Rolls-Royce lifted by strong revenue growth

Never miss an issue of Master Investor Magazine – sign-up now for free! |

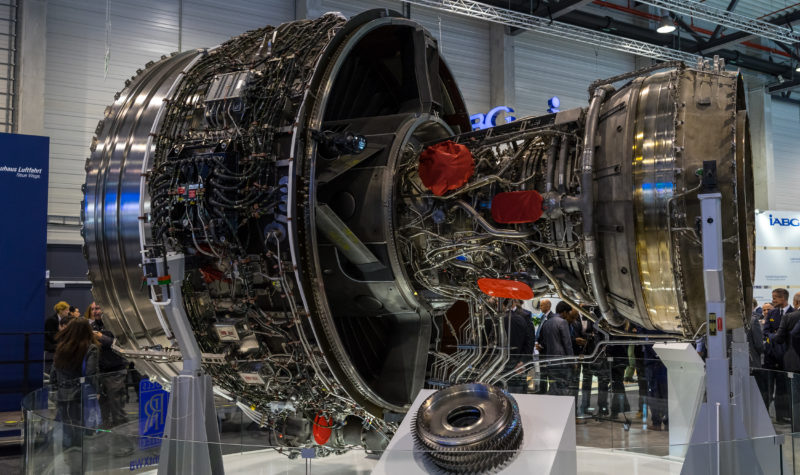

Engine Manufacturer Rolls-Royce (LON:RR.) increased revenues by 14% to £7,040 million during the first half, driven by a 26% improvement in the civil aviation division. Underlying profits and free cash flow both improved substantially, but reported profits were hurt by an abnormal £554 million charge linked to Trent 1000 engine’s total costs through to 2022.

Management said that they now expect results for the full year to be towards the upper end of the existing guidance and large scale engine production is continuing to ramp up.

Chief executive officer Warren East commented: “Rolls-Royce is at a pivotal moment in its history. After a long period of significant investment and innovation, we are poised to become the world-leader in large aircraft engines. Now we need to deliver the fundamental changes that will enable us to realise the potential of our position, delivering improved returns while continuing to invest in the innovation needed to realise our long-term aspiration to be the world’s leading industrial technology company. Our new business structure and drive for greater pace and simplicity, combined with our growing installed base, means we are well placed to exceed free cash flow of £1bn by 2020 and push towards our mid-term ambition for free cash flow per share to exceed £1.

This is the time for execution. In Civil Aerospace our installed widebody fleet will continue to grow and we will strive to further reduce cash deficits on engine sales, whilst working hard to minimise the disruption caused to our customers by in-service issues. The benefits of creating a single Defence operation with greater scale and the ability to offer customers a broader range of products and services, should present us with new opportunities. In Power Systems the continued expansion of our end markets is driving strong volume and this, combined with the further product portfolio rationalisation and the development of new service offerings, gives us confidence for the full year“.

Shares in the company were up by 6.95% at 1,056.50p (as of 14:45 BST).

Comments (0)