Fight back against inflation with high-yielding small caps

According to the latest Office for National Statistics numbers, the UK Consumer Prices Index measure of inflation hit 5.5% in January 2022. The last time rates were at this level was March 1992, when John Major was prime minister and Right Said Fred were at the top of the pop charts with “Deeply Dippy”. However, back in the early 90s, despite high inflation, you could still make a risk-free, real return on your savings.

Savings-statistics website swanlowpark.co.uk suggests that in 1992 the average interest rate on UK savings accounts was 8.19%. But with the Bank of England base rate at10.38% for much of the year, you could have probably got a better deal if you shopped around. In any case, savers were enjoying at least a few percentage points of real returns on their savings. Contrast that with today, with inflation set to hit 6% this year and average savings rates sub 1%, and we are seeing negative real returns of around 5%.

Fortunately, for those investors willing to expose their cash to higher levels of risk, the stock market provides numerous opportunities to earn higher rates of return. Here follow a few high-yielding, small-cap shares which currently offer some inflation-busting dividend yields, supported by strong asset backing and predictable cash flows.

Alternative income REIT

Property companies offer good investment opportunities due to their consistent and predictable income generation from rents, along with asset backing and potential for long-term increases in their valuation. One type of property business is a REIT, a real-estate investment trust. If it meets certain conditions under UK law, then a property company can qualify as a REIT and be exempt from paying corporation tax on rental income and gains on sales of investment properties used in a UK property-rental business. What’s more, 90% of property-income profits must be distributed to shareholders each year.

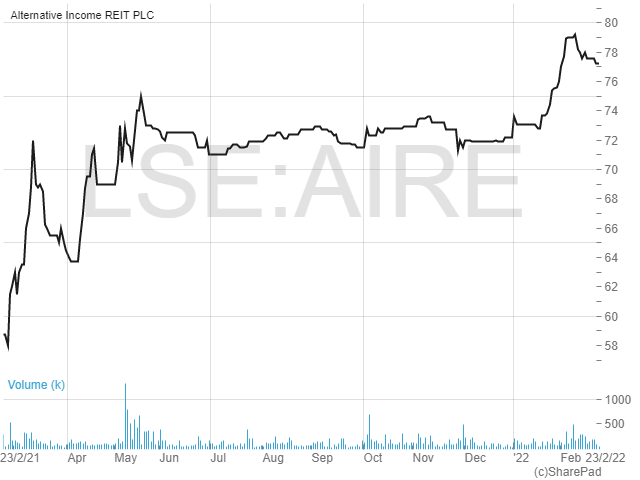

This structure has been attractive, with almost 100 REITs now registered in the UK. One of these is Alternative Income REIT (AIRE), a firm which listed on the main market of the London Stock Exchange (LSE) in June 2017, raising £80.5m at the time. The company’s remit was to generate a secure and predictable income return, sustainable in real terms, by investing in a diversified portfolio of UK properties, predominately in alternative and specialist sectors. Since then, a portfolio of 18 properties has been built up, worth almost £108m as at 31 December last year.

The current portfolio contains a mix of assets, including hotels, care homes, a car showroom, industrial units, student accommodation and gyms. Important in the current environment, the majority of assets are let on long leases and 93% of them have inflation-linked rent-review provisions. They are also full of tenants: 99.7% had been let at the end of last year and the remaining space was let following the period end.

REIT good trading

The most recent company update covered trading in the final three months of 2021 and there was a lot of good news across the board. While the portfolio value was down from £108.53m 12 months earlier, this failed to reflect the sale of a car showroom in Huddersfield during the year. However, on a like-for-like basis there was a 4.6% increase in the valuation year on year and a 1.7% increase since the end of September. The net asset value (NAV) at the period end was £72.75m or 90.38p per share. This was up from 87.8p at the end of September due to the rise in portfolio valuation and income earned.

Nearly all (93.3%) of rents for the current quarter to March were said to have been collected as at the date of the announcement, rising to 99% if considering tenants who are contracted to pay monthly. Overall, 100% of rent due for the quarter is expected to be collected. Providing long-term visibility of earnings, the weighted average unexpired lease term was 18.2 years to the earlier of break and expiry at the end of December, with 20.2 years to expiry.

AIRE pays dividends every quarter, and the payment for the three months to December was set at 1.3p per share. This was in line with the previous quarter, up from 1p in December last year and well covered by earnings of 1.68p. The company also confirmed that it remains on track to deliver on its target annual dividend of 5.5p per share, with full dividend cover expected, by September 2022.

