Transense Technologies – interims could help to reignite the share price

In the middle of last September, I profiled a little company that provides specialist sensor systems which are used to gather real-time data to improve efficiencies, performance and reliability.

The business

The Bicester-based company Transense Technologies (LON:TRT) is a Torque Sensor specialist.

Torque sensors or transducers measure torque in a variety of methods. The basic principle is, in essence, a very simple mechanical process. It is a measure of the ‘force’ being used or attempting to turn an element. When a force of ‘torque’ is applied to a shaft, the shaft twists by a very small amount.

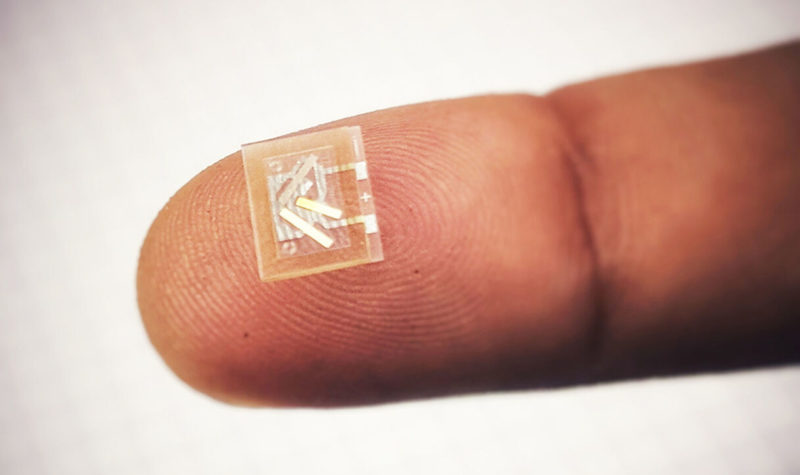

The Transense torque sensor is a non-compliant sensor that measures minute changes in surface strain using its Sensor Acoustic Wave (SAW) technology, which is a patent protected product.

Its product offers

The company offers inspection gauges for car, commercial truck and bus tyres; and for tread depth, tyre pressure, radio frequency identification, and as a tyre pressure monitoring system data collection tool; as well as radio frequency identification tags, patches, and passenger car audit system products, together with various types of probes.

It also develops and markets sensor systems for measuring torque, temperature, and pressure, currently aiming at the highly-specialised military, automotive and aerospace sectors.

While its tyre pressure monitoring system, iTrack, looks to be a future winner. Already the world’s largest tyre producer, the Bridgestone Corporation, is convinced enough to have taken out a ten-year license with the company.

The motorsport sector was a specific target for Transense. It tied up a five-year Joint Development Agreement last September, with McLaren Applied to develop non-contact torque measurement sensing products.

Over the years the company, which was set up in 1985, has built up a number of collaboration partnerships with industry-leading outfits such as Goodyear, Ford, GE, Bridgestone, Allied Motion, McLaren Applied, and the University of Southampton, amongst many others.

Brokers View

Analyst Ian Jermin, at Allenby Capital, the group’s NOMAD and Broker, considered that the group did well last year as its revenues trebled from £0.6m to £1.8m, which helped it to significantly reduce its losses from £1.27m to just £0.16m.

For the current year to end June, Jermin was estimating £2.62m of revenues and £0.36m of pre-tax profits, worth 2.56p per share in earnings.

For next year he has already pencilled in £3.59m of revenues £1.17m of profits and 7.55p per share in earnings.

Allenby Capital has published a ‘fair value’ of 150p for the group’s shares based upon its future royalties and cash generation.

Share price performance

The group’s shares were profiled at 102p and I set a price aim of 127.5p. They hit 117p within two weeks before falling away to 91p, then climbing back up again to hit 124.4p in early November – within a whisker of my objective.

They drifted back to the current 67p in general lacklustre trading over the last few months. And that was despite various directors of the group, including the Chairman, the COO and the CFO, paying prices of 106p down to 83p for additional holdings.

Even Harwood Capital added to its now 660,000 shares holding.

Equity

There are some 16.44m shares in issue.

The larger holders include CriSeren Investments (9.33%), Seneca Partners (7.60%), Peter Lobbenberg and family (5.89%), Walker Crips Investment Management (4.91%), Harwood Capital (4.02%), Legal & General Investment Management (3.29%), Javen Abrahams (3.20%), Gerald Oury (3.00%),SpreadEx (2.39%) and Chairman Nigel Rogers (1.52%).

My View

Well, I have to say that I get a good ‘feeling’ about this company and its potential over the next few years.

I believe that it will be using its products and technology to create big returns in due course

The £11m capitalised group will be announcing its interim results next Tuesday and the accompanying statement could bring the market up to date on its corporate developments.

I reckon that the shares, now at 67p, could well have another upward run and my Target Price remains totally intact.

(Profile 17.09.21 @ 102p set a Target Price of 127.5p)

Comments (0)