The Master Investor Covid-19 Market Recovery Portfolio: +83% in the last year

Mark Watson-Mitchell looks back on his Covid-19 Recovery Portfolio, which has performed rather well since its inception at the beginning of the Covid crisis.

A year ago, we were deep in the initial shock of just how the Coronavirus had almost instantly impacted the market.

Investors, both professional and private, were running around like scared chickens.

‘The market is most dangerous at its best and at its best when at its worst.’

This is what I said back then:

Taken from this website on 25th March 2020

Anyone who tells you that he or she has seen all this market melee before is a liar.

I am very old and have endured many a market rout over the years, but I have to say that this recent crash is probably the worst.

So, what do you do with a fully invested portfolio bearing recent buy prices? Do you just sell out the lot and prepare to escape to your selected bolt hole when you are given permission to travel?

Or are you lucky enough to have supplies of fresh cash just burning a hole in your bank accounts?

To sell and get out?

First of all, I would not recommend dumping your stocks – you chose them for your holdings because you liked the story and the investment criteria to back up your selections, so hold tight.

Obviously the Covid-19 pandemic has thrown practically everything off kilter, hopes and prospects have been changed significantly and there is nothing you can do to repair them, other than hope that times get better – and soon.

Is any recovery due?

With such improvements it will be inevitable that recently obliterated share prices will see some smart recoveries, with the indices responding similarly.

Various of my previous company profiles now look totally out of line, while some are still showing strength, but all have been impacted by the virus in some way or another.

So, what would I do?

Several people have asked me which companies I would select for fresh investment, seeking a good recovery bounce before the year end.

Accordingly, I have compiled a quick hit list of ten stocks – my CV19 Market Recovery Portfolio.

……

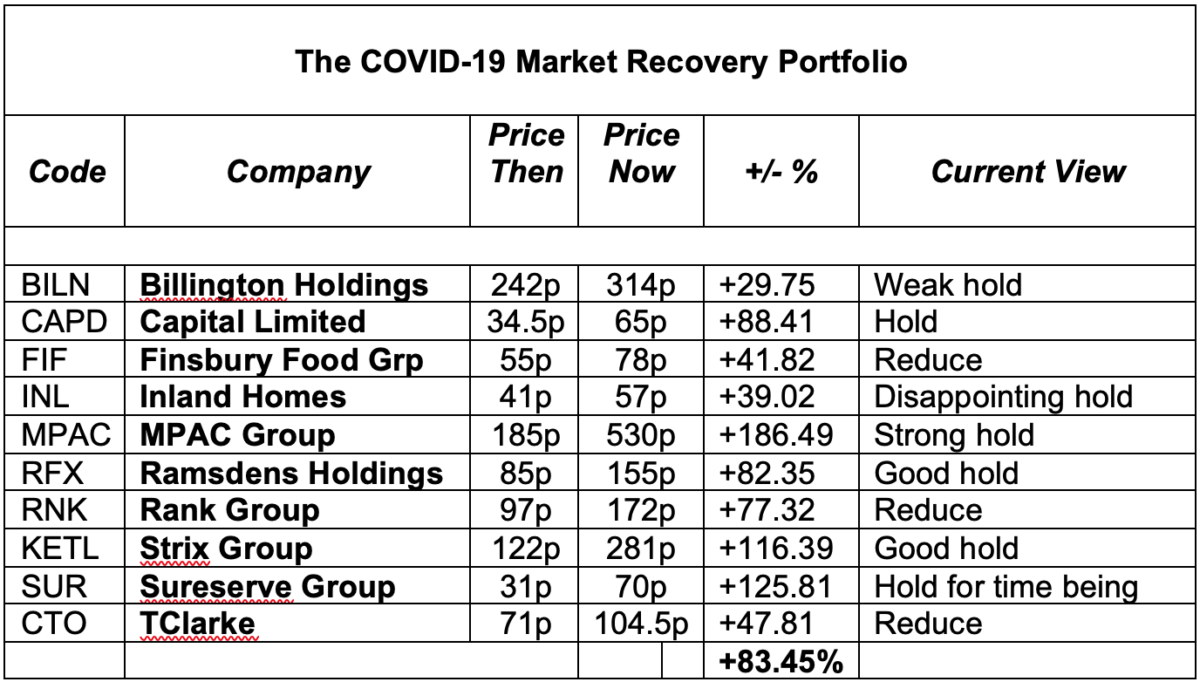

The table above is that selection of stocks and their subsequent performance. I have also noted my current view on the same shares, assuming that the holdings had been bought and held over the Covid-19 period.

Since that selection, the FTSE has risen just under 23%, compared to the ten stocks selected which have gained more than 83% in the same period.

So what now?

Always bear in mind that ‘Good stocks recover, cats and dogs die.’

We still have a panic going on in this country centred around the Covid-19 pandemic. However, it does feel that we are gradually pulling ourselves out of it.

Companies are now seeing their order books increasing again, while many are actually realising that they can get more out of their workforce when working from home.

Obviously, employers will flag up that their employees are now required back at their desks, and under some overall supervision that is not instantly available on Zoom.

Better margins becoming evident

Benefits are being entered into finance directors’ workings, following cost-cutting measures installed last year, which will help to push better operating margins.

As I have said before, I can see 2020 as being a write-off year in corporate records, with the majority of brokers’ analysts recasting their views on how companies will do business this year and next.

The bloody 2020

Believe it or not, 2020 may well prove to have been a ‘blood-letting’ that was very necessary for the market and its investors, both private and professional.

It will have slowed down aspirations and expanded time-frames when assessing the future performance of companies, instead of six-months being the ‘view’ time, we will edge back to taking the more sensible eighteen-month opinion instead.

That will be so good for the market overall, enabling it to trade up to new highs in due course as UK Plc recovers.

Face up to the panics and gain

‘Scared money never makes any money.’

Hopefully by now you see that ‘panics’ must not be feared, but instead one should use them to reassess what exactly is going on and then calmy set about a new plan to counter any side-effects.

Good luck going forward with selecting your own portfolio stocks, depending upon your personal requirements.

Remember:

Sir John Templeton, the renowned investor, is quoted as saying that:

“The only way to get a bargain is to buy when most investors are selling.”

and

“To buy when others are despondently selling and to sell what others are greedily buying requires the greatest fortitude, even while offering the greatest reward”

Comments (0)