Renewi – ‘waste no more’, invest now in this pure-play recycler

Following the recent £1.3bn agreed offer by Energy Capital Partners for Biffa, Renewi will now be the only quoted waste/recycling group in the UK.

That bid valued Biffa on some 18 times its current year earnings.

On that basis, I believe the shares of Renewi are significantly undervalued.

And that is despite the current year trading pressures that it has been enduring.

On Thursday of next week (10 November) the group will be reporting its interim figures to end September, which is when I look for further detail on just how it fared in the half-year.

The Business – turning today’s waste into tomorrow’s raw materials

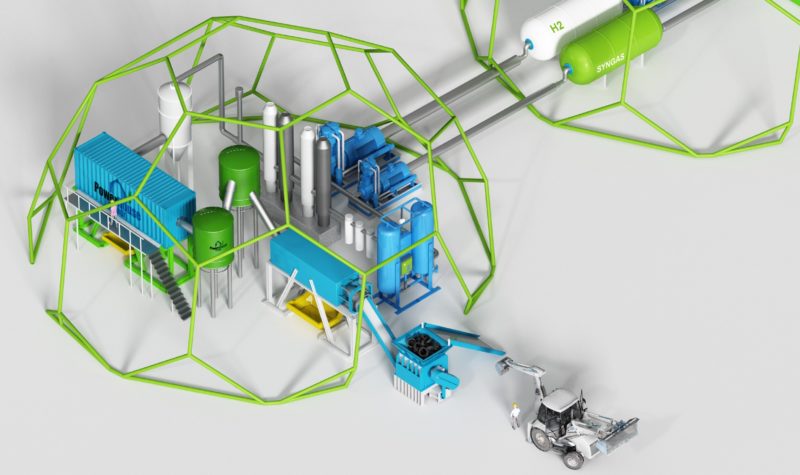

The £445m group, which has more than 6,000 employees, operating at 174 sites across Europe, is a leading waste-to-product company that gives new life to used materials every day.

It uses the latest technology to turn waste into useful materials, such as paper, metal, plastic, glass, wood, building materials, compost and energy.

The result of its work is less waste and contamination, while creating a smarter use of scarce raw materials, as well as a reduction in carbon emissions.

Operations

The company operates through Commercial Waste, Mineralz & Water, and Specialities segments.

The Commercial Waste segment engages in the collection and treatment of commercial waste in the Netherlands and Belgium; and processing of wood, aggregates, plastics, paper products, and organic waste.

The Mineralz & Water segment decontaminates, stabilises, and re-uses contaminated materials to produce secondary products for the construction industry in the Netherlands and Belgium; processes and cleans bottom ash, fly ash, and other soils; and handles contaminated soils, old road surfaces, industrial waters, sludges, chemical waste, incinerator residues, and packed hazardous waste.

The Specialities segment engages in the processing of plants that focus on recycling and diverting specific waste streams, as well as operating waste treatment facilities for UK city and county councils, and the recycling of waste from electrical and electronic products, and glass. It operates in the UK, the Netherlands, Belgium, France, Portugal, and Hungary.

Sales per Business and Region

Net sales break down by activity as follows:

– collection, recycling and treatment of commercial and organic waste (72%). The group also develops power generation activities using landfill gas, industrial cleaning, biomass processing and production of fertilisers;

– municipal waste management (17.4%);

– hazardous waste management (10.6%): floor reprocessing and cleaning, waste water, etc.

The group’s net sales are distributed geographically as follows:

the Netherlands (57.9%), Belgium (28.4%), the UK (12.1%), France (1.1%) and other (0.5%).

Strategy – sustainability is at the heart of its business model

It launched its enhanced strategy just over two years ago, supporting a vision to be the leading waste-to-product company.

This further differentiates Renewi as a ‘pure-play recycler’, to extract value from waste and contribute to a solution to the world’s climate problem.

The Equity

There are some 80m shares in issue, of which the bulk are owned by investment institutions across Europe.

Holders include NS Partners, Paradice Investment, BNP Paribas, Avenue Europe, Bank of America, Citigroup Global, Janus Henderson, ACTIAM, Farringdon Netherlands and Beach Point Capital.

Broker’s Views – values of 1012p to 1091p on the shares

Analyst Joe Brent at Liberum Capital considers that the shares are a Buy.

His current year estimates suggest that the imminent Interims will effectively point to a 54% first-half weighting.

He considers that the exit multiples in the waste sector imply that the group’s shares could double.

Brent is maintaining his price objective of 1012p on the shares.

Over at Edison Investment Research, analyst David Larkin has current year estimates for the year to end March 2023 of €1906m(€1869m) in revenues, while pre-tax profits will see a slight easing to €97.2m (€105.3m), taking earnings down to 90c (98c) per share, but easily covering a 5.0c (nil) dividend per share.

Larkin reckons that, based on the ECP price being paid for Biffa, Renewi shares have to be worth at least 1091p each.

My View – 650p short-term and still 850p longer-term

Ahead of next Thursday’s interim results to end September, I would not be at all surprised to see this group’s shares rise from the current 555p to over 650p in the short-term.

I still maintain my longer-term 850p Target Price for the group’s shares.

(Profile 09.10.20 @ 240p set a Target Price of 350p*)

(Profile 25.03.22 @ 684p set a Target Price of 850p)

(Asterisks * denote that Target Prices have been achieved since Profile publication)

Comments (0)