John’s Mining Journal: Bacanora Lithium and Armadale Capital

Veteran mining analyst John Cornford reviews some of the more interesting plays in the junior mining sector…

Gold’s 13% retracement since its peak last year translates to a 30% fall in gross margin to a gold miner with average costs, which explains why the sector itself is some way off the top. Some commentators seem to think gold will resume its uptrend once the current worries about inflation and interest rates subside, in which case many goldies, including for instance Pan African Resources (LON:PAF) (30% off its top at 16p) with its 4.5% yield, should bounce back.

But the gold setback has allowed miners of other commodities to show why they could be better long-term investments. Base and speciality metals reflect demand in a real world where little supply capacity has been created over the last two and sometimes even four decades. Hence the investor rush for developing copper and nickel suppliers, where many miners, large and small, are well into the early stages of new exploration and plant building. (Xtract Resources (LON:XTR), for instance, which remains a strong buy in my opinion).

Readers will have followed my comments on Horizonte Minerals (LON:HZM), which is developing a major new nickel source in Brazil. But like all mid-cap miners, whose shares are not being continually traded by major investors, and mainly by private investors, it has seen strong spikes in its price when progress is announced, only to fall back again on profit taking. Emmerson (LON:EML) has behaved in the same way, and both shares look right currently for a longer term and less erratic recovery

But with an even larger demand/supply imbalance forecast than for copper and nickel (and potash fertiliser) are the markets for battery materials. Rather later than for copper and nickel, investors have only recently started to look more seriously at potential suppliers of lithium and graphite, as well as of cobalt and manganese. Only recently, that is, because initial forecasts for the expansion in electric vehicles were being scaled back even before the pandemic struck, so that the lithium price for example, by the end of 2020 had almost halved from its 2018 peak.

But there has been a sudden recovery over the last few months, triggered I suspect by news – after a long news-free lull – of progress at one of the largest potential lithium suppliers in the world – Bacanora Lithium’s Sonora project in Mexico.

Bacanora (LON:BCN) (market cap £139m at 42p) saw its shares take off in mid-November when the long-awaited full endorsement from China’s Ganfen Lithium – the world’s largest lithium metal producer – arrived. Having been a key cornerstone investor for the last two years, Ganfen, is moving to be a full joint venture partner with a 50% equity stake, and will lead all the mine and plant construction. With Ganfen’s investment funds received, initial site works have already started, and lithium carbonate production is now slated to begin in 2003, three years later than hoped for two years ago.

That means that all the finance (loans, equity, and take-off deals) to build a first stage plant to produce half the eventual planned 35,000 tonnes of lithium carbonate per annum has now been secured. The first stage will cost some $450m, in return for which it is estimated Sonora will earn a $1.25bn 8% NPV with a 26% IRR and an almost unlimited mine life. On that prospect, and like those of HZM at a somewhat similar stage of development, BCN’s shares look attractive for the longer term now that they have relapsed from their 65p peak.

As I say, it was probably the Ganfen deal which set off the lithium price generally. But it is not easy to pin down, because only recently has any sort of lithium price index been created. Prices are usually set confidentially for bulk deals between buyer and seller, and according to market commentators who track them, the average price throughout the year fell from about $17,000/tonne in 2018, to $8,000/tonne in 2020.

But they are now reporting an 88% increase so far in 2021 to an average of $12,635 per tonne, purportedly on market shortage, as many producers sell out of product inventory.

