Hydrogen: THE fuel of the future?

Electric vehicles are all the rage right now, but those with a longer-term horizon in mind are looking to hydrogen as the truly green energy source of the future. Master Investor caught up with the CEO of one very exciting company, Powerhouse Energy, to get a glimpse of the shape of things to come…

James Faulkner: Powerhouse is a waste-to-hydrogen business focused on the development and commercialisation of its proprietary Ultra High Temperature Gasification technology. First of all, can you explain to readers where waste-to-hydrogen sits in the wider energy landscape?

Keith Allaun: Hydrogen is poised to become THE clean fuel of the future. It’s been predicted to be so for decades, but now the technology has aligned to allow the inexpensive production of hydrogen, from traditional waste products, in an environmentally responsible, economically viable, and industrial efficient manner.

JF: Powerhouse’s technology has numerous commercial and environmental advantages over rival products. Can you give us some insight into what makes it so special?

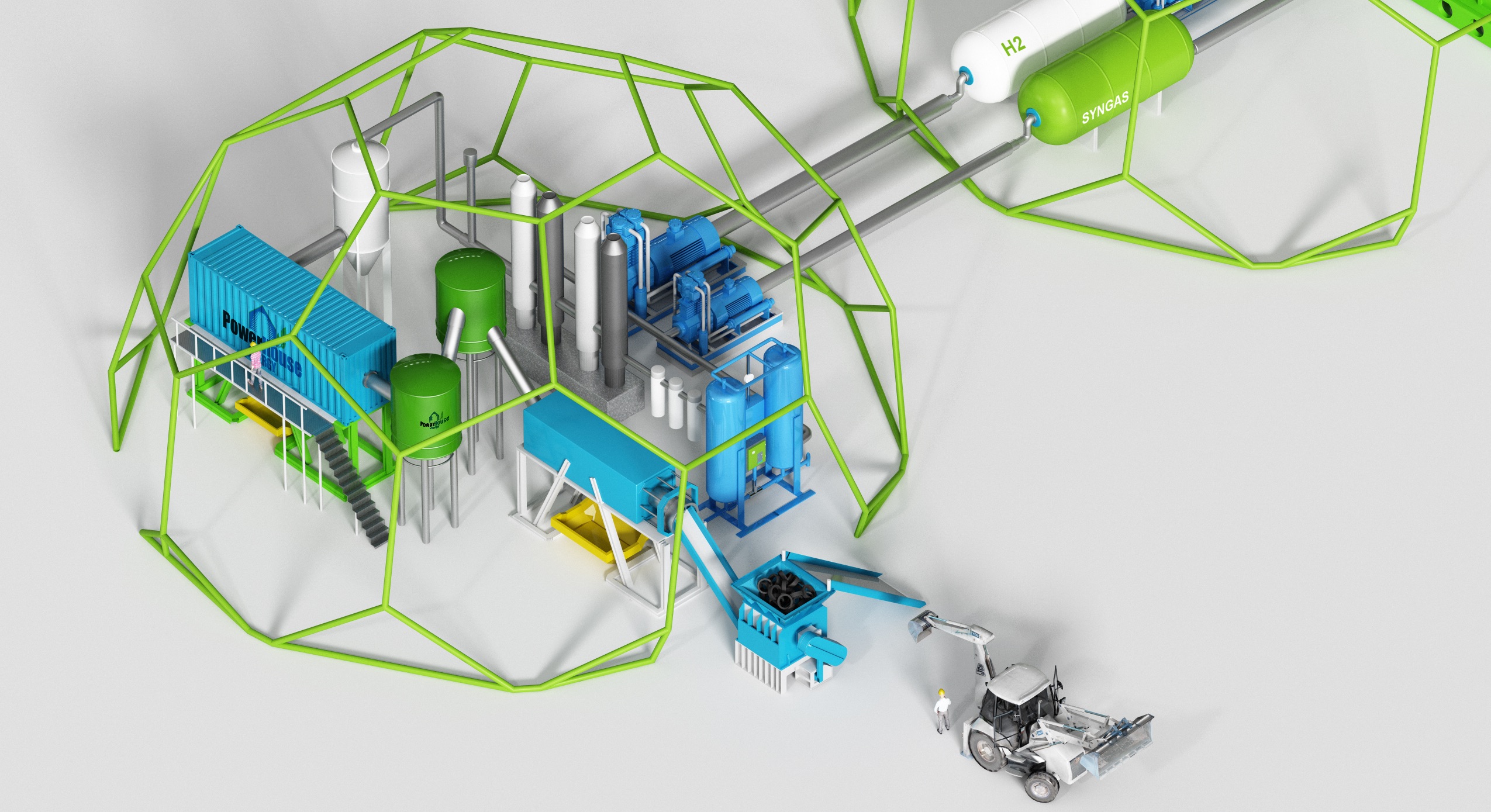

Powerhouse’s DMG unit

KA: Our DMG Waste to Hydrogen system is a breakthrough technology that allows several things to occur simultaneously. One is the ability to reduce the cost of hydrogen production, thereby allowing H2 to be sold at or below the cost of current road fuels. By using our DMG process this allows us to produce H2 in a distributed manner (with Distribution being the highest cost of H2 production).

