Taking a bullish ‘Small-Cap’ look at SCE, IOF and TED2

Surface Transforms (LON:SCE) – ready to accelerate away

When I first profiled this company, with its shares then at just 17p, I stressed that readers must take on board that they would be an extreme speculation, even so I stated that I felt a real buzz about the company.

Since then, we have seen the shares break way above my first price aim and also that of the second profile objective fourteen months later.

Now I would suggest that the shares are beginning to look substantially less speculative, and that they may well have another run upwards due soon.

The group – the ‘home of carbon ceramic brakes’ – has been significantly innovative in creating its now patented materials technology for the process of producing advanced brakes.

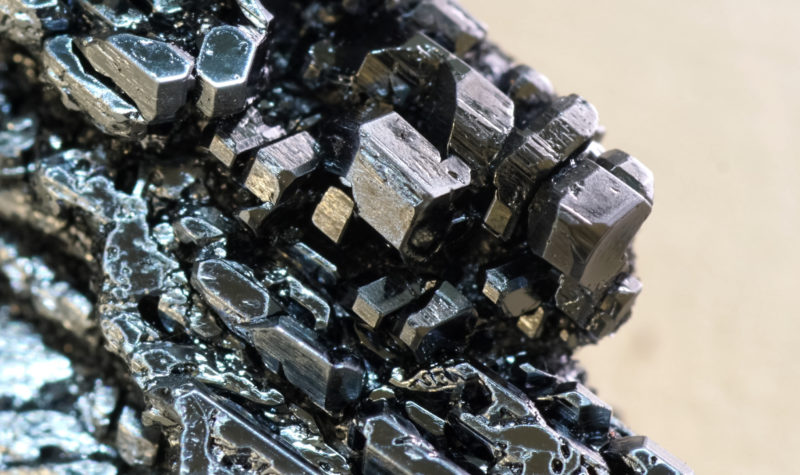

On your car you will generally have carbon ceramic discs which are produced using chopped carbon fibre. However, Surface Transforms interweaves continuous carbon fibre to form a 3D multi-directional matrix.

This process creates a much stronger and very durable product that enables it to conduct three times the heat of standard production components, which keeps down the temperature of the brake system while maintaining the consistency of the performance of the brakes.

The company’s unique patented carbon ceramic technology helps to create the ultimate braking performance for road and track. It saves up to 70% less weight than iron brakes, improves performance in both wet and dry conditions and it is corrosion free. Their technology improves handling and driveability, gives less noise, vibration and harshness, and furthermore even from cold it gives outstanding performance.

That is what excites advanced car makers to contemplate such products for their own superior special vehicles, then for their mass production line models.

This group, which is the UK’s only manufacturer of carbon-ceramic brake discs, there being only one other maker world-wide, is still at an early stage in its development, but very much further ahead now than when I first ‘profiled’ the company.

Makers of racing cars, high performance cars and even mega-powered trucks are early-stage users, but also this new product can be used in rail brakes, aircraft brakes, rocket motor systems and even aerospace components and ballistics. Its potential is massive.

Last Thursday the company announced that it had signed a major new contract with one of its existing customers, replacing a previous £27.5m deal declared in September 2020. The new deal is for a value of some £100m and has been extended up to 2027.

This group is just beginning to run a lot faster and its potential is starting to show through, cooling down the ‘speculative’ flavour and replacing it with investment appeal.

Analysts Raymond Greaves and Michael Clifton, at brokers finnCap, estimate sales increasing from £2.4m to £14.5m for the current year to end December 2022, with a massive reduction in losses from -£4.4m to only £0.2m down.

For the next two years they see £19.9m and then £30.0m sales, with £1.1m profit in 2023 and £5.7m in 2024, worth 0.9p then 2.6p per share in earnings.

They have a price objective of 69p for the shares, which closed at 55.5p on Friday night.

I consider that the shares, which have been up to 80.95p, really do have very good appeal at this level, especially ahead of the announcement early next month of the 2021 final results.

My view is that the shares will rise strongly over the next year, leaving the broker’s estimates well behind.

For anyone who might be interested the group will be holding a Capital Markets Day at their Knowsley, Liverpool premises on Wednesday 27 April.

(Profile 19.09.19 @ 17p set a Target Price of 30p*)

(Profile 08.01.21 @ 50p set a Target Price of 65p*)

Iofina (LON:IOF) – staining up for a higher price

Just a few days ago the shares of this iodine group were trading at up to 23.10p.

Late last week they closed at just 19.35p, but still up over a third on the price a month before.

So, what has suddenly excited the shares?

It could well be one of the companies that can actually take benefit from the Ukraine conflict.

Demand for iodine tablets has rocketed, both in the UK and in the EU, on the back of nuclear war fears.

The UK-based group specialises in the production of iodine and the manufacturing of specialty chemical derivatives, produced water, and natural gas in the US and the UK.

It is the second largest producer of iodine in North America.

It offers halogen chemicals, disinfectants, electronic specialty gases, sanitisers, heat stabilisers, preservatives, and specialty intermediates, as well as animal health, mineral separation, and odour control products for use in the electronics/semiconductor, pharmaceutical, food and beverage, personal care, paints and coatings, dairy, chemical intermediates, gemological, fish and wildlife, and nylon markets.

We should be getting a Trading Update from the group within the next couple of weeks or so.

Estimates for the results for the last year to end December 2021, suggest an increase in sales from $29.7m to $37.0m, with pre-tax profits more than trebling from $1.3m to $4.5m, picking earnings up from 0.7c to 2.3c per share.

Ahead of the recent Ukraine impact it was pencilled in to see $41.0m sales this year, producing $6.25m in pre-tax profits, worth 3.3c per share in earnings.

I fancy the shares now for another uplift fairly soon.

(Profile 29.07.20 @ 13.5p set a Target Price of 18p*)

Ted Baker (LON:TED) – a wide-open takeover gamble worth taking

I have already made it very clear that my view is that any potential bidder for this lifestyle brand group will have to pay well up in victory.

My pitching price would be 150p cash per share from any well-heeled predator, while 180p could prove to be closer to the victorious level.

I understand that the Quest division, of brokers Canaccord Genuity, has run the numbers through their machines and come out as negative on the possibility of the US-based private equity group Sycamore Partners cash bid at just 130p a share winning the day.

Quest came out and rated such a proposal as being very opportunistic, reckoning that instead a bid would need to be well above that level, taking account of the brand group’s recovery that is now underway.

The shares closed at 126.15p on Friday night.

As I stated last week, buying the shares now, awaiting a much higher approach from Sycamore or any other bidder – is ‘Heads you win of tails you don’t lose too much.’

(Profile 14.07.21 @ 139p set a Target Price of 175p)

(Profile 22.03.22 @ 124p set a Target Price of 150p)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)