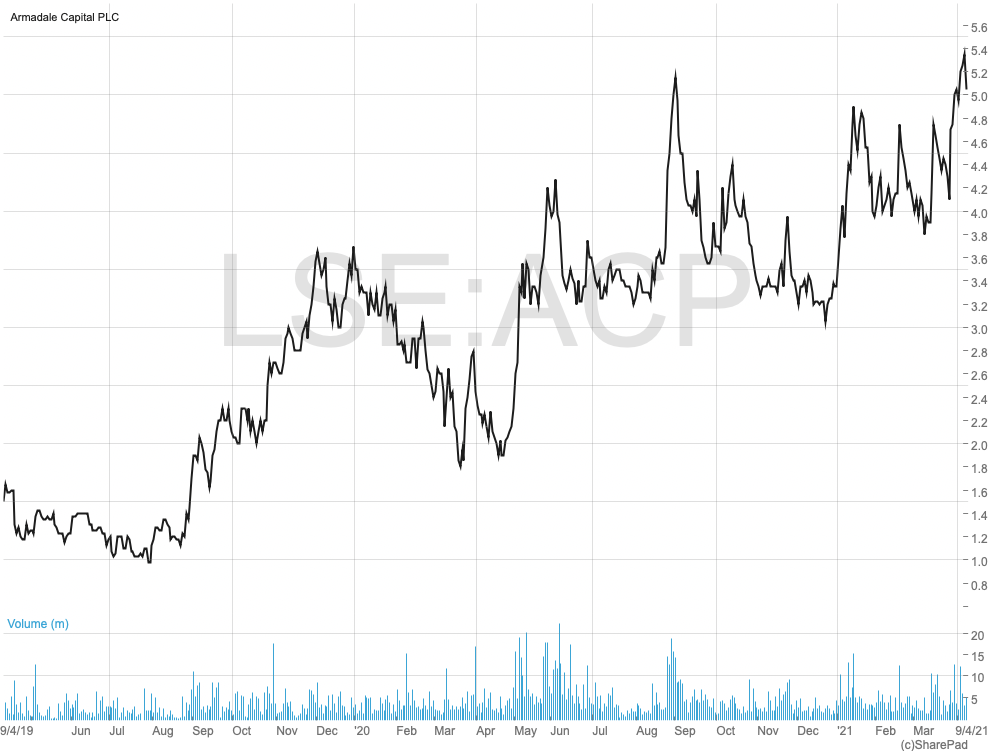

So, although that means the lithium price might progress from now onwards only in fits and starts, its indications of a revival in the battery minerals market generally has spurred investors towards the smaller potential suppliers of that market. Among those is Armadale Capital (LON:ACP) with its Mahenge graphite project in Tanzania which I have mentioned in the past.

ACP claims that its Mahenge-Liandu project contains one of the largest, highest grade, and lowest cost graphite resources in the country, and according to its 2020 Definitive Feasibility Study, is almost ready to deliver a 10% NPV of $430m and a 91% IRR, in return for only a $40m initial cost.

Even so, despite that ACP reports that it is in the final stages of applying for a mining licence, has a short list of contractors, and has gained approval for its product grades and its treatment processes from testing authorities in China and Australia, it is now nine months since it announced financing discussions with ‘reputable’ Private Equity Mining specialists and Asian parties, and little progress seems to have been made.

That hasn’t stopped investors pushing ACP’s shares to a 5-year peak, but is in contrast to some other potential producers in the same Mahenge area who have recently gained backers. ACP said nine months ago that “It is encouraging to note the level of funding interest in other graphite development projects in the Mahenge area which share many of the attractive characteristics of our project”. Whether that statement has anything to do with the recent interest I can’t say. Funders might, for all we know, have a plethora of ‘attractive’ opportunities nearby.

One of the largest of ACP’s neighbours is Australia’s Ecograph Resources, which is a vertically integrated graphite producer and owns the Mahenge-Epanko project. It has recently gained a $60m finance deal towards the $89m cost of developing Epanko, which has a bankable feasibility study showing a $211m NPV (at a 10% discount rate – the same as Liandu’s) and a 38.9% IRR.

The disparity with ACP’s project is striking. Epanko is a larger resource with a 40-year life. Yet it appears to be far less profitable than Liandu which has a 15-year life, although eventual production levels are twice that planned at Epanko. The answer might be that Liandu’s study is only to ‘Definitive’ rather than ‘Bankable’ standards, and that ACP bases it on a two-stage plan whereby a much larger capital cost will be incurred four years into the project in order to reach full production, financed by cash flow from the earlier stage.

Readers will know my scepticism about the use by developers of NPVs. ACP hasn’t published the full study, and no-one as far as I can see has asked the question: from what point and with what assumptions about later capital spending is the NPV calculated, and what initial capex is it using to arrive at the high IRR quoted?

If I were one of the financiers with whom ACP has said it is still negotiating, I would want to see that full multi-page DFS which, as far as I can see, has not been made available to ordinary investors. That ACP’s plan looks rather less robust than Ecograph’s, might make financing more difficult.

But I might be too cautious – or I might not. Investors are buying what looks like one of the cheapest and most profitable shares around because they expect news soon about a mining licence, which ought to be followed by a financing offer. I, personally, would wait to see whether their expectations are met.

Comments (0)