John’s Mining Journal: featuring Xtract, Emmerson and Controy Gold

Veteran mining analyst John Cornford reviews some of the more interesting plays in the junior mining sector…

Apart from specifics, many junior miners have come off as gold is dented by rising interest rates, and because a large number of UK small caps have seen their IG margin call limit sharply increased. Xtract Resources (LON:XTR)however has resisted the malaise and remains the share I’m mainly invested in myself, expecting drill results, dripping slowly out, to maintain a steady, if slow, momentum.

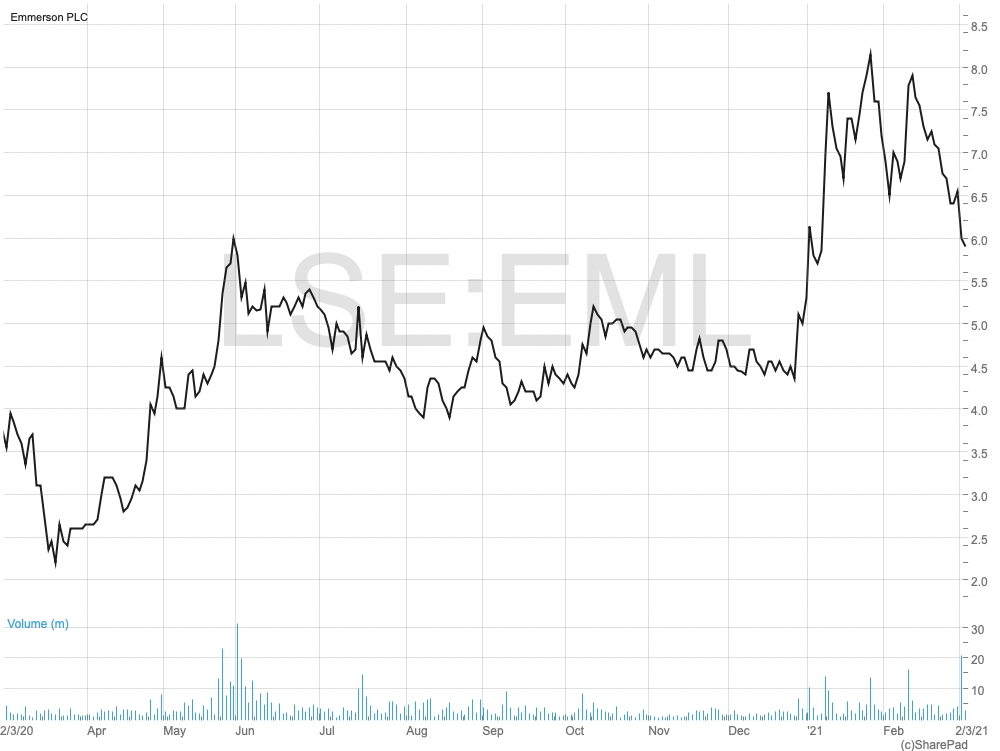

Positive specifics were behind Emmerson’s (LON:EML) (see MI Sept 2 – current market cap £47m @ 6.4p) near-doubling in December after an upbeat investor presentation, a month before receiving the mining licence for its Khemisset Potash project. Since then, profit-taking and, perhaps, anticipation of a £5.5m cash raise (adding 13% to issued shares) which finally came along at 5.75p two days ago, has tipped it a bit off the top. It has also offset the further positive announcement two weeks ago that EML is improving its mine plan, aimed at increasing eventual production and for a lower initial cost to shareholders.

Not so wellreceived either was an intention to move down from the main market to AIM. Although saving costs, AIM allows ‘corporate transactions’ (including financing) to be undertaken with less shareholder involvement. Together with some observers’ worries that Khemisset’s quoted NPV is highly sensitive to price and funding assumptions, and that project lenders might be over-cautious accordingly, an AIM transaction could leave ordinary shareholders with less say.

Nevertheless, I don’t think that is significant in the light of EML’s aim to start construction before the end of the year, with first production in 2023. It says it is already engaging with various potential funders, so that all shareholders need to worry about is the £100m or so of equity funding (on top of £300m of loans or pre-sold offtake) that is needed to start building. As described back in September, the estimated $1.1bn – $1.4bn (depending on potash price) NPV of the project at a conservative 8% discount rate, compared with a $411m total capital cost and with EML’s current £47m market cap, gives scope for a share price considerably higher in the run up to construction start.

