Seven value stocks from Europe

Filipe R. Costa digs out seven value stocks from Europe for those investors looking for an alternative to all the hype.

There is plenty of money flowing into assets, pushing the prices of SPACs, NFTs, cryptocurrencies and fashion stocks continually higher. These are thrilling segments of the market with a lot of price action. Their value is also undeniable, as the future is on their side. However, for investors who like to be able to touch what they own, these segments have little to offer.

If you’re one of those investors that is looking for something tangible and boring, with predictable and quiet price action, then my picks today may be for you. I’m looking for seven value stocks from the old continent to counterbalance the new digital trends. Let’s dig in!

First of all, let me say that I’m not going to dig deep into financial statements, as that’s boring and time-consuming. Second, I must say that I’m not really a follower of analysts’ consensus ratings as they usually underperform the market. With that said, my only option is to play with the numbers and use some statistics.

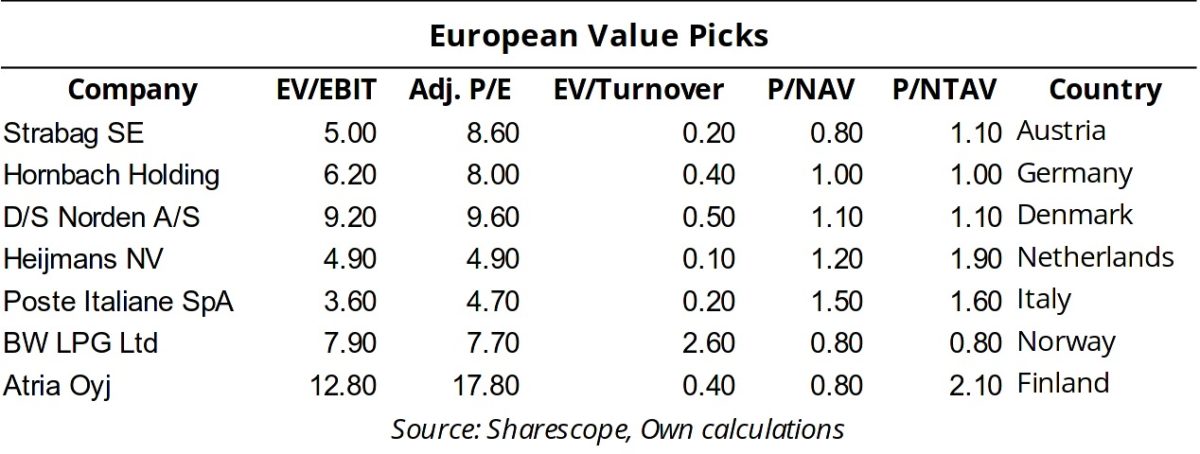

Instead of looking into financial statements, I’m starting with a list of 1,932 European stocks and using a database to collect the numbers for five different ratios from all those stocks. I want value plays, so I’m looking at price ratios that are related to how cheap a stock is trading. The first problem is to choose the best proxies for that cheapness.

A value play is a stock trading at a price below its fundamental value. While price is an objective measure, fundamental value isn’t. To overcome the problem, we need to use a few price ratios that compare the stock price with a few different corporate metrics that we expect to be linked to fundamental value. While there are many options here, I like the following five:

- Instead of using the price/earnings ratio, I prefer to replace price with enterprise value and earnings with EBIT. Enterprise value captures the value of the whole company and EBIT is much less manipulated than the bottom-line earnings.

- If we’re going to use some kind of price/earnings ratio, then let it be the ratio adjusted for leverage.

- More often than not, price/turnover ratios are great indicators of value. Before making money, a company must sell something.

- It’s good to know how much we’re paying for the assets we’re buying. If something goes really wrong, it’s the net asset value we’re going to get.

- Some companies rely too heavily on intangibles. Brand names certainly have value, but intangibles are very volatile and difficult to value. Discounting these values is sometimes a good idea to avoid paying too much for stocks.

My picks from the lot

In order to have an idea of how cheap a stock is, we would need to set a threshold for the proxies we set above. For example, buy stocks with a debt-adjusted P/E less than 6x or with a Price/Net Asset value less than 1.5x. However, the concept of value is relative. I prefer to attribute a rating to each stock. Let’s say I have 100 stocks. I rank them from highest to lowest in terms of value (according to the price ratio used) and start attributing ratings: 100, 99, 98, …1. I do this for all the five ratios. The last step involves summing the ratings for each stock. I then choose the top of my list. This way of selecting stocks better fits the concept of relative value and allows us to use several different ratios to build our own ratings system. It’s relatively simple and cheap!

As I was planning to choose just seven stocks from the list and each from a different country, I did some final filtering and came up with the following list, which includes stocks from Austria, Germany, Denmark, the Netherlands, Italy, Norway and Finland.

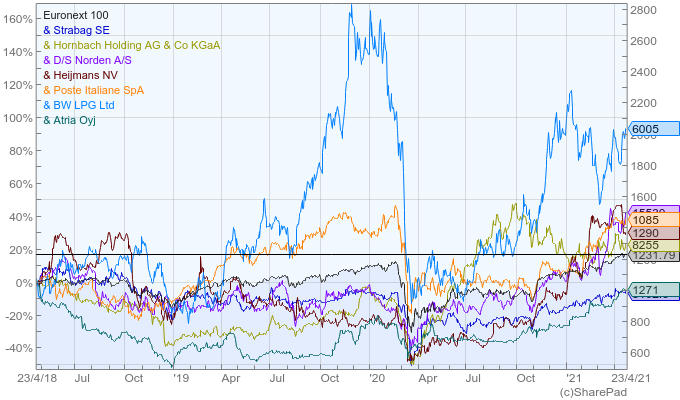

Strabag SE (VIE:STR)

The Austrian company provides tech services to multiple stages of the construction process. It has been growing its sales and profits steadily over the years. It’s trading at a decent EBIT yield and has been paying dividends reliably.

Hornbach Holding AG (FRA:HBH)

Hornbach is a French company providing retail and real estate services. It shows a good pattern of rising sales and strong and reliable profits. It also pays dividends.

D/S Norden A/S (CPH:DNORD)

D/S Norden is an independent shipping company. Over recent years it experienced a steady rise in sales and profits. After a turbulent period between 2012 and 2016, the company recovered very well and improved its overall financial condition. It’s very reasonably priced.

Heijmans NV (AMS:HEIJM)

Heijmans is a construction company. Its sales declined for a few years until reaching a low in 2016 but have recovered since then. Its operating profits are increasing fast and margins are improving while debt is declining.

Poste Italiane (BIT:PST)

Poste Italiane is a conventional business including mail, parcels and distribution segments that provides downside protection to a portfolio. The company has been showing a systematic increase in turnover and profits. It’s trading on a great EBIT yield and low P/E. Additionally it pays reliable dividends and has almost no debt.

BW LPG Ltd (BWLPG.OL)

BW is a transportation and logistics company that ships liquefied petroleum gas (LPG) through its fleet of maritime vessels. It shows strong profits, trades on a low P/E and provides a good dividend yield.

Atria Oyj (HEL:ATRAV)

Lastly, we have Atria, a meat and food company. It has been paying reliable dividends and has been increasing its turnover.

Comments (0)