Prime property

While there are a lot of REITs to choose from on the London markets I believe that AIRE is one of the most attractive. Its portfolio assets have a wide spread of uses, are not exposed to any one sector, and notably there are no office assets – a tricky area to be in right now given the rise in working from home. There is full occupancy at the moment, with long-lease terms and critical provisions in place regarding inflation-linked rent reviews.

The valuation also looks good. At the current price of 79p buyers have the opportunity to get on board at a discount of 12.6% to the last stated NAV. The dividend yield, based on the annual target of 5.5p per share, is highly attractive at almost 7%.

Duke Royalty

Corporate royalty financing is becoming an increasingly popular form of financing. Put simply, a financier provides capital to a business in return for a percentage of its revenues. For companies, this is attractive as it doesn’t have the dilution effect of equity nor the refinancing impact of straight debt. For the lender, royalties provide annuity-like revenue streams and exposure to increased payments via the growth of the business.

AIM-listed Duke Royalty (DUKE) devised its current strategy in 2015, deciding to invest in a diversified portfolio of royalty finance and related opportunities. Its aim was to build a stable and reliable income for shareholders by investing in revenue-based royalties in private and public companies. The business model sees Duke providing financing to companies, usually in the form of a quasi-loan with a typical duration of around 30 years. In return it receives rights to a small percentage of future revenues. The percentage payable is reset annually, subject to a ceiling and a floor, according to revenue performance. The borrowing company can buy itself out of the agreement but there will be penalties and fees to pay.

Since inception, Duke has built up a portfolio of 13 investments, or “royalty partners”, across a range of sectors, having deployed £180m of cash. Partners include independent glass merchant United Glass Group; healthcare facilities manager InterHealth Canada; and industrial coatings and paints business Trimate Global Coatings. Five exits have also been realised, delivering decent returns which have been invested in other opportunities.

‘Vis-counting’ the cash

A recent trading update revealed that cash distributions received from royalty partners reached £3.9m in the quarter to December 2022. That was a record level and up from £3.3m in the previous quarter. What’s more, based on current trading and further investments, cash revenues are expected to hit £4.4m in the March quarter − another record.

Setting itself up for further growth, the quarter also saw record levels of capital deployment. These were in excess of £38m (more than double deployed in any previous quarter) and came after a £35m equity fundraise in April.

In December, Duke completed its largest new royalty financing to date with a $21m investment in Atlas Signs Holdings, a US-based, national, brand-implementation company that delivers signage, sign maintenance, lighting, installation and project-management services. Duke also completed a new £10.5m royalty financing with Tristone Healthcare, a company which provides specialist residential and domiciliary care for adults with severe mental, physical or learning disabilities, and for care leavers.

Three follow-on investments into existing royalty partners were also made. There was a £4.2m investment in recruitment firm Bakchysarai to finance the acquisition of IT contracting and talent- acquisition business Vantage Resources; a £5.3m investment inrecreational-vehicle-parts wholesale business Miriad Products for a shareholder restructuring; and a £2.1m investment in Step Investments, facilitating the purchase of an 85% equity interest in digital-advertising company Adtower.

Better than its peers

Following the recent investments, Duke Royalty looks set to have its best-ever year in 2023 – the year end is March. Before that, looking at 2022, analysts at Cenkos are looking for cash revenues to rise by 39% to £15.2m. In 2023 they are expected to rise to £19.3m. A dividend of 1.1p has already been paid so far this financial year, with the expected full payment of 2.4p yielding 5.9% at the current share price of 40.5p. The yield rises to 7.2% in 2023 on expectations for a 2.9p per share dividend.

While Cenkos doesn’t have a target price on its corporate client, analysts at Canaccord Genuity recently confirmed their buy rating on the shares with a 53p target price. If hit, that price implies upside of 31% from current levels. There is also decent asset backing here, with net assets of £122.3m as at 30 September 2021, covering 83% of the market cap.

Chesnara

Consistent and regularly rising dividends are what most income investors are looking for. This next company fits that bill perfectly, with one of its stated aims being “to provide shareholders with their least troublesome source of sustainable, attractive dividend yield.”

Chesnara (CSN) is a life-and-pensions company which listed on the LSE in May 2004 in order to acquire UK life-assurance business Countrywide Assured. It also had plans to act as a consolidator in the fragmented life-insurance industry. Since that date it has built up a business making almost £300m of annual insurance premiums, which add to other income, including commissions and investment returns. Chesnara administers approximately 900,000 policies, had funds under management of £8.7bn at the end of June 2021 and operates in three countries across Europe.

