Transense Technologies – Is this little company set create big returns?

Have you ever heard of surface acoustic wave sensors?

No? Nor had I before I was given a nudge to take a look at the AIM quoted Transense Technologies (LON:TRT).

This little company, capitalised at some £17m, is in fact a world leader in the SAW sector.

What is SAW

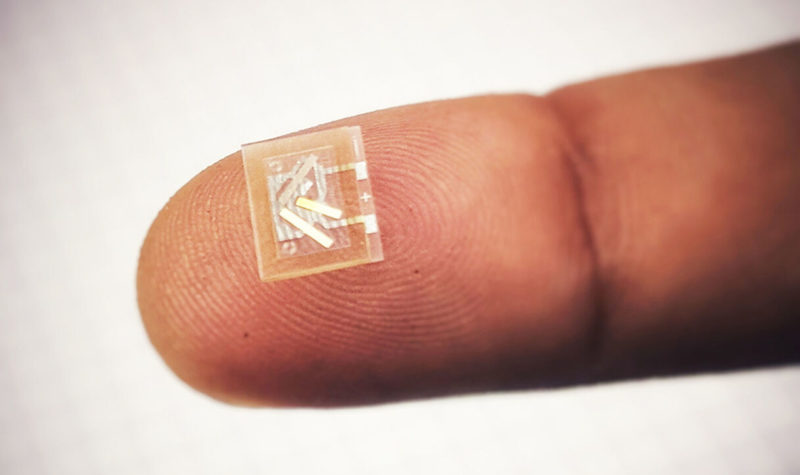

Surface Acoustic Wave (SAW) sensors are wireless and battery-less, they are used in the real-time measurement of torque, temperature and pressure to improve power, performance and efficiency through condition monitoring and asset/predictive maintenance.

This patent-protected technology offers significant advantages over alternative sensors, and is particularly targeted towards the aircraft, specialised automotive, renewable energy, rail, marine and industrial markets.

Thirty years of operations

This is not a new business. In fact, the Bicester, Oxfordshire based company was established way back in 1991.

The company develops, manufactures, and sells, primarily in the UK, highly specialised sensor systems and enabling technology, using surface acoustic wave technology.

Its development work carries on year after year, it has a dedicated team of scientists, mechanical and electronic specialists, many of whom have been with the company for over 20 years.

So exactly what is a Torque Sensor?

Torque sensors or transducers measure torque in a variety of methods. The basic principle is, in essence, a very simple mechanical process. It is a measure of the ‘force’ being used or attempting to turn an element. When a force of ‘torque’ is applied to a shaft, the shaft twists by a very small amount.

The Transense torque sensor is a non-compliant sensor that measures minute changes in surface strain using its SAW technology.

Its product offer

The company offers inspection gauges for car, commercial truck and bus tyres; and for tread depth, tyre pressure, radio frequency identification, and as a tyre pressure monitoring system data collection tool; as well as radio frequency identification tags, patches, and passenger car audit system products, together with various types of probes.

It also develops and markets sensor systems for measuring torque, temperature, and pressure.

Top name collaborators

The company has a declared strategy to maximise shareholder value through the delivery of sustained revenue growth from all three of its principal technologies – SAW, iTrack and Translogik probes – through leveraging its excellence in innovation, its know-how in commercialising technologies, in industry partnerships and through exposure to global growth markets.

Over the years it has built up a number of partnerships with industry-leading outfits such as Goodyear, Ford, GE, Bridgestone, Allied Motion, McLaren Applied, the University of Southampton and many others.

In June last year the group announced that it had granted exclusive worldwide licence for its iTrack technology to the world’s largest tyre producer, the Japanese Bridgestone Corporation. It gave that company the ability to offer to its customers worldwide tyre monitoring systems for all off-the-road vehicles based upon iTrack technology.

Transense in turn will receive quarterly royalty payments based upon the number and classification of vehicles upon which the iTrack technology is deployed over a ten-year period.

Apparently, the group is about to reap the benefits of all its development work, there are surely more big contract partnerships as future projects to be announced in the intervening periods.

The latest deal

On Tuesday of this week Transense announced the signing of a Joint Collaborative Agreement with McLaren Applied. This gives the latter company exclusivity in elite motorsport drivetrain applications in exchange for meeting minimum target revenues on an annual basis over five years.

McLaren anticipates significant growth in the adoption of this technology for torque sensing in motorsport, at a regulatory body level as a control sensor for rules compliance, and for performance advantage.

Interesting equity spread

The group has some 16.43m shares in issue.

Larger shareholders include CriSeren Investments (9.33%), Seneca Partners (7.60%), Lobbenberg Family (5.89%), Walker Crips Investment Management (4.91%), Harwood Capital (4.87%), Legal & General investment Management (3.29%), Hargreaves Lansdown (3.20%), Gerald Oury (3.00%), SpreadEx (2.39%), Nigel Rogers (1.37%), and Graham Storey (0.48%).

By the way ex-PWC chartered accountant Nigel Rogers (60), who is the group’s Executive Chairman, is also Non-Executive Chairman at another of my favourite profiled companies Solid State (LON:SOLI) and also at Surgical Innovations Group (LON:SUN).

Results due within the next fortnight

The annual results for the year to end June are due to be announced on Tuesday 28 September, with an Investor Presentation the next day.

Analyst Ian Jermin at Allenby Capital is estimating that the group will have seen its revenues treble in the last year to £1.82m (£0.60m) while its pre-tax losses will have reduced significantly from £1.27m to just £0.17m. In that period, he estimates that the company’s net cash position will have fallen to just £1.05m (£1.19m).

But going forward it looks very interesting

However, for the current year to end June 2022 Jermin sees revenues rising to £2.27m, with a pre-tax profit of £0.36m, earnings of 2.56p per share and increased net cash of £1.11m.

But this is where it now gets very interesting – looking at the end June 2023 trading year forecasts.

He sees £3.24m revenues, profits of £1.17m and earnings of 7.55p per share. Net cash could be £2.05m by the end of that trading year.

My View

We have done very well with a previous profile company Surface Transforms (LON:SCE). It too has tied up a number of contract relationships which will earn the company big returns for the use of its products and technology. Its shares have risen from 17p to the current 67p, with more upside to come.

This group’s shares have enjoyed a fair run this year, from 53p in early January up to 112.34p in late August.

Now at 102p they offer investors, who are prepared to take a longer-term view, the potential of being twice this price in due course.

It will take a little while for the funds to really start to roll into the Transense coffers, but when they do I feel that the royalty payments will be significant, with the profits multiplying in reaction.

I now set an early Target Price of 127.5p on the shares.

Comments (0)