Building a portfolio of quality dividend-paying stocks

Pandemics, geopolitical tensions, growing inflation, stretched valuations. You pick what scares you the most. But, no matter what your choice is, everything this year is pointing towards the side of caution.

I believe in the potential of crypto-assets and Cathie Wood’s Ark innovation fund, but I currently see an expensive stock market, where growth stocks are still priced as if growth were to remain elevated no matter what happens. With so many risks mounting, this is perhaps not the best of times to enter risky positions.

The rising tensions in the Ukrainian border are contributing to keep energy prices at a peak, which may later in the year translate into higher consumer prices and press central banks to act faster than expected. Apart from inflation, a potential war itself is certainly a big and risky event, which adds additional danger. In particular, when there is Russia on one side…

Summing it all, I believe it is worth pursuing a reduction of the duration of a portfolio and replace some of the bolder bets for quality assets. With bonds offering almost nothing and threatened by inflation, dividend-paying stocks may be a good bet.

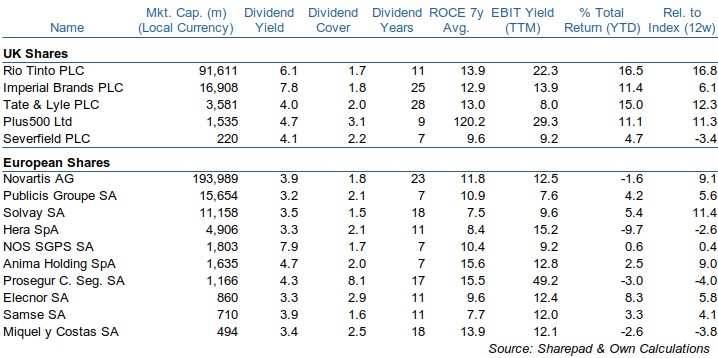

Instead of buying ETFs, this time I’m looking into my own screener and seek for UK and European stocks offering decent dividends. At the same time, I’m carefully making sure the results are reasonably priced stocks, which are in good financial shape to continue paying dividends into the future. Let’s start by filtering stocks with a current dividend yield of at least 3%. I know that this rate looks poor but I don’t want to be too greedy for now, as I want to end up with at least some stocks. We can refine it later, if needed. The next step involves making sure that I’m selecting stocks with a reliable record of dividend payments and with a strong enough financial position to continue paying them. The past tells a story but if cash doesn’t flow, dividends may end suspended. With this in mind, I require the stocks in my shortlist to have been paying dividends for the last 7 years without interruption and to have a dividend cover of at least 1.5x.

When applying these simple filters to the FTSE market, my list was shortened from almost 600 stocks to 67. Just imagine what would happen if imposing a high dividend yield! Nevertheless, I’m not just seeking for yield, but for downside protection in case things turn less rosy. I want a selection of quality, profitable businesses that are not too expensive and pay dividends. To capture these additional dimensions, I’m requiring an average ROCE for the last 7 years and an EBIT Yield for the TTM of at least 7%. These filters get rid of two-thirds of the remaining stocks in my list. But, like I said, I’m looking for quality here.

Finally, I don’t have the money and patience for value investing. In particular, bets on undervalued stocks that are currently unloved by the market and that may remain this way for longer than my wallet can take. In other words, I don’t want stocks that are completely out of momentum. To avoid such stocks in a cold streak, I’m filtering out stocks underperforming the FTSE All-Share for more than 5% during the last 12 weeks.

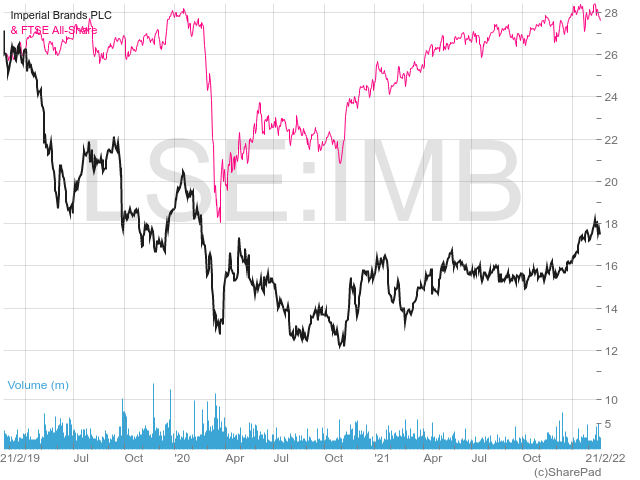

After applying the above filters, there’s only five stocks left in the FTSE. These are Imperial Brands (LON:IMB), Rio Tinto (LON:RIO), Plus 500 (LON:PLUS), Severfield (LON:SFR) and Tate & Lyle (LON:TATE). Imperial Brands currently offers a juicy dividend yield of 7.8% and is a great defensive play. But, why not take them all?

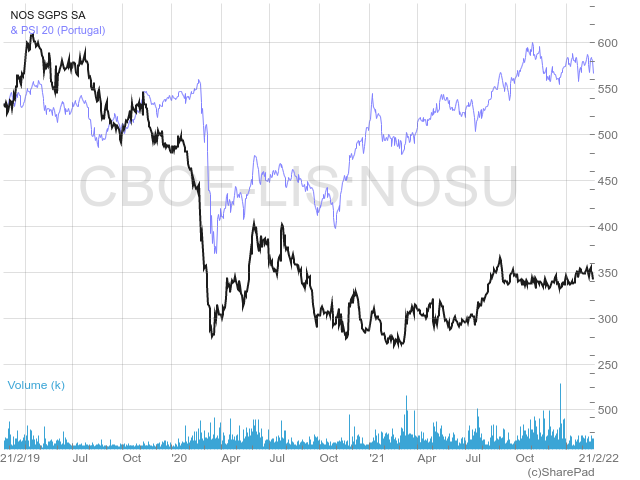

For those looking to extend holdings into Continental Europe, I have an additional 10 stocks that currently trade within the above requirements. The larger company is Novartis AG (SW:NOVN), which currently offers a dividend yield of 3.9% and is one of the most reliable dividend payers. For those seeking for the best yield, the Portuguese telecom NOS (LS:NOS) is trading at an insanely high yield of 7.9%. I believe this company is way undervalued.

While the growth stocks in Cathie Wood’s list will certainly outperform over time, the ARK fund is down 30% YTD, which means that some of the stocks in the portfolio are losing more than half of their value in a period of two months. While such volatility (As Cathie Wood poses it) is certainly less important when we consider a long enough period, it is a huge risk this year, as geopolitical risks are mounting. So, why not take a few safer bets?

do you not also consider the dividend growth over the past few years too?