John’s Mining Journal: Galantas, Kefi, Xtract and more…

Veteran mining analyst John Cornford reviews some of the more interesting plays in the junior mining sector.

The Old Sailor (investor) – apologies to A. A. Milne

“There was once an old sailor my grandfather knew

Who had so many things that he wanted to do

That, whenever he thought it was time to begin,

He couldn’t because of the state he was in.

And so in the end he did nothing at all,

But basked on the shingle wrapped up in a shawl.

And I think it was dreadful the way he behaved —

He did nothing but basking until he was saved!”

Five of my gold picks are, I think, due to resume their long-term (in some cases very long-term) uptrend after in most cases a bit of a hiatus. They are Solgold, Galantas Gold, Condor Gold, Kefi Gold and Copper, and Xtract Resources. But which to jump (back) into first?

Galantas (LON:GAL) is on a roll, and will maybe hit the 60s, at which time it may be right to take a short-term profit. Following closing of its funding last week, news is still awaited that will sustain investor interest. This includes a timetable for production, and just as important, some updated economics now that gold is about 50% higher (and some three times more profitable to mine at Cavanacaw) than when the last feasibility study was published.

Remember that GAL’s main trading platform is on the Toronto exchange and that it is little known in London, and remember also that Canadian company reporting requirements are more detailed than in the UK, meaning that quarterly Management Analyses and Discussions of progress as published on SEDAR are an extremely useful source for investors to get one over those who only look to LSE announcements.

Kefi Gold and Copper (LON:KEFI) is, once more, halted by delay in closing the funding for its Tulu Kepi mine. But, as always, the boss insists ‘it will be done’ – after the company AGM some time in June. Before he said as much, investors had had a nasty shock two weekends ago when the press reported (reliably or not isn’t confirmed) that the Ethiopian Government was threatening to withdraw licences from projects they thought were unduly delayed, mentioning Tulu Kepi among them.

But given that TK appears on the verge of funding and start, if the EG’s threats deterred that final investor from closing the deal, it would delay any start achieved by any other owner or funder by months if not years – so why do it? Despite that risk, Kefi still looks one of the biggest rewards around, and will be determined sooner than many others. So I’m keeping my own holding.

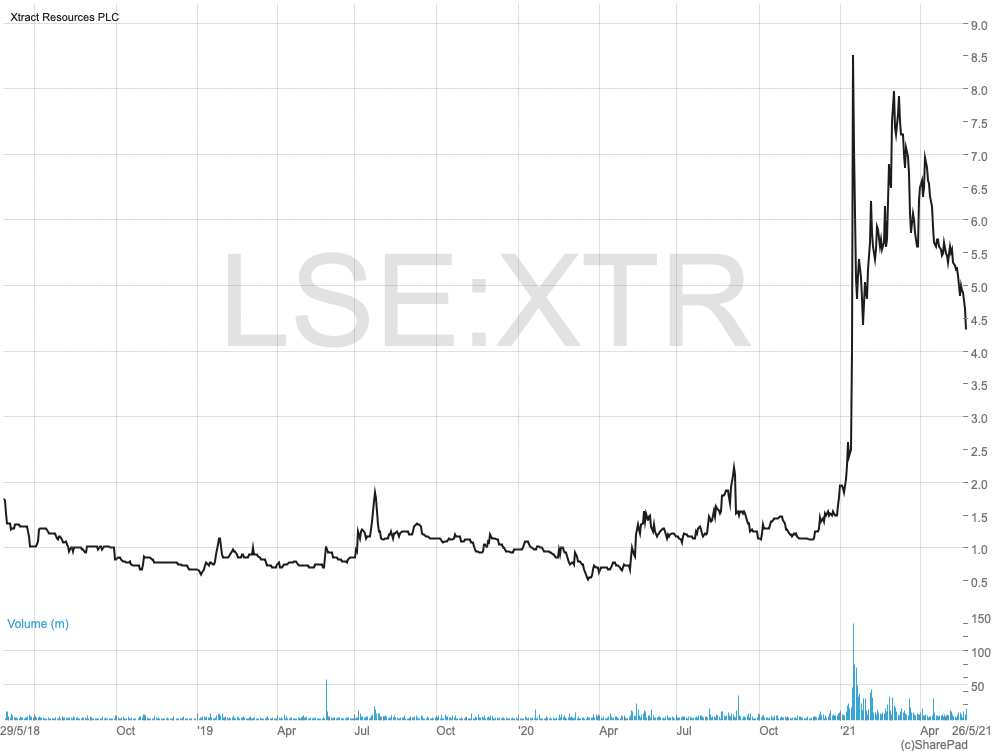

Xtract Resources (LON:XTR) has entered a new phase in its exploration of the Racecourse copper deposit 100 miles from Sydney in New South Wales. The shares have entered the usual accompanying second stage for exploration miners, when investors realise that the going from now on is getting more expensive and probably more drawn-out. And as usual, it is accompanied by jitters among some holders who misread drill assay results.

