The small caps entering new horizons – MAGAZINE EXCLUSIVEMAGAZINE EXCLUSIVE

MAGAZINE ARTICLE

This article first appeared in Issue 39 of Master Investor Magazine.

Click here to download the article as a printer-friendly PDF

Get this article and many more – for free! |

New products, new markets, new opportunities…

Small cap investors love spectacular returns. And some of the most spectacular returns seen from small cap shares over the past few years have come from companies which have taken advantage of growing demand for completely new products.

Take Accesso Technologies (LON:ACSO), for example. Named Lo-Q in its early days as a listed company, and with a market cap of only a few million pounds, the company went on to flourish by providing theme parks with a nifty gadget that helped customers to electronically claim their place in a queue for a rollercoaster. This helped to improve guest satisfaction and freed up time for them to do other more productive things like spend money on hot dogs. Accesso built on its early success to now be a wider provider of technology solutions to over 1,000 clients in 27 countries around the globe. Shares in the company recently hit an all-time high of £25, up from just 28p at the same time a decade ago.

In a similar vein, other companies have seen huge returns from selling already existing products in completely new markets. ASOS (LON:ASC), for example, came out of nowhere in 2001 to take advantage of the explosion in demand for buying fashion online. Driven by a shrewd management team, along with some quirky and cutting edge marketing, shares in the company are currently up by 202,977% since hitting a low of 3.25p in August 2003.

While is it difficult to know with certainty what the next big thing will be, there will always be a number of dynamic small cap firms listed in London which are looking to ride the wave of opportunity. As young companies operating in developing markets most of these will be highly speculative investments. But as we have seen in the past, even one single success story could see long-term returns worth many, many multiples of an early stage investment. For the brave investor, here are three small caps which I believe offer that kind of potential.

SATIVA INVESTMENTS

Like David Cameron, I too had a “normal university experience”. But little did I imagine 15 years ago that what was then a taboo industry would soon become a growing and potentially lucrative, and legal, investment opportunity. I’m not talking about pigs’ heads here but cannabis – also known in its recreational form as African broccoli, grandpa’s medicine, jazz cabbage and by thousands of other creative slang terms.

Recreational use of cannabis remains largely illegal, or at least illegal but decriminalised or unenforced, in most countries around the world. In this context it stays well off the investment agenda. However, recent years have seen a liberalisation of laws in many jurisdictions for use of the plant and its derivatives in medical and scientific applications. Some countries where weed is now legal in one or both of these contexts include Argentina, Australia, Canada, Denmark, Israel and the Netherlands, with medical marijuana now broadly legal in 29 US states.

In 1961, cannabis was recognised under the United Nations’ Single Convention on Narcotic Drugs as a plant that no longer served any medical purpose. However, research carried out in recent years has found that cannabis has a number of benefits in a medical context, including pain management, treatment of muscle spasms and treatment of nausea associated with chemotherapy. While research on the subject remains limited, mainly due to the drug’s historic illegality, the discovery of these benefits has led to a growing acceptance of cannabis for medical use.

Joint venture

Looking to take advantage of growth in the industry, in March this year Sativa Investments (LON:SATI) completed the UK’s first medicinal cannabis investment IPO, listing its shares on the junior NEX Exchange and raising £1.1 million. This gave it a net £1.548 million for investment opportunities. The company is looking to put its cash into businesses which focus on the production, testing & compliance, research & development, commercialisation and sales & marketing of medicinal cannabis in jurisdictions where it has regulatory acceptance, with an initial focus on Canada.

Crucially, Sativa has committed to an independent legal review prior to each investment to verify compliance with the prevailing regulatory environment. Canada, where medical use of marijuana has been legal since 2001, seems a good place to start, with forecasts from Brightfield Group looking for the medicinal cannabis market in Ontario to grow from C$379 million in 2018 to C$2.22 billion by 2021.

Since going public Sativa has announced three notable investment agreements. In April, the company signed an MoU to buy 51% of George Botanicals, a UK-based manufacturer, wholesaler and distributor of wellness CBD products, for c. £0.2 million. CBD, or cannabidiol, is a chemical produced by the cannabis plant and as a food supplement is legal in the UK. George Botanicals has been providing its customers with CBD products since September 2017, including vape pens, balms, E-Liquids, drops and edible gels.

Then in May the company announced a C$0.2 million investment in Canada based pharmaceutical company Veritas Pharma Inc. Veritas focuses on the discovery, product development and commercialisation of effective patented medicinal cannabis therapies which target disease conditions in the areas of chronic pain, senior long-term and palliative care. This deal was followed by aC$0.2 million investment in Toronto-based Rapid Dose Therapeutics Inc, a business which has a patent-pending technology, QuickStrip™, a fast-dissolving strip that is placed on or under the tongue, or inside the cheek, for thedelivery of medicines.

Shares to get high?

