are then actively managed with a view to positively influencing any future financing rounds and the eventual exits, with the aim being to return up to 50% of the gains on disposal. The shares are currently trading on a 3% premium.

Fund of the month

The Allianz Technology Trust (LON:ATT) has been around for almost 25 years and with assets of £544m is a decent size without being unwieldy.It benefits from having an experienced and well-resourced management team that is based near Silicon Valley in California, which puts it close to the headquarters of many of the large global technology companies.

Manager Walter Price has been investing in these sorts of stocks for over 40 years and has put together a relatively concentrated 75-stock portfolio. He tends to favour mid-cap higher-growth businesses, which means that the largest positions include less-familiar companies such as Paycom Software, Zscaler, Okta, Cree and Twilio.

Price looks for companies that are addressing major growth trends with innovation that replaces existing technology, or radically changes products and services and the way in which they are supplied.

He says that they are seeing an ongoing wave of innovation that they believe has the potential to produce attractive returns for companies with best-in-class solutions. Despite the high valuations for some of the higher-growth companies, they continue to see massive addressable markets that will support much larger revenue streams.

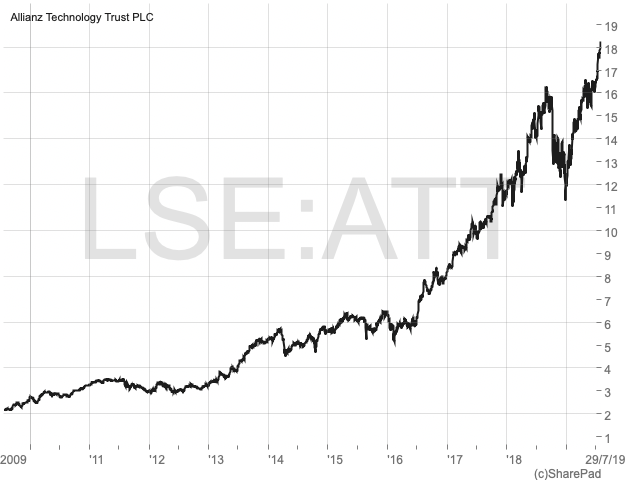

Winterflood believes that Allianz Technology is well-placed to outperform its benchmark over the longer term and it is one of their recommendations for the year. The shares have returned 655% over the last 10 years and are currently trading on a premium of 2%.

Fund facts

Name: Allianz Technology Trust (LON:ATT)

Type: Investment Trust

Sector: Technology

Total assets: £544m

Launch date: December 1995

Current yield: 0%

Gearing: 0%

Ongoing charges: 0.92%

Website: www.allianztechnologytrust.com

Comments (0)