Small-Cap Catch up: FTC, TRT, JNEO And AVG

Filtronic (LON:FTC) – Shares Have Doubled In Just One Month, Time To ‘Top Slice’

They touched 41.75p last Friday on a day with some 6.45m shares being traded, then peaked at 42p on Monday.

Some 2,750,000 of the shares traded last Friday represented a slight reduction of the holding of Mr MH and Mrs DM Dixon, taking their stake down to 38,500,000 shares, representing 17.77% of the group’s equity.

It looks as though Canaccord Genuity Group also took out some of those shares on behalf of discretionary clients, yesterday it announced that last Friday it took their holding up by around 1.65m to 30.75m shares, representing 14.27% (13.51%) of the equity.

The £86m capitalised Sedgefield-based group designs, develops, manufactures, and sells advanced radio frequency (RF) communications equipment for telecommunications infrastructure, aerospace and defence, critical communications, and space markets.

In just over a month this group’s shares had doubled from my early January new Target Price setting.

That they proceeded to go even further, before the inevitable profit-taking set in, is perhaps quite an influential marker as to just how this groups shares could well perform in the future.

The 38-page research note pushed out last week by Cavendish Capital Markets’ analysts Edward Stacey and Kimberley Carstens had a fixed Price Objective of 37.5p for the shares, based very much on the prospects for the group in the 2024-2028 period.

Well, they beat that Price Objective in less than six days – which was quite an exemplary performance.

The analysts are estimating that the current year to end April will see revenues rise from £16.3m to £23.5m, while its adjusted pre-tax profits could hit £2.5m against the 2023 result of just £0.1m.

They go for earnings to increase from 0.1p to 1.1p per share.

However, we do need to heed their views for the coming year to end April 2025 – in which they anticipate £24.0m sales, £2.3m profits and 1.0p per share in earnings.

It is sensible to stand back and not chase, but perhaps look to ‘top slice’ before the shares ease back even more ahead of settling for a while at a lower price.

Yesterday the shares closed at 35.5p.

(Profile 04.02.22 @ 11.6p set a Target Price of 14.5p*)

(Profile 04.01.24 @ 21p set a Target Price of 24p plus*)

Transense Technologies (LON:TRT) – Keenly Awaiting Next Monday’s Interims

Next Monday morning will see the announcement of this group’s Interim Results for the six months to end December 2023.

The late November AGM Trading Update by the provider of specialist sensing solutions and measurement systems, stated that its Management was pleased with the momentum in the ongoing commercial pipeline, both for SAWsense and Translogik, which provided confidence in the prospects for the current financial year and beyond.

The Bicester-Oxfordshire-based group is estimated by analyst Ian Jermin at Allenby Capital to be showing strong ongoing trading this year.

His figures suggest revenues in the year to end June 2024 will show a 25% increase to £4.80m (£3.53m), while adjusted pre-tax profits will come out well ahead at £1.69m (£1.08m), lifting earnings to 11.4p (10.2p) per share.

For the coming year he goes for £5.60m sales, £2.06m profits and 13.6p per share in earnings.

Jermin reckons that the group will end the current year with £1.50m (£0.98m) net cash and then see its next year ending with a very healthy £3.42m in the bank.

The group’s shares, which hit 120p last October, are trading now at 99p each, capitalising it at around £15.20m – which looks cheap to me.

I await the half-timers next week, together with the updated corporate outlook statement.

(Profile 17.09.21 @ 102p set a Target Price of 127.5p)

Journeo (LON:JNEO) – The Growth Continues, Shares Still Offer Good Upside

Monday’s Trading Update for the year to end 2023 helped to pick the share price up after having closed well down last Friday night.

After collapsing to 234p during that day, they ended 29p off on the day at 249p.

I do not know what spooked the price, but I was pleased to see the Update stating that results will be in line with market expectations.

Revenues are expected to be up 118% at £46.0m (£21.1m), while estimates are for adjusted pre-tax profits of £3.9m (£1.0m), which would double earnings per share to 20.6p (10.3p).

CEO Russ Singleton stated that:

“I am very pleased with the progress we made in 2023, both organically and through two acquisitions.