Thirdly, the amount of CO2 produced in traditional H2 production is 16X greater than our DMG system production. And finally, as the feedstock is waste plastic or end-of-life tyres, it has effectively a zero-carbon footprint – in that that footprint was counted upon the original production of the product before it became waste.

The hydrogen economy is upon us today.

The special mechanism of DMG is that it is distributed, small footprint, and modular which allows us to grow the system utilizing pre-commissioned modules which are interconnected with one another. The fact that we’re not releasing emissions into the surrounding atmosphere allows us easy planning and permitting permissions and co-locating with many industrial distribution centres.

JF: The short-term opportunity lies in tapping into the electricity generation market. However, the longer-term goal is to address the growth of the FCV (fuel cell vehicle) market. How far away are we from seeing FCV cars on our roads and what advantages do they offer over electric (EV) and conventional (ICE) vehicles?

KA: This week, the Metropolitan Police Department announced the acquisition of 550 FCVs by 2020 in London. Bus fleets throughout the world are being tendered to be replaced by FCV busses. Industrial applications of H2 transport are being rolled out NOW for trains, ferries, lorries, and consumer vehicles.

Keith Allaun, Powerhouse CEO

The hydrogen economy is upon us today. We’re at the very bottom of the “j” curve but we’re seeing it accelerate. FCVs allow effectively unlimited range in transport, they provide the same tremendous power-curves one expects from EVs; however, refuelling is a 5-minute exercise, not a 30-minute (or 3-hour) exercise.

The weight of lithium battery packs is massive in order to power an 18-wheel vehicle. Not so the weight of a fuel cell and the 40 kilos of H2 that provide it with a 300 to 500-mile drive range. The weight differential between batteries and fuel cells is between 3-10x for batteries.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

JF: You’ve said that we will look back on 2018 as the year that the door opened on hydrogen fuel as a viable alternative technology. What makes you think that we’ve reached an inflection point for this technology?

KA: FCV technology has finally caught up to the massive investment that has been made in EVs over the past decades. It’s now been 20 years since the introduction of the Prius and the hybrid car. FCVs will follow Moore’s law and begin to accelerate their development, expansion, efficiency, and reduction in cost.

The tipping point has been reached. We are at the tipping point today. This inflection point is obvious as we look at the billions being spent by auto manufacturers, the political will being placed on the elimination of greenhouse gasses (and most EVs are still recharged by brown power…simply moving the CO2 footprint away from the auto back to the power station). Only 3% of all electricity is being generated by alternative means. FCVs can generate their own electricity with NO GHG emissions.

PowerHouse is intent on having its first commercial operation, generating electricity for private wire sale, commissioned by year’s end 2018. Adding the H2 component to the process will follow-on shortly thereafter. We don’t intend a standard roll-out of the DMG system; rather, we envisage the rapid expansion of over 100 systems in the UK in the next 5-10 years and another 200-500 world-wide in that same time period.

This is a disruptive mechanism by which we can reduce plastic waste, end-of-life tyre incineration, and the efficient generation of both electricity and road-fuel quality hydrogen.

JF: The problem of waste plastic has worked its way into the public consciousness of late. How does this feed into the growth story for Powerhouse and can you give us some idea of the scale of the commercial opportunity?

KA: There will be 300 MILLION tonnes of virgin plastic generated next year. Another 8-10 MILLION tonnes of that plastic will make its way into our oceans and streams. If we can play a role in interdicting even a fraction of that plastic, we can fuel thousands of vehicles – with NO Greenhouse emissions – and help save the entire Ocean ecosystem and a major portion of our food chain. And we can do this while generating generous profits.

We can save the planet profitably and use the proceeds to continue to enhance the existence of our ecosystems for our children and their children.

We can save the planet profitably.

JF: Finally, what catalysts should investors be looking out for going forward?

KA: Investors should be looking at market drivers: The environment is now massively intertwined with the economy. One cannot ignore one in favour of the other any longer. We’re doing something disruptive to provide a solution to a failing planet by eliminating waste plastics from the planet while recovering a highly prized resource – hydrogen and green electricity.

The demand for distributed electricity is growing, the demand for distributed hydrogen is growing, the demand for landfill diversion is growing – we provide a solution for all of these with a small footprint, an environmentally robust approach, and profitable returns on our investments.

What about Velocys or ITM? They are in the same area.

Storing hydrogen is the biggest bugbear to its use. Even when liquified, a very costly process, the very low density of hydrogen is a problem. this does not seem to be addressed in then above article.

I purchased shares some years ago in a company called ITM, who have now apparently almost perfected the separation of hydrogen from water to power cars; thus eradicating current poisonous exhaust fumes (from petrol & diesel engines) and greatly reducing the cost of fuel.

The storage of H2 will be overcome I suspect graphene composite will make a strong enough tank. The lithium battery is heavy and slow to charge and a serious pollution creator in manafacfure. H2 is very fast to charge seconds as opposed to hours and light. Lithium degrades and will need a rebuild in a few years. I predict the Tesla car will be history in eight to ten years. The responsible fuel is H2 and it can be made on almost every farm, industrial site and solar or wind farm, so requires no distribution. Also H2 not used for transportation can be used to heat buildings. H2 is the fuel of the future even for aircraft.