So, with production slated to start from 2023 onwards, I think EML looks a better bet over the medium term than, for example, Solgold.

In the short term however, Solgold (LON:SOLG) will probably stage a bounce from its current depressed level and I think has more potential in the very long term. But I can’t say the same for Greatland Gold (LON:GGP), whose shares I think have seen their palmiest days – at least for some time.

That’s because the time is approaching (if not already) when Newcrest will have acquired majority control of the Havieron prospect, through meeting the majority costs of exploration and the start of early construction works by the end of this year. The same will be true later on, for the second farm-in agreement with Newcrest arrived at last November for a wider exploration programme in the Paterson range.

Once the first happens, there will be a problem working out the value to GGP’s shareholders of its remaining – minority – share of what, admittedly, should be a more valuable Havieron project. Newcrest plans to produce a pre-feasibility study for it by the end of this year, and even if it shows a very robust project, it seems unlikely that GGP’s eventual 25% share can ever match the sky-high valuation that its shares, when over 30p, accorded to the estimated gold-copper resource.

In any case, I’m not sure whether even the parties, let alone market analysts, have worked out the basis on which GGP will account for its reduced share. The project by then will be under Newcrest’s control, who will determine how it integrates Havieron’s output into its Telfer mine to carry out all the processing, and therefore will control the ‘value’ of Havieron’s contribution. In such circumstances, the stockmarket values the minority share of a project at a discount, rather than at the extreme premium GGP has traded at recently. The problem might not be a consideration for investors at the moment, but I think it will loom larger as time goes on.

I was going to mention other mining minnows at the time Xtract Resources took over my writing space. One of these is Conroy Gold and Natural Resources (LON:CGNR), which spiked in July and again in late December, when, after many years exploring, finding (including a 900 oz gold ‘nugget’ – worth £1.3 million today) but not developing its promising gold finds at Clontibret and elsewhere on the same trend in Ireland spanning the border, someone stepped in offering to finance work necessary to bring them to mine-construction ready status.

First it was Anglo Asian Mining, who seemed to be stalling in January (allegedly over land acquisition issues) so that, last week, Conroy found (it says “was approached by”) an alternative, and apparently better-heeled suitor, in the form of Turkish mining and industrial conglomerate Demir Export. The proposal is for Demir to fund all spending up to construction-ready state, in return for an eventual 57.5% stake in Conroy, in three stages where the first two give it 40% after putting up Euros 9m. Presumably the third stage will only happen if Demir is certain it can be construction-ready thereafter, within its own spending criteria.

Even so, if the preliminary ‘Letter of Intent’ is converted into a deal, investors will compare CGNR’s current £11m market cap (at 34p) with the potential value of what it says could be an 8.8 million ounce gold resource across all the licences to be included.

It is not yet clear to what extent ‘construction-ready’ applies just to Clontibret – which has only a 517,000 oz resource so far, based on little drilling – or to the other licences which contribute the 8.8Moz total ‘target’ resource. A scoping study on Clontibret as it was back in 2011 estimated a $72m NPV, and a high 49.4% IRR at a then $1,372/oz gold price and a conservative 8% discount rate. With further drilling and the current gold price, one analyst has estimated the NPV would be at least doubled, while I imagine that Demir can see a lot more.

For comparison, Solgold’s Alpala project has an equivalent gold resource of some 60Moz at current copper/gold prices. And Xtract at its Racecourse prospect is hoping for around 9Moz equivalent for Anglo American to buy it back, while the Curraghinalt deposit not far away from Clontibret in Co Tyrone being developed by Dalradian Gold, has 6Moz.

Demir and Conroy have said they will fast track negotiations to finalise the deal, so CGNR should be worth watching over the next few months. But if the deal falls through (we don’t know whether – or why – AAZ either jumped, or was pushed) the market’s traditional scepticism regarding Conroy’s ability or willingness to develop its gold will decimate the shares. They were below 5p back in 2019.

Comments (0)