These developments are fuelling our strategy to broaden our customer base, extend our geographic reach, deepen our capabilities and provide us with access to thematically linked adjacent markets.

We have strengthened our recurring revenue alongside our order book and pipeline, providing good forward earnings visibility and a solid base on which grow the business further.

Together with significantly improved cash balances, we are investing in our people and technologies to develop innovative products and services that meet our customer requirements, as well as anticipating the future needs of the public transport sector.

With a strong sense of momentum and an increasingly compelling customer offering, we look forward to further organic and acquisitive growth.”

For the current year analyst Andrew Renton at Cavendish Capital Markets looks for £48.0m sales, £4.4m profits and 23.1p earnings.

His Price Objective for the shares is 385p, compared to last night’s closing price of 271p, which offers quite a useful upside.

At the end of last month, they hit 298.44p, they could soon be up there again.

(Profile 07.04.21 @ 95.5p set a Target Price of 120p*)

(Profile 24.03.23 @ 147.5p set a Target Price of 175p*)

Avingtrans (LON:AVG) – Will We See Current Year Estimate Adjustments At The End Of This Month

Not for chasing yet until good news is published is what I stated late last September when the shares were ‘treading water’ at around 395p.

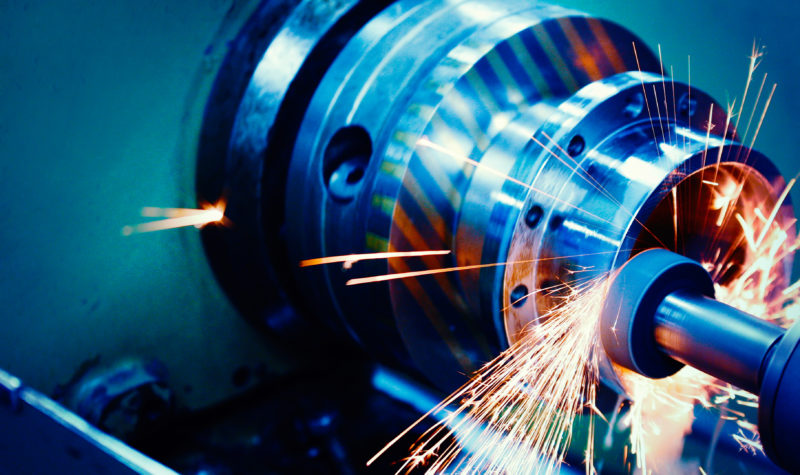

In a fortnight’s time, on the 28th, the group, which designs, manufactures and supplies critical components, modules, systems and associated services to the energy, medical and industrial sectors, will declare its Interim Results to end November 2023.

In the middle of last month CEO Steve McQuillan stated that:

“I am pleased to announce that the Group’s trading performance for the first half of the year is in line with the Board’s expectations and, we are comfortable in achieving market expectations for FY24.

Additionally, we are pleased to announce the formation of the new Advanced Engineering Systems division by combining the mature engineering businesses and identifying their contribution to the Group, which contrast to the investment requirements of the nascent Medical and Industrial Imaging division.

We will comment further on this in our half year results in February.”

The £116m capitalised group’s shares, which hit 410p in January, have subsequently eased back to a recent low of 342.50p before closing last night at 355p.

The Chatteris, Cambridgeshire-based Avingtrans company designs, manufactures and supplies original equipment, systems and associated aftermarket services to the energy, medical and industrial markets worldwide.

Analyst Caroline de La Soujeole, at Singer Capital Markets, issued a Buy note on the group after the January Trading Update, fixing a Price Objective of 510p on the shares, which were then trading at 375p.

Her estimates for the current year to end May suggest revenues of £137.0m (£116.4m) but slicing adjusted pre-tax profits to £2.3m (£9.0m), slashing earnings down to 2.8p (23.5p) while increasing its dividend to an uncovered 4.70p (4.50p) per share.

She envisages £160.9m sales in the coming year, with profits of £3.5m, earnings of 6.0p and a 4.90p dividend.

I wonder what she will be thinking about the group come the Interims announcement.

Due to a ‘sum of the parts valuation’ I feel that the shares remain a Hold until more news becomes available.

(Profile 04.11.20 @ 260p set a Target Price of 325p*)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)