Diversified Gas and Oil ticks all the boxes

At first glance, Diversified Gas and Oil looks like a yield trap with a dividend yield of 11%, but there’s more to this company than first meets the eye, writes Master Investor Editor James Faulkner.

I know that many of our readers rely on their investments to supplement their income in retirement; but the advent of Covid-19 has cast a long shadow over UK dividends. Even Royal Dutch Shell (LON:RDSB), once regarded as a gilt-edged investment that could be relied upon in good times and bad (it hadn’t cut its dividend since the Second World War), took the knife to its humongous dividend pay-out, slashing it by a whopping two-thirds. That’s a terrible blow to UK income funds and to many income investors, and sadly this is par for the course in 2020.

With even the dividend pay-outs of some investment trusts now in question, it seems sensible for income investors to get a little more imaginative with their investments. In order to generate a good and sustainable income in this environment, investors need to be prepared to look further afield and off the beaten track. The good news is that the opportunities are there if you know where to look.

One of those opportunities is Diversified Gas and Oil (LON:DGOC). OK, you’ve been burnt by Shell – so why would you want to look at another hydrocarbon producer in an environment where oil prices are at rock bottom? And in any case, hydrocarbons are on the way out, aren’t they? Well, the beauty of this situation is that with all the oil and gas stocks being tarred with the same brush, there are some really great investments hiding in plain sight. Diversified Gas and Oil, as I shall endeavour to explain, is by no means your average oil and gas company.

A niche operator with a “once in a generation” opportunity

You may not have heard of Diversified Gas and Oil, but as of today it’s actually one of the top three producers on the London market. Since listing on AIM in February 2017, the firm has grown quickly via the completion of around $1.5 billion of acquisitions to reach production of around 94,000 boepd (barrels of oil equivalent per day). It recently completed its move to the Main Market of the London Stock Exchange, which will open up the firm’s equity to institutions that don’t invest in AIM, whilst also improving its corporate governance profile.

DGO occupies a rather interesting niche in the hydrocarbons space. Operating primarily in the Appalachian Basin (see image below), the oldest hydrocarbon region in the US, it acquires high-quality producing conventional and unconventional oil and gas assets, primarily from other companies that are looking to refocus elsewhere or (increasingly likely in the current environment) reduce debt through non-core disposals. The company then uses its operational expertise to maximise production efficiencies and thereby achieve a very solid return on investment.

Source: DGO presentation

The beauty of this approach is that although it relies partly on debt in the first instance to acquire the assets, it is highly cash flow generative and earnings-enhancing, with deals typically done on valuations of 2-4x EBITDA, primarily because the vendors are typically prepared to sell on attractive terms by virtue of the assets being non-core, plus their own financial imperatives for getting a deal done. Moreover, there are very few well capitalised buyers around in the hydrocarbon space right now, so this is very much a buyer’s market. In fact, CEO Robert (“Rusty”) Hutson has described the current market conditions for DGO as a “once in a generation” opportunity.

Stable and reliable returns

DGO’s assets are generally characterised by stable, long-term production profiles (in excess of 50 years), which delivers reliable cash flows. The firm uses its cash flow to pay a very generous dividend to shareholders (11% yield at time of writing), with a pay-out target of 40% of free cashflow. The rest is used to pay down debt and buy back shares. Net debt to EBITDA currently stands at around 2.3x, with the company targeting a range of 2-2.5x. Since its IPO DGO has returned $259 million to shareholders via dividends and buyback, which is all the more impressive given the experience elsewhere in the sector. Whilst Shell was cutting its dividend by two-thirds, DGO maintained its pay-out. It was able to do so in part due to its hedging programme, with 40% of its long-term production hedged under six- to ten-year contracts. In 2019, hedges added an impressive $50 million to revenues. Of course, hedging can be a double-edged sword if spot prices rise, but the key thing here is that DGO’s cash flows are protected – and that means reliable returns for investors.

