Small-Cap Catch-Up: Iodine and Global Specialist Vacancies

Iofina (LON:IOF) – Strong Demand Throughout Last Year

As I suggested last week, the snapping-up of a few more shares in this specialty chemicals business by its currently largest shareholder was a sensible move.

Former fund manager Richard Sneller now has nearly 35m shares in the group, representing 18.2% of its equity.

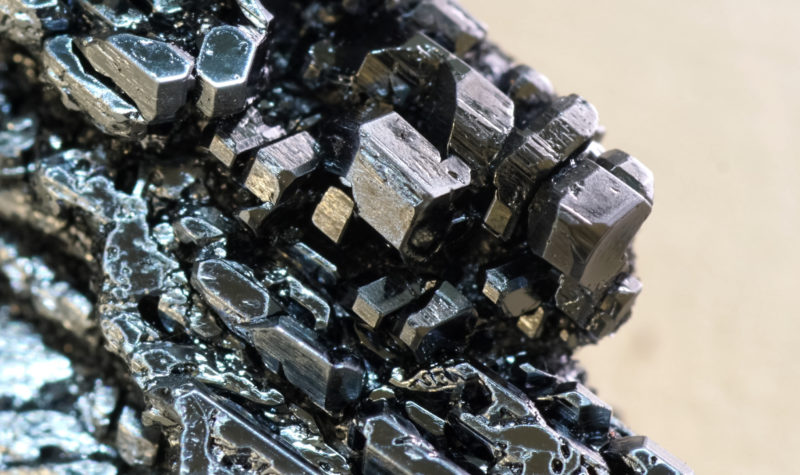

The vertically integrated group specialises in the production of iodine and the manufacturing of specialty chemical products.

It is the second largest producer of iodine in North America, with operations in Kentucky and Oklahoma.

Iodine is in demand for uses in X-Ray contrast media, polarising film, catalysis and as an antiseptic and biocidal agent.

In a Q4 Corporate Update issued on Monday, the company stated that demand for its products had remained strong, helped by a rising iodine spot price which had moved up from $50/kg at the beginning of last year, to a closing level at around $70/kg at the year end.

What is more, prices are expected to stay high with global supply being restricted.

Boss Dr Tom Becker stated that:

“Iofina had a strong end to 2022, with H2 iodine production surpassing our initial target and product sales remaining robust. As such, the Company is pleased with the expected outturn of its business in 2022.

Looking ahead, with brine water supplies to our plants consistent and IO#9 on track for completion and start-up in Q2 2023, Iofina Resources will have the capacity to deliver a significant increase in crystalline iodine production going forward.

Market dynamics for raw Iodine remain very favourable and coupled with the demand for our specialty products, the Board of Iofina is confident in the current outlook for the new year.”

After Monday’s Update analyst Alex Brooks at Canaccord Genuity maintained his Buy rating for the group’s shares, with a price objective of 35p, against last night’s closing price of 22.5p.

His estimates for the 2022 December year end are for sales of $42.1m ($39.0m), with adjusted pre-tax profits having risen from $4.9m to $6,6m, worth 2.5c (2.5c) in earnings per share.

For the current year Brooks goes for $44.5m sales, $8.4m profits and 3.2c per share in earnings.

On Monday morning the group’s shares hit 24.45p in reaction to the strong demand news, before easing back on gentle profit-taking.

Reflecting the current year prospects, could the shares rise back to hit the 28p level hit last June.

Hold very tight.

(Profile 29.07.20 @ 13.5p set a Target Price of 18p*)

SThree (LON:STEM) – Contract Growth Showing Through Strongly

This group provides specialist contract and permanent staffing services for the technology, engineering, life sciences, banking and finance, and other sectors.

With operations across the globe, its diverse base of over 8,200 clients spans across 14 countries.

It is the only global specialist talent partner focused on roles in Science, Technology, Engineering and Mathematics, hence its market code of STEM.

At the end of this month the £525m capitalised group will be declaring its results for the year to the end of November 2022.

Broker Liberum Capital analyst Sanjay Vidyarthi currently has a Buy rating out on the group’s shares, with a price objective of 725p a share.

His estimates for 2022 show an increase in net fee income to £431m (£356m), profits before tax of £76.5m (£60.0m), earnings of 40.2p (30.8p) and a dividend of 16.1p (11.0p) per share.

Liberum goes for £81.2m profits this year, then £91.1m next year, worth 41.9p then 46.1p per share in earnings.

On such estimates it is, perhaps understandable why Vidyarthi has such a high price aim, but is it realistic enough in such times?

We shall get a more interesting update on the group’s affairs come 30 January.

As at the end of November last year it had a £65m net cash balance, which shows its strength.

In the meantime, its shares are trading at around 386p, off 30p yesterday.

At that level they look ready for buying ahead of the finals.

(Profile 23.07.21 @ 473p set a Target Price of 560p*)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)