IQE sinks as it cuts guidance further

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

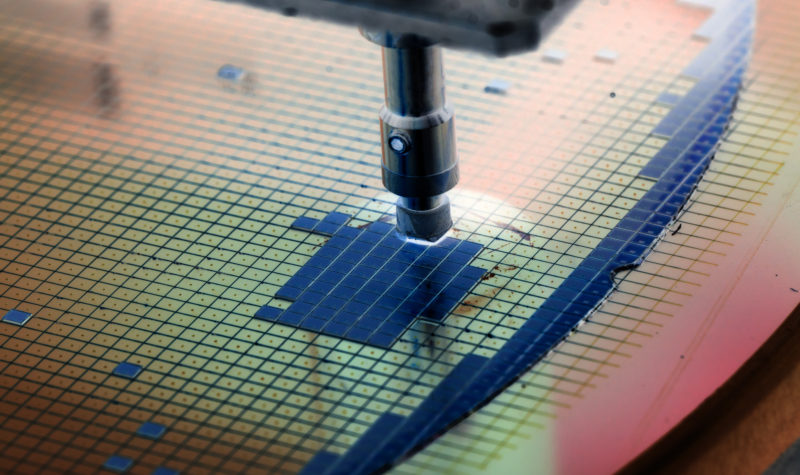

AIM-listed semiconductor manufacturer IQE (LON:IQE) has seen its share price drop by 29.81% to 50.29p (as 12:05 BST) after it cut revenue guidance for the year. Management said that the mobile phone sector had remained sluggish and there had been customer specific problems in the iridium phosphate laser market.

There have also been geopolitical concerns linked to Huawei that have now been revealed to have a larger impact on the supply chain that previously expected.

CEO Dr Drew Nelson commented: “These are unprecedented times for the global semiconductor industry as geo-political conditions affect interconnected global supply chains. It is now clear that the impact of Huawei’s addition to the US Bureau of Industry and Security’s Entity List is having far-reaching and long-lasting impacts on global supply chains. This is a matter outside of IQE’s control but we have responded swiftly to leverage our breadth of relationships and to pursue new sales opportunities. We are also taking prudent expenditure actions in order to manage through this period of uncertainty. IQE remains well placed to adapt to mid – long-term share shifts at both the component (chip) and the OEM level. Indeed, we are now seeing increasing activity from customers in alternative supply chains across our business units as these supply chains respond to current market dynamics. We anticipate significant new customer qualifications during the second half of 2019 as a result. As global markets adjust and recover, we remain extremely well placed for significant future growth“.

Comments (0)