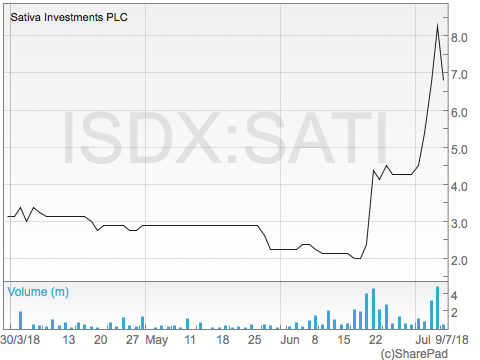

Shares in Sativa currently trade at a mid-price of 2.5p on the NEX Exchange, capitalising the business at just over £10 million. That valuation may be well ahead of the net cash position as at the IPO date but reflects the huge growth opportunities in the medicinal cannabis market – analysts at market research firm Technavio forecast the global medical marijuana market to grow at a CAGR of 21.11% during the period 2018-2022.

Overall, I believe the shares provide a unique way to play this exciting growth market, with the firm’s investment approach giving it fund-like characteristics in terms of diversification. It is also worth noting that CEO Geremy Thomas owns c. 55% of the company and has a successful track record of building up and selling businesses.

GFINITY

Another part of university life back in the early 2000s was playing computer games until 3 in the morning. Little did I know then that this could have been a future career.

Founded in 2012 and listing on AIM in December 2014 raising £3.5 million, Gfinity (LON:GFIN) is one of the world’s leading eSports companies. For those not familiar with the subject, eSports are a form of competition which sees players compete against each other on popular video games. While video game competitions have been around pretty much as long as the games themselves, it has only been in the past decade or so that professional competitions have taken off, with players competing for prize money. There has also been a sharp increase in the number of people watching the competitions, mainly via live streams on the internet.

According to analysts at statistics company SuperData, the eSports industry brought in revenues of $1.5 billion in 2017, with it on track to hit $2.3 billion in 2022 if current trends continue. Sponsorship is the biggest source of income, along with media sales, advertising, merchandise and ticketing. Sponsors are targeting growing audience numbers, with an estimated 143 million people being frequent viewers of eSports in 2016, up from 58 million in 2012 and the numbers set to grow to 250 million by 2021 according to market intelligence firm Newzoo. Additionally, the estimated number of occasional viewers are more than double these figures. The sector has become so popular that even the International Olympic Committee has recognised that competitive eSports could be considered as a sporting activity, pointing out that players prepare and train with an intensity which may be comparable to athletes in traditional sports.

Game on

London based Gfinity organises and hosts eSports tournaments, both on-line and off-line,which are attended by leading international players and teams, in addition to producing industry leading eSports broadcasts. The company’s Gfinity Esports Arena at Fulham Broadway showcases regular tournaments, including the flagship Elite series which was launched in 2017, across the full range of competitive games. Beyond its own tournaments Gfinity provides a full service for brands wanting to create their own eSports tournaments and has staged premium events around the globe for leading publishers and brands including Formula 1, Microsoft, Activision, EA, Xbox, Gillette and HP.

Gfinity makes money via a combination of sponsorship, advertising, and broadcast income relating to its own events. It also receives license fees and revenue share from licensing the Gfinity Elite Series format as part of an international roll-out, along with fees from creating and delivering bespoke eSports events for commercial sponsors and game publishers seeking to engage with the eSports community.

The company has had an eventful time so far in 2018, with the year’s major event being a £6.7 million fundraise in March, completed at a price of 12p per share. The funds will be used to deliver Seasons 3 and 4 of the Gfinity Elite Series in the UK, to support the launch of Season 1 of Gfinity Elite Series Australia, along with investment in the eSports digital platform, growing the digital community and providing the potential to drive license revenues through the provision of technology to partners.

Earlier in the year Gfinity announced a major agreement with Facebook for the exclusive global online streaming rights for the Gfinity Elite Series, excluding Australia, until the end of 2018, providing a major new customer and significant revenue stream. Prior to this the company completed the acquisition of RealSM, owner of the fan-oriented digital sports media platform, RealSport, for £2.4 million in new Gfinity shares. RealSport has built an online user base of more than half a million active monthly users, with eSports currently accounting for over 40% of all traffic on its website, putting the deal in line with Gfinity’s strategy to build a large and engaged digital eSports community.

A sporting chance?

While having built up a good business over the past few years, Gfinity has yet to turn a profit as it remains in investment mode. For the year to June 2017, while revenues rose by 64% to £2.37 million, the pre-tax loss was £5.3 million. This was in line with management expectations, reflecting investment in expanding the executive team, refurbishing the eSports arena, investing in technology and launching the Gfinity Elite Series. More recent results for the six months to December 2017 showed a loss before tax of £7.7 million on revenues up 103% at £1.8 million.

Investors seem to be getting a bit impatient with Gfinity, the shares falling from a peak of 36p in December last year to the current 13.875p. That capitalises the business at £39.7 million. There is no doubt that the valuation looks racy at the present time, especially with profits looking several years away at the earliest. But considering the growth opportunities in the market I believe Gfinity looks worthy of a risky punt. I also note that investorNigel Wray, who has a certain following, owns 11.19% of the business.

