2 retail stocks set to benefit from government policy

The last few years have been exceptionally challenging for bricks-and-mortar retailers. Evidence of this can be seen in the fact that around 50,000 High Street jobs have been lost since the start of 2018, with a number of well-known companies such as House of Fraser and Maplin closing a large number of stores.

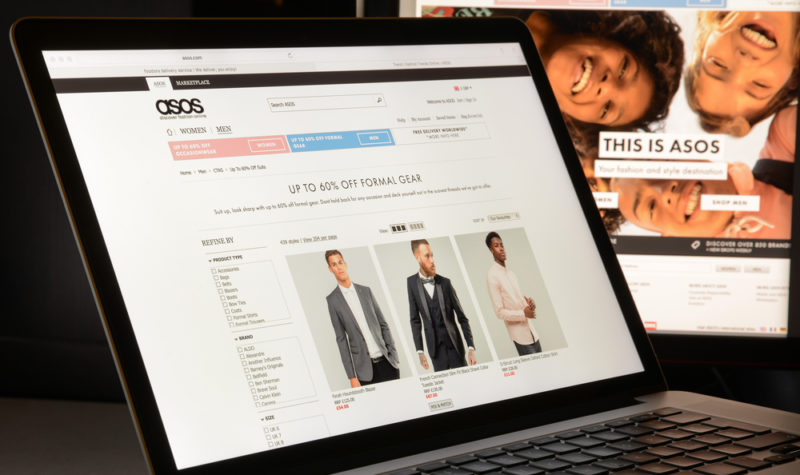

One of the reasons for the difficulties faced by High Street stores is rising business rates. They were changed in 2017 for the first time in seven years, and provide an advantage for online retailers. As a result, investing in online-only operations such as ASOS (LON:ASC) and Boohoo (LON:BOO) could be a shrewd move.

Competitive advantage

Get this article and many more – for free! |

While the change in business rates in 2017 was revenue neutral and did not raise any additional funds for the government, some businesses benefited while others suffered. Since business rates are based on the rental value of a property, High Street stores have been hit much harder than their online equivalents. It is estimated that in London, a typical shop faced a 14% rise in business rates, while online retailers operating from warehouses across the country saw an average 2% rise.

In the case of ASOS, its business rates did not change in 2017, while Boohoo saw its business rates fall by 13%. These figures provide the two companies with a further advantage over their High Street rivals. As well as having lower labour and rent costs to begin with due to the nature of their businesses, falling business rates means that they can be even more competitive on price at a time when consumers remain highly price-conscious.

Online trend

Of course, there is also a general trend towards online shopping. In the last five years, online sales of non-food items as a percentage of the total market have risen from 11.6% to 24.1%. This trend is showing little sign of slowing down, with improvements to technology being a key driver. Improved delivery times have also contributed to the popularity of shopping online, with next-day delivery now standard across the clothing sector. And with returns usually being free and hassle-free, shopping online looks set to grow in popularity in future.

Investment potential

Boohoo and ASOS are forecast to post high EPS growth over the next two years. In the case of the former, its bottom line is expected to be 47% higher in the 2020 financial year than it was in the 2018 financial year. Meanwhile, ASOS is expected to post EPS growth of 53% between the 2017 and 2019 financial years. Compared to bricks-and-mortar retailers, these levels of growth are exceptional.

Of course, neither stock is cheap at the moment. Using their most recent EPS figures, they have P/E ratios of 80 (ASOS) and 59 (Boohoo). But if they are able to deliver on their growth forecasts over the medium term, these figures could fall rapidly. Since they have relatively simple business models that rely upon being competitive on price, offering the latest fashion trends and high levels of customer service, they could continue to record high levels of share price growth.

Comments (0)