Why it’s time to short Apple

– Apple has struggled to innovate over the last several years compared to the other technology companies such as Facebook, Google, Amazon, and Tesla.

– If a portfolio comprises technology stocks, shorting Apple may provide downside protection to your portfolio if and when the market corrects.

– Investors have to be careful when shorting stocks, but is it likely anyone is going to look to buy Apple at a market cap of $600bn and an EV of $460bn?

– iPhone constitutes 60%+ of Apple’s revenue. Smartphone market saturation and lengthening phone replacement cycles pose a challenge to Apple’s growth prospects.

– As an ex-employee of Nokia and Skype, I’ve seen how companies can fail from very strong positions due to weak leadership and not much innovation.

– At the price of $112, Apple trades at a 2017 consensus P/E of 11 times. Excluding the big cash balance from the price, the stock trades at a P/E of 8.5 times. The stock may seem cheap based on these multiples but with its mega market cap several institutional investors would have already reached their limit of purchases in the stock.

– I’ll cover my short position if they start innovating or if the US gives them a tax holiday or break to bring back the overseas cash.

– Investors can track real-time, relevant and personalised stories for Apple and other tech companies here.

Markets are up in 2016 significantly despite the uncertainties

2016 has been an interesting year to say the least, and amidst all the uncertainties, most markets have gone up significantly – maybe due to excess liquidity and little expectation of increases in interest rates.

The last 7-8 years have been great for most investors like me but I’m nervous now. Hence, instead of keeping a long only portfolio, which is what I’ve done over the last several years, I’m now looking to hedge my portfolio by adding stocks that I think are overvalued.

One such stock is Apple, which, going forward, I believe, will face a significant diversion from its more-than-a-decade-long growth path.

Source: Google Finance

Apple has been quite volatile over the past year

The stock has declined 7% in the past year despite a strong stock market. Investors may have already been punishing the stock for its lack of innovation and declining growth prospects.

Source: Google Finance

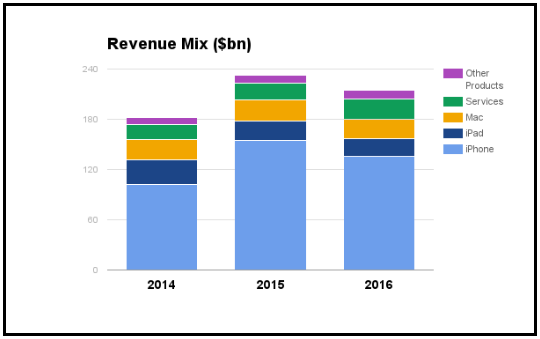

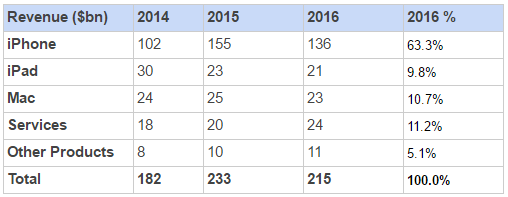

Apple’s annual sales and profits declined for the first time in 15 years in FY16

It reported three consecutive quarterly declines in FY2016 with Q416 seeing a 9.8% decline in sales and 23% decline in profits. The decline in sales was mostly due to slowing iPhone sales (declined 13% y/y), which contribute to 2/3rd of the company’s total revenues. Its iPhone sales decreased despite the launch of iPhone 7 in September and the boost it received from Samsung’s Galaxy Note 7 debacle.

The company also faced headwinds from China, one of Apple’s fastest growing markets. Increasing competition from local manufacturers have impacted volumes, while regulatory issues in the country are impacting Apple’s service segment revenues.

Source: Apple Form 10-K for fiscal year ended 24 Sep 2016

Source: Apple Form 10-K for fiscal year ended 24 Sep 2016

Apple has been the least innovative amongst the key tech stocks

While we hear about AI, cloud services, solar panels, etc. from the innovative tech companies such as Facebook, Amazon, and Google, the only recent innovations Apple can talk about are Apple Watch and Apple Pay.

The Apple Watch, despite its “stellar sales performance” in FY2016, was clumped together with other products due to its small contribution to Apple’s revenue pie. Lack of innovation has resulted in over-reliance on its flagship product, with 63% of Apple’s revenue coming from iPhone.

Source: Google Finance

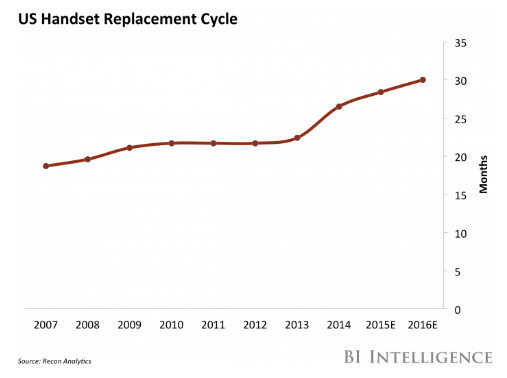

Phone replacement cycle to have a big impact on the business

A shift in the consumer composition driven by increasing penetration into the low income markets, reducing tech updates, and communication service providers de-emphasizing free upgrades in their marketing plans are all contributing to an increase in the duration of the smartphone replacement cycle. The average replacement cycle in 2013, as shown in the graph, was around 2 years in 2013. It is expected rise to almost 3 years going forward.

As per a Gartner report, the smartphone market is becoming saturated – growth in 2016 is predicted to be only 7% vs 14.4% growth in 2015.

Decreasing numbers of first time buyers along with lengthening replacement cycles is going to further impact Apple’s sales volumes in the future.

Summary

The company’s sales from its core segments – iPhone, iPad and Mac – are declining. Its services segment, which has been growing rapidly is cushioning Apple’s revenue declines from other segments but Apple will have start innovating again to keep investors interested!

2017 could well be an inflection point for Apple with product refresh but for now I’m short Apple to hedge my tech portfolio during the current uncertainties at a macro level.

You can track real-time, relevant and personalised stories for Apple and other tech companies here

About the author

Ruzbeh Bacha is the founder and CEO of CityFALCON. He has been investing and trading in the markets for the last 15 years, is a qualified accountant and has an MBA from University of Oxford.

Comments (0)