Trackwise Designs – good news could set the shares alight in such a tight market

On the face of it the shares of this £13.7m company look very expensive; but, when you look deeper, their potential value shouts out at you, argues Mark Watson-Mitchell.

Only floated on AIM at the end of July last year, Trackwise Designs (LON:TWD), which is based in Tewkesbury, Gloucestershire, is an as yet ‘tiddler’ in a massive market place. Trackwise manufactures products using printed circuit technology with a worldwide customer base. Sounds boring? Nothing new? Think again!

The company manufactures to customer specification, specialist products using printed circuit technology. Working across two primary divisions, Radio Frequency (RF) and Improved Harness Technology™ (IHT), the company’s specialist circuits are used globally in RF/antenna and lightweight interconnect products, across multiple market sectors and applications.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Flexible printed circuit boards were first developed over 60 years ago as a smaller and lighter weight alternative to traditional wire harnesses. FPC’s show benefits in space saving, weight saving, improved precision, improved reliability, reduced installation time, the ability to be bonded onto/into supporting structure and the ability to integrate electronic components. Globally the FPC market is a massive, multi-billion-dollar industry.

Some manufacturers can make flex printed circuit boards between 12m to 30m long, but they are only single or double-sided circuits. Other manufacturers can make between between 2.4m to 5m in lengths of multi-layer circuits. However, Trackwise’s IHT division has developed a unique proprietary technology which is a process to manufacture unlimited length of multilayer printed circuits. These, the company claims, are the world’s largest flexible multi-layer PCBs. And knowing how unique their technology really is, they have already filed patents on their IHT in the UK, the US and in China.

The IHT technology has a considerable scope for replacing traditional wire harnesses in a very wide range of industries, especially in the manufacture of civil aircraft across the world. Trackwise knows that its strongest IHT markets are in the aerospace (with Boeing and Airbus being the biggest players), automotive (particularly in electric vehicles), space (for unmanned aerial vehicles) and the general industrial sectors.

It has taken Trackwise some years, since 2010, in developing its IHT technology and a lot of money in doing so. That has largely been sustained by the profitable supply of RF products in support of 4G and 5G network deployment, as well as taking development grants.

RF (radio frequency) is the rate of oscillation of electromagnetic radio waves in the 3kHz to 300 kHz range, as well as the alternating currents carrying the radio signals. This is the frequency band that is used for communications transmission and broadcasting.

The cash generative RF business unit manufactures printed circuit boards, which are used, for example, in the antenna infrastructure to support the 3G and 4G mobile phone networks, and now too for the soon-to-be-launched 5G set-ups. These are a very large and revenue generating market place but a specialist field for Trackwise, which will underpin future demand and growth.

The RF business, for which there are multiple applications, has been the core of Trackwise over the last 25 years and is both profitable and stable with a gross margin of some 40%.

The company has several long-standing customer relationships – some 60% of the sales over the last five years has come from its top four clients. Circa 70% of sales is export. A key factor is that relatively low volumes and specialist nature gives the business some protection from global competition.

The patents, its know-how and its ‘first mover advantage’ are key to future success. And the company is committing itself still further to develop its capability, its competitive advantage, as well as creating new products.

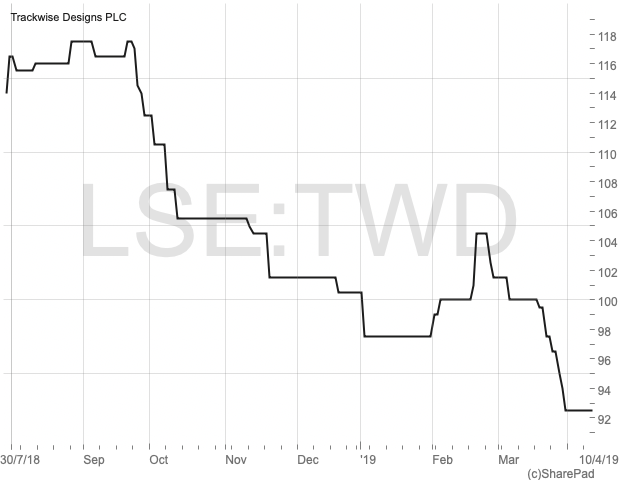

Trackwise floated last July, through a placing of 6,619,049 shares at 105p each. Some £4.6m net of expenses was raised for the company, whilst existing holders sold off just 9.3% of the enlarged equity.

With 14,772,372 shares now in issue it is impressive to note that, at my count, some 13,719,990 shares are in firm hands – with Miton Asset Management holding 13.31%, Octopus Investment 11.28%, Unicorn Asset Management also with 11.28%, and Shard Capital with 3.22%.

Even more impressive is the fact that Philip Johnston, the boss, who is 56 years old and holds degrees in aeronautical engineering and law, retains with his wife a 45.28% holding. Other holders include Adare Sladen with 5.79% and William De Winton with 4.13%.

The company should be announcing its 2018 results on Thursday (11thApril) and sales of around £4m could well have generated £0.3m of pre-tax profits, worth 2.1p per share in earnings. Brokers suggest that this year sales may jump 43% to around £5.7m and profits could leap 100% to £0.6m, worth 3.5p in earnings.

As I write, Trackwise shares at just 92.5p may look expensive, but I reckon that the potential for both sales and profits is enormous over the coming years. And that is why I see them, now at 12% below the AIM placing price, as a cracking longer term punt – with 150p, even 200p per share in target.

Comments (0)