Avingtrans – Is This The Right Time To Buy?

Last Wednesday Avingtrans (LON:AVG) issued a positive Trading Update for its financial year to the end of May.

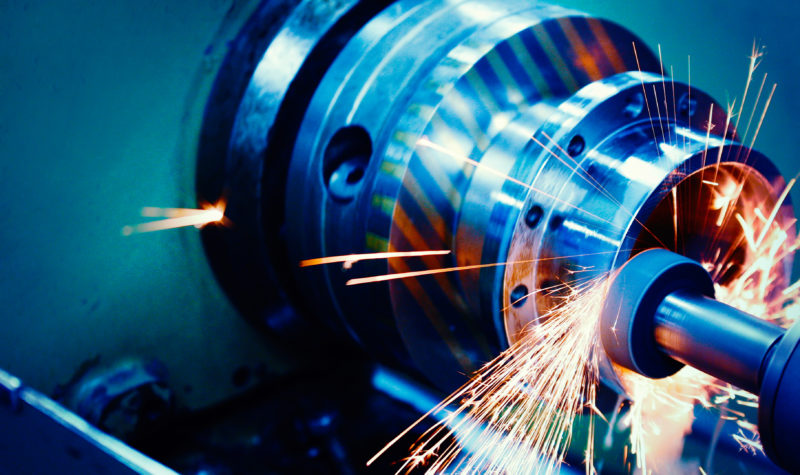

The £127m capitalised group, which is over 70% owned by professional investors, designs, manufactures and supplies original equipment, systems and associated aftermarket services to the energy, medical and industrial markets worldwide.

The Trading Update

The company reported that revenue from continuing operations had reached a record level and aligned with market expectations.

It also stated that its adjusted EBITDA from continuing operations is materially ahead of market expectations and is expected to be in the range of £13m-14m.

That is in part due to lower than budgeted commercialisation costs in the group’s Medical Division, some of which have now been delayed into FY25.

Net debt at £6.1m, excluding IFRS16, was better than anticipated, with the completion of several key projects contributing to enhanced cash receipts and lower-than-expected spending on medical developments.

We will have to wait until Wednesday 25th September for the group to declare its Final Results.

Management Comment

CEO Steve McQuillan stated that:

“We are very pleased with the Group’s performance reporting record revenue with Adjusted EBITDA ahead of market expectations.

Lower commercialisation costs in the Medical Division, some of which have been delayed into FY25, have contributed to this performance but we are pleased that the Group is entering FY25 with record-level revenue from continuing operations, leading the Board to view the outlook for this year with confidence.”

Brokers’ Views

Analyst Caroline de La Soujeole at Singer Capital Markets rates the shares as a Buy, notes that Avingtrans’ management has an excellent track record of creating shareholder value, driven by a focussed and successful ‘Pinpoint-Invest-Exit’ strategy, which she has every reason to believe can be enduring.

She commented that update confirms record FY24 group sales, in line with expectations with a material EBITDA beat (c.34% at the mid-point of the new £13-14m guidance range) and that the broker had upgraded its FY24 forecasts accordingly.

She now goes for revenues of £137.6m (£116.4m) for the end May 2024 year, but with adjusted pre-tax profits of just £6.6m (£9.0m), easing earnings to 15.6p (23.5p) but with a better dividend of 4.7p (4.5p) per share.

For the current year to end May 2025 she looks for £158.9m revenues, just £3.5m profits, earnings of 6.0p and a dividend of 4.9p per share.

I reckon that her earnings estimates are far too conservative, however she has a Price Objective of 510p out on the group’s shares, which assumes a ‘value position rather than one based upon current profitability.

Over at Cavendish Capital Markets its analyst David Buxton is not quite so bullish with his Price Aim of 495p.

His estimates for 2024 are for £137.8m sales, £7.0m profits, 15.4p of earnings and 4.7p for dividend.

The current year could see £161.0m revenues, £3.5m profits, 6.0p earnings and an improved 4.9p dividend per share.

After the recent guidance the analyst notes that he has not changed his 495p target price.

“We remain firm supporters of the group, given its well-proven turnaround capabilities but also its development of MRI and 3D X-ray equipment.

If these medical products are successful, the shares deserve to be substantially higher.”

My View

At the end of February this year I headlined a piece on this group, which I have followed for decades, suggesting that the shares were an interesting medium-term Buy.

I noted that both analysts believed that the group will, within the next year or so, be making another example of its PIE Strategy – Pinpoint-Invest-Exit – as it sells off one or possibly two of the group’s interests.

I suggested that at the then 350p the group’s shares value the group at far too low a valuation.

In the middle of last month, they hit 440p, since when they have eased back to rest around the 375p level.

Although I do like this group and its longer-term value potential, despite the analyst consensus price objective of around 500p, I would prefer to be a buyer of its shares on any of the dips which could occur between now and the end of September, when the Finals are due to be announced.

(Profile 04.11.20 @ 260p set a Target Price of 325p*)

(Asterisk * denotes that Target Price has been achieved since Profile publication)

In my humble opin if this share price does not make headway then the Company is very likely to attract a bid, probably from the US. I am happ to continue to hold.