Following the aerial IP survey results 10 days ago which showed the deposit (‘apparently’, because IP results can’t be definitive) considerably longer and deeper than first thought, Xtract yesterday published results from its first phase drilling, to deliberately find the edges of that expanded existing resource at the deeper northwest end. Assays have taken three months due to high demand, not helping the jittery, and, surprise surprise, they showed copper grades have fallen off somewhat towards those edges although there is still plenty there. There are two more results to come from further out and even deeper and, as is to be expected, they might or might not show continuation of the deposit but probably also of diminishing grade.

But what counts for a porphyry deposit is the size, rather than grades in the middle, and the IP survey showed extensions to both ends, so CEO Colin Bird is already talking of Racecourse exceeding the 2 million tonnes of contained copper at which Anglo America has an option to buy 80% of it. (Although it can also do so if Xtract decides to mine before reaching that size – something that a rising copper price makes more feasible.)

In any event, finding the edges of a deposit is more important for planning detailed drilling, and this together with the IP results has enabled the company to plan a more extensive, 20,000 metre – i.e. perhaps 20 hole – drilling campaign to start around July. That will probably take six months before the results define the deposit accurately enough for a reliable estimate of its size, shape, and grade of copper (and maybe some gold).

After raising another £5.5m last month (at 5.6p, adding 13.6% to shares in issue, plus the usual ½ warrants (at 8.5p) for the broker, Xtract says it has enough cash to fund the Racecourse drilling as well as to progress its African projects, which I assume means until the year end. This might mean a slower or more shaky share performance over the next six months, and although well worth holding on a year’s view (with the possibility always of exceptionally good progress countering that view) Xtract looks like one of the buy decisions the sailor can wait to make once the shares have settled down.

I have not updated Condor Gold (LON:CNR) for some time, and it is still making solid progress towards a decision between the various options it has to start mining the most profitable parts of its La India project in Nicaragua. It still, apparently, has the option of at least a partial toll processing collaboration with the larger Calibre Mining which will help limit start up costs, but has also obtained, cheaply, a key component for its own processing plant. Condor is also finding encouraging drill results on a satellite prospect which, it says, will eventually enable it to claim to be a magic 5-million-ounce gold resource – a size which majors will always be interested in acquiring.

Meanwhile, however, it looks as though it will be another six months before Condor has fitted all the jigsaw parts together, including a long-awaited update of the very out-of-date feasibility study, to show a proper valuation for La India. Armed with that, Condor will be able to arrange whatever funding is still required. Condor says this could be as much as $70m and although it will almost certainly be in an economical form and limit whatever extra equity is required from shareholders, until it is settled investors are unlikely to push the shares to a higher value for the time being. So this is a prospect the sailor might, just for the moment, dither about.

That leaves Solgold (LON:SOLG), which is perhaps the most difficult conundrum. Its latest report on SEDAR on May 14th looked encouraging, with progress towards unwinding the strategic tangle into which its management under Nick Mather had seemed to embroil it. Drilling to plan a quicker and cheaper way to develop its very large Alpala gold/copper deposit is under way, and more recent results at the Tandaya America satellite deposit only a few miles away, showing significant mineralisation much closer to the surface that at Alpala itself, should lead to a much cheaper and quicker way to develop the whole Cascabel area. We will know when a revised feasibility study is published towards the end of the year.

Meanwhile at the other (southern) end of Ecuador, Solgold’s drilling at the Porvenir project is also showing an ever-increasing potential to develop it as a surface, open pit mine, possibly even larger than Alpala.

But the market doesn’t yet seem to be convinced. Perhaps the management legacy is too recent, and although Solgold has stated an intention to bring in partners to help fund some of its other promising projects in Ecuador, investors are still not sure of the implications for raising more shareholder funds in the medium-term future.

Nevertheless, it now appears that the spat with its two largest shareholders, Newcrest and BHP, who apparently disagreed with its strategy under Nick Mather, is over. I think therefore that Solgold can only go one way from now on, and has perhaps the best long-term potential of the five I cover here. Perhaps the charts would be our sailor’s best guide, but it might take four-six months before they become useful.

Xtract’s CEO Colin Bird bought over £50,000 of shares a while back (Feb. this year?), at about 5.8p, so he is nursing a considerable loss at present. He clearly didn’t expect the pull-back in price, and presumably is more optimistic about prospects that your analysis would suggest. But Colin has been in the business a long time, so should know what he is doing?