The UK division mainly consists of the insurance company Countrywide Assured which manages around 240,000 policies and is in run-off, meaning that it no longer accepts new business. The business follows an outsourcer-based operating model, outsourcing functions such as customer services, investment management and accounting and actuarial services. In Sweden, Movestic is a life-and-pensions company which is open to new business. It offers personalised, unit-linked, pension-and-savings solutions through brokers. Finally, the Dutch businesses, The Waard Group and Scildon, aim to deliver growth and earnings through a dual closed and open book approach and through acquisitions.

The growth strategy focuses on three elements. Its main aim is to maximise value from the existing business by efficiently administering customers’ life and savings policies, generally making sure that they are happy and well served. The second aim is to acquire life and pensions portfolios or businesses − the company has developed a reputation as a reliable acquirer of portfolios no longer seen as core by vendors. Finally, Chesnara also adds value by writing profitable new business in Sweden and the Netherlands.

Top payer

Chesnara’s financial results are a bit difficult to read given that insurance companies report their numbers somewhat differently and use a lot of industry jargon. Profit figures can also be erratic given the effect of market movements on investment results and the effect of forex changes.

To provide some easier to understand figures, in the last fully reported financial year (2020) insurance premiums grew by 9% to £293.4m. However, the main income movement was within the net investment-returns section, which fell from £1.09bn to £254.6m following the market crash that year. Overall, net profits fell from £96.1m to £24.6m.

After a difficult year, the first half of 2021 saw a recovery after premiums continued to grow and net investment returns hit £621m. Net profits for the period were £17.9m compared to a £6.8 m loss in H1 2020. In the results Chesnara noted that it was actively looking for acquisition opportunities. To that effect, in February this year the company further boosted its spending power by issuing £200m of loan notes to fund such deals.

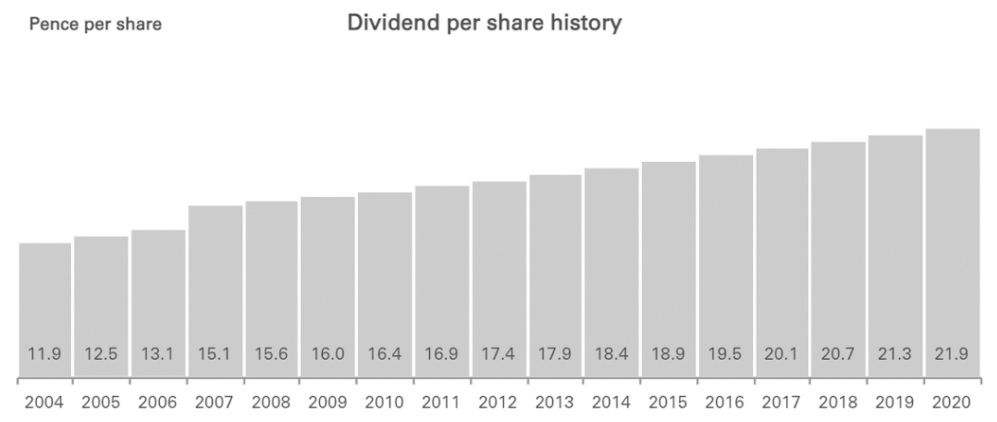

Chesnara has been an income investor’s dream in recent times having increased its dividend payment 17 years in a row. From 2004 to 2020 the dividend went from 11.85p per share to 21.94p. That’s a compound annual growth rate of only 3.92% but shows consistency and the financial soundness of the business, even through economic downturns. The annual rise was also higher than the average annual inflation over the period of 2.9%. What’s more, the half-year payment for June 2021 was increased by 3% to 7.88p.

A share for life

Chesnara may not be an exciting company in operational terms. But its track record of strong shareholder returns is far from boring. The company has delivered capital gains of 167% since close on the first day of dealings, with the 301.17p per share worth of consistently growing dividends taking the total gain to 436%.

Chesnara’s core valuation measure is economic value, which is based on the estimated and discounted value of future cash flows, using core economic assumptions determined by the market. For much of its history, Chesnara traded at a premium to its economic value. But in recent years that has reversed, with the shares now trading at a substantial discount. The closing economic value stood at 419p per share as at 30 June 2021. So, at the current share price of 298p, investors can currently buy the shares at a 29% discount and also enjoy a dividend yield which should be at least 7.6% for FY2021.

Hi Richard,

Thanks for you articles. I do enjoy reading them. Good insight.

I do think when covering REITS though one should explain the associated charges as well. I haven’t read one article from financial journalists where they are mentioned.

All the best,