Aberforth Smaller Companies: Value Play Or Value Trap?

One of the higher risk areas that has come under pressure in recent months is the smaller companies sector, where many of the underlying businesses are sensitive to changes in credit conditions and struggle when interest rates rise. It’s a part of the market that’s been left behind during this year’s rally, yet historically the small caps have delivered better returns and growth than their larger counterparts.

UK smaller companies look particularly cheap as this country is completely out of favour with investors, although we probably need to see interest rates peak and inflation start to come down before any serious money comes into the sector. This is reflected in the ratings of the relevant investment trusts that are trading on an average discount of 11%.

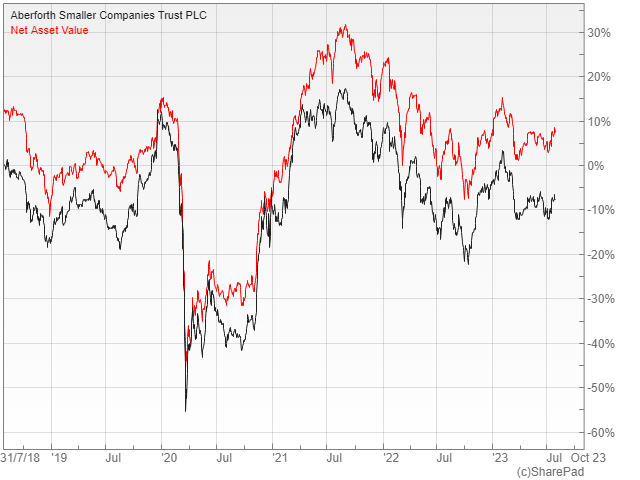

A good example is the value-oriented Aberforth Smaller Companies (LON: ASL), which has just released its interim accounts to the end of June. These show an NAV total return of 0.4% over the period compared to 2.6% by the FTSE All-Share, with the performance continuing to lag in the month since then.

Cheap As Chips

The trust currently holds 78 different stocks, with an average market cap of £528m compared to £945m for its small cap benchmark, reflecting the managers’ preference for companies at the smaller end of the spectrum. Having a strong value bias means that the average historical PE multiple is typically much lower than the index and currently stands at 7.1x earnings versus 9.6x.

It is possible that the cheap valuations will at some point result in more bids from bigger competitors. During the six month reporting period, a total of six companies in the benchmark were subject to M&A activity, of which four were members of the portfolio.

The managers believe that Aberforth Smaller has a bright medium to long-term outlook, as whenever valuations have reached similar levels, the total returns over the following five years have been strong. They think that the risks facing the UK have already been factored in and that continued M&A will expose the “absurdity” of current prices.

Value Or Value Trap?

It is not just the underlying companies that are cheap as the trust is trading on a 14% discount to NAV compared to a 12 month average discount of 9.5%. This is despite an active programme of share buybacks being conducted by the board.

Another good indication of value is the fact that more than half of the portfolio holdings raised their most recent dividend. As a result, Aberforth was able to increase its interim distribution by 7.5% to 12.95p per share, giving the trust a prospective yield of just over three percent, with solid dividend cover of 3.4 times.

The broker Numis says that the managers have stuck to their value style through both the good times and the bad, so investors know what they are getting in terms of approach, which differentiates the fund from its mainly growth focused peer group. All the evidence suggests that it is cheap, although it will require a significant change in sentiment before the returns pick up.

This was not a small cap trust which I had followed. But your simple and straight forward description will lead me to do my own research. Thank you