SILENCE THERAPEUTICS

AIM listed Silence Therapeutics (LON:SLN) is a biotechnology company operating in an area which has been described as one of the most exciting in drug discovery today – RNA interference (or RNAi). This is a fast growing industry, with analysts at Mordor Intelligence expecting the global market for RNAi technology to grow from $12.56 billion in 2016 to $31.52 billion by 2021, that’s a CAGR of 20.19%.

First discovered in the late 1990s, RNA interference is concerned with gene suppression, or “gene silencing”, a process which enables the regulation of gene expression – the process whereby information from a gene is used to produce proteins and ribonucleic acid (RNA). RNAi is a naturally occurring process and can be used to selectively suppress the genes which cause certain diseases, thus providing the potential for treatments to be developed.

RNAi technology has made significant advances over the past decadeor sofollowing the 2006 Nobel Prize in Physiology or Medicine being awarded to Andrew Fire and Craig Mello for, “their discovery of RNA interference – gene silencing by double-stranded RNA”. The industry looks to be on the verge of having its first drug go to market, with pharma giants Alnylam Pharmaceuticals and Sanofi having reported positive Phase III results for their RNAi drug patisiran last year and looking set to launch later this year pending marketing approval.

Gene geniuses

Broadly, there are two parts to the company’s technology – molecules and the delivery system. Silences’ focus is on so called short interfering RNA (or siRNA), molecules which carry an “anti-code” into the body and result in the expression of a disease causing gene being inhibited. These are then combined with delivery systems which enhance the molecule’s efficiency by directing them to the right part of the body. Silence current focusses on the GalNAc delivery system, a highly efficient, simple and specific delivery approach whereby a sugar molecule (N-Acetylgalactosamine, GalNAc) is conjugated to the siRNA molecule.In recent years GalNAc conjugates have become the main accepted and clinically validated technology for optimised stability, delivery, targeting, specificity and efficacy of RNAi.

The company’s current focus is on conditions of the liver where it is looking to develop treatments for conditions with a high unmet need and those where its therapies can make a dramatic difference to patients. Lead candidate SLN124, which is being developed for the treatment of iron overload disorders, will enter clinical development by the end of 2018 and will be Silence’s first GalNAc-siRNA candidate to generate data in humans. Second programme, SLN226, designed to help patients with alcohol use disorder at high risk of fatal consequences, is on track for a Clinical Trial Authorisation filing by mid-2019, potentially with a partner company.

Important patents

Silence Therapeutics’ technology is protected by an extensive patent portfolio, which strengthens its competitive position within the industry and provides opportunities for licensing to third-parties. One such deal is with industry giant Quark Pharmaceuticals under which Silence receives licence payments, milestones and potential royalties for use of its technology. In July 2017 Quark announced positive results of a Phase 2 trial (which used Silence’s proprietary chemical modification technology) evaluating the efficacy and safety of an siRNA treatment for the prevention of Acute Kidney Injury in patients at high risk following cardiac surgery.

Perhaps more significantly, in July last year Silence issued a claim in the UK High Courts of Justice (Patents Court) against Alnylam Pharmaceuticals, largely considered to be the market leader in GalNAc technology, for patent infringement. This included the accusation that Alnylam was using Silence’s IP on the soon to be approved patisiran drug and three other late stage candidates. This litigation is proceeding towards a trial in the High Court in London which is expected to begin in early December this year. To highlight the potential value to Silence, CEO Ali Mortazavi told The Sunday Times last year that a potential pay out, if the company is successful, could be in the “hundreds of millions of pounds” if the drugs being developed by Alnylam are approved for sale.

Healthy gains to come?

Shares in Silence Therapeutics have slipped from a two year high of 245.5p since October last year to the current 152.25p. That capitalises the company at a shade under £107 million. But with net cash standing at £43 million at the beginning of 2018, the markets are effectively valuing the business at just £64 million. I believe that looks excellent value for a business with a strong IP portfolio, operating in a rapidly growing market. At current levels I would not be surprised if the firm was on the watchlist of potential acquirers– it would not be difficult for a number of big pharma companies to snap up Silence given their vast cash resources. What’s more, the possibility of a successful court case later this year provides an additional “bonus ball” for investors.

|

Sativa Investments (LON:SATI) Interesting but: “Shares in Sativa currently trade at a mid-price of 2.5p on the NEX Exchange, capitalising the business at just over £10 million. That valuation may be well ahead of the net cash position” So given they went to over 8p with recent articles including this, how ahead of the net cash position it that now? And what are the barriers of entry to the companies Sativa are investing in? Could the cannabis sector (mainly Canada) not well be in bubble territory already? This going from 2p – 8p in a few days couldn’t be rational and weren’t shares sold by insiders after the first jump? A barrier is that these aren’t easy to buy for Joe Bloggs as can’t be bought online? very costly charges otherwise depending on broker? And when is the next fund raise likely – what price that likely to be – I would suggest a huge discount?