Small Cap Round-up – Under Pressure?

Pressure Technologies (LON:PRES) – growing order books will speed on recovery

I have profiled this specialist engineering group’s shares several times over the last couple of years or so – it has still to perform to my hopes and expectations.

In the next week or so we should be getting a Trading Update for its first half year to end-March 2022.

My hopes remain high that a return to growth is well on track.

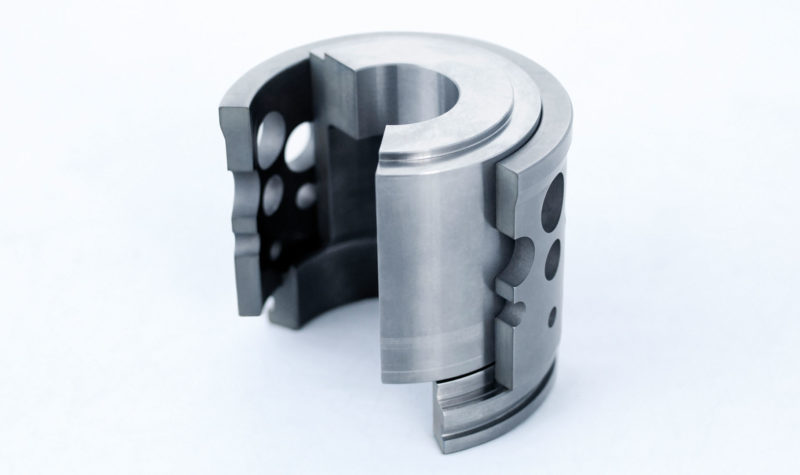

The Sheffield-based group has two main divisions – Chesterfield Special Cylinders, and Precision Machined Components.

It is a designer and manufacturer of high-integrity, safety-critical components and systems.

Its customers are involved in the various supply chains within the oil and gas, defence, industrial gases and the hydrogen energy markets.

The cylinders side is said to be enjoying its order book at the highest level for some five years, with new contracts currently under negotiation.

The hydrogen energy market is growing significantly and so too are the group’s order books for this activity.

On the components side it too is enjoying increasing order intakes as the oil and gas market improves dramatically.

Obviously, the group as a whole has been enduring inflationary cost pressures and supply chain hassles, but its management appears confident that it can weather such difficulties.

We shall see just how it could fare in this, the second half year.

Analysts Richard Hickinbotham and Alex Estefanous, at the group’s NOMAD and broker Singer Capital Markets, are expecting a significant turn around from last year’s £1.2m loss, estimating a £0.9m adjusted pre-tax profit, worth 2.9p per share in earnings.

For the next year to end September 2023 they see sales of £34.0m (est £29.5m) and profits of £2.0m, worth 6.4p per share in earnings.

Less than two months ago the group’s shares touched 104p, before reversing to 82p a month since.

Now at 92.8p, I do feel that this group’s shares continue to offer upside. I maintain my faith in the group’s potential.

(Profile 17.06.19 @ 117p set a Target Price of 170p)

(Profile 04.12.20 @ 71p set a Target Price of 100p*)

(Profile 04.04.22 @ 88p set a Target Price of 110p)

Bloomsbury Publishing (LON:BMY) – a long-time favourite offering so much more than just Harry Potter

Next week, on Wednesday 15 June, this publishing group will be announcing its results for the year to the end of February 2022.

I am looking for the group to announce yet another set of improving figures.

The £330m company, which has been and remains a long-time favourite of mine since it floated in 1994, publishes academic, educational, and general fiction and non-fiction books for consumers, children, teachers, students, researchers, and professionals worldwide.

Operating under two main divisions – Consumer which takes in Children’s Trade (40.3% of 2021’s sales) and Adult Trade (23.6%) sections, and Non-Consumer which includes Academic & Professional (23.9%) and Special Interest (12.1%).

Some 63.4% of the group’s £185m sales in its 2021 year are into the UK, North America took 29.1%, Australia 6% and India 1.5%.

Bloomsbury offers books and digital resources to international research community and higher education students; online law, accounting, and tax services for the United Kingdom and Eire professionals; and publishing services for corporations and institutions.

It also provides support content for continuing professional development and teaching for teachers and trainee teachers, as well as serves communities of shared interest with sports and sports science, nautical, military history, natural history, arts and crafts, and popular science; and study materials for students of the arts, humanities, and social sciences in backlist, print, and e-book formats.

In addition, the company publishes cookery, fiction, non-fiction, biography, food and drink, history, memoir, popular science, and popular psychology titles for adults; and activity, fiction, non-fiction, picture, and preschool books in print, audio, and e-book format for children.

Estimates are for the last year to have seen sales rise from £185m to £225m, while pre-tax profits could come out at £24.1m (£17.3m), lifting earnings up from 17p to 22p per share, with a steady 9p dividend.

For the current year £242m of sales, £25.1m profits, 23p earnings and a 10p dividend are the market expectations for the year to end February 2023.

Next week’s statement will help to enlighten investors on the group’s prospects and its ability to cope with cost pressures.

Broker Peel Hunt rates the group’s shares as a ‘buy’.

In the last year they have been down to 309p each and as high as 454.82p, however the shares are currently trading at around the 384p at which I suggest holders remain very firm, while new longer-term investors should not be put off by the high rating because this really is a quality business.

(Profile 28.02.19 @ 231p set a Target Price of 257p*)

(Profile 27.03.19 @ 238p set a Target Price of 270p*)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)