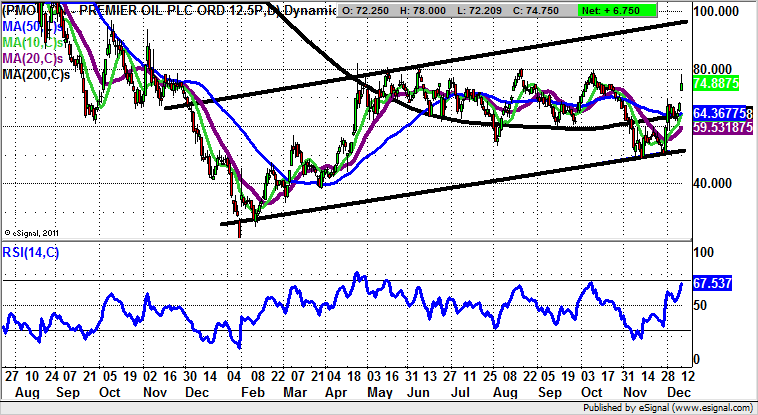

Premier Oil: Knocking on 80p resistance

The latest oil market deal may or may not hold, and may just be a sentiment booster on a temporary basis. However, it has helped the second line oilers no end today, Premier Oil (LON:PMO) amongst them.

It may not be that 80p is Heaven’s Door, to paraphrase Nobel Laureate-to-be Bob Dylan, but a clearance of this level would certainly be transformational for the stock. This is said on the basis that we have seen this number play repeatedly in terms of the price action of the independent oil exploration group.

Indeed, since November last year we have seen the shares blocked, with this being particularly surprising given the better performance of the underlying commodity since the start of the year, and then particularly after the OPEC and Non-OPEC deals of late.

From a technical perspective the best thing to look out for here is golden crosses between the near-term moving averages, given the way the main 200 day line at 64p has been rising sharply since the beginning of last month.

At this point we would be expecting 80p to be broken as soon as the end of this week, with a top of December 2015 price channel target heading for 100p on a 1-2 month time frame. Any dips towards the initial 69.7p resistance of December can be regarded as buying opportunities, with only a weekly close back below the 200 day line upsetting the bull argument.

Comments (0)