Cash flow is also supported by a very conservative capex profile, which sees only 8-10% of its adjusted EBITDA invested annually. Unlike many of its unconventional-focussed peers, DGO does not rely on costly exploration and development programmes to drive growth, and capex is instead focussed primarily on the maintenance of its assets and its midstream system. Moreover, with the portfolio including c. 60,000 conventional and unconventional wells, 12,000 miles of natural gas pipelines and a network of processing facilities, DGO is not overly exposed to any one particular well, which reduces risk, whilst its proprietary network benefits margins and reduces reliance on any third-parties.

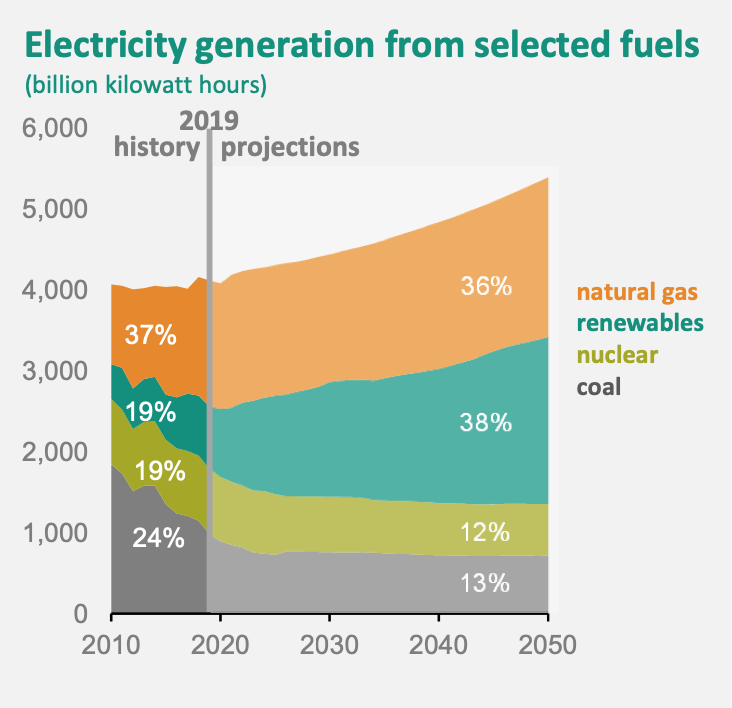

Despite its name, DGO is overwhelmingly a gas producer (99% of production), which sets it in good stead for the future. This is because natural gas’s share of the energy mix is forecast to remain constant out to 2050, even as renewables’ share doubles (see chart below). Let’s also be clear here, despite all the doom and gloom in the energy space right now, hydrocarbons are a fundamental building block of our economy whether we like it or not. Regardless of what you might be led to believe in the media, demand for these products is not going to evaporate overnight.

Source: DGO presentation

Skin in the game

But what I find most compelling about DGO is that this is a grassroots story. CEO Rusty Hutson’s ancestors worked in the oil and gas industry as far back as the 1900s, as did Hutson himself during his early summers. After initially taking a different path to the rest of the family and becoming an accountant and working in the financial sector, Hutson’s father told him about some wells for sale in West Virginia. After taking out an $80,000 home equity loan, Hutson bought the assets for $260,000 in 2001. That was the beginning of DGO. Hutson has literally built this company from the ground up.

As DGO grew and eventually began to explore the options for listing, it quickly became clear that the US markets were decidedly uninterested in a small conventional producer, and by that time the commodity sector in general was beginning to take a turn for the worse. That’s how the AIM listing came about. America’s loss is our gain.

DGO looks well placed to keep the dividends flowing, not least given that Hutson himself holds just over 3% of the equity, amounting to some 20,350,000 shares. Income seekers might consider joining him, with the dividend yield currently at 11%. At first glance, this might seem like an obvious yield trap. But this dividend does not appear to be under threat any time soon. The free cash flow yield is a whopping 25% and around 90% of 2020 production and more than 60% of 2021 production is hedged, meaning that there is considerable visibility on those cash flows. With the company eyeing up further value accretive deals, there is more gas in the tank here. DGO could very well turn out to be a great total return investment as well as a great income play.

You fail to mention the witholding tax , so UK shareholders loose 30% of the dividend to this tax.

Shareprophets have been pointing to numerous red flags for a long time.

If its AIM listed, would withholding tax apply?