Warning Bells Are Ringing

If you believe the last summer was tough to invest in the equities market, then just wait for the rest of the year and you’ll see how bad things can get!

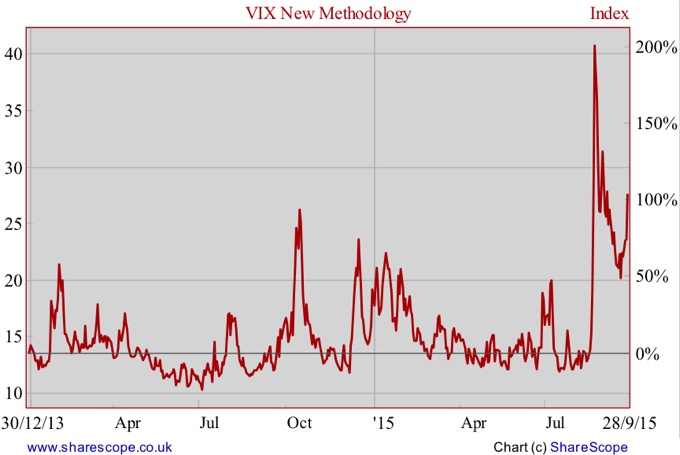

I don’t want to be the “Dr Gloom” of Master Investor, but I’m increasingly worried about the proportions the current distortions are taking, as central banks fail to realise the impact of their actions. Seven years ago central banks aggressively cut their interest rates to reduce the impact a liquidity squeeze would have in the real economy; then they proceeded to adopt a few unconventional measures to overcome the zero lower bound problem; and now they are willing to perpetuate the “emergency” policy that was adopted during severe conditions at a time when the economy is approaching full employment levels. Investors are becoming very anxious about the future, not because they expect interest rates to rise soon, but because they fear that may not happen. The extended delays in hiking rates and the wobbling speeches made by the Fed chair are giving conflicting signals to investors and then contributing to a substantial increase in volatility that may end very badly. The warning bells are ringing and the US equity market is going out of favour.

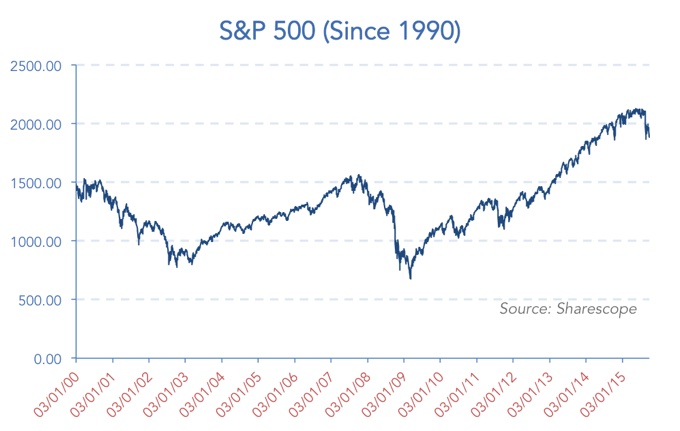

It was on 9th March 2009, when the financial crisis was reaching its crescendo, that the S&P 500 hit a bottom. In the advent of the Lehman collapse and the huge liquidity problems it created, the market could only be severely damaged. From an all-time high of 1,565.2 recorded in September 2007, the index went downhill towards the 676.5 level, hit in March 2009. In 18 months the S&P 500 had lost 57% of its value. But with the help of rate cuts and a few billions of asset purchases, the FED was able to push the market back to record levels, this time to 2130.8, which was hit in May of the current year.

A financial markets crisis? What crisis? Those who perfectly timed the market by entering at the peak of the crisis could have accumulated a stunning 216% return in May. But those whose timing was poor and who entered at the prior market top in September 2007 would still have accumulated a respectable 36% return. Every trader/investor is a winner under such conditions.

While financial markets recovered, the real economy did too. The current projections are for inflation to approach the 1.7% level next year and for GDP growth to surpass 2% and move into line with its long-term level. As for the unemployment rate, it is already below 5% and thus near the estimated NAIRU (non-accelerating inflation rate of unemployment). Under such circumstances the FED should have already hiked rates, because its models predict an acceleration of inflation at full employment. Even if that was not the case, the models also predict that monetary policy cannot improve the real economy in the long-run, so there is a double reason to hike rates. At least, that is what their models say.

But Janet Yellen seems worried about the future and tremendously hesitant about the Fed’s next move, which is creating huge uncertainty about the ability of the US economy to survive without the life-supporting zero interest rate. The effectiveness of monetary policy increases with the central bank’s ability to create surprise movements and decreases with uncertainty surrounding its decisions. When the central bank creates too much surprises and the path taken is too uncertain, there is a decrease in efficiency, as agents prefer to take defensive action and delay decisions. I believe that at this point the Fed is delaying what everybody is waiting for – a rate hike. Said hike is widely expected because every data point supports that particular direction. In postponing its first rate hike, the FED is not only delaying the next stage of important economic decisions but also undermining its credibility, as agents may start believing the FED is either willing to accept more inflation, or predicting lower inflation levels than it first announced. Compounding the problem is the inconsistency of Yellen’s speeches. As a strategist from DRW Trading Group puts it: “What are they [the FED] talking about? They’re not raising rates because of these concerns [emerging markets trouble and no worry about inflation on short-term], which are real concerns, and yet they could do it [raise rates] in October?” Yellen and other FED policymakers are talking too much and in different directions, contributing to the current uncertainty and raising a credibility issue. It should come as no surprise that corporate America is keeping a cash pile and investing it in corporate debt of other corporations instead of investing in new projects. No one is sure about when the FED will raise rates and whether that is really going to happen or not. The last FOMC meeting gave the impression that if the global economy deteriorates, the FED may continue to postpone rate hikes.

Because of all this, Goldman Sachs has just cut its S&P 500 projections. The bank now attributes the index a target of 2,000 for the year, revising its prior projections of 2,100, citing a combination of the slower pace of economic activity in China and the US and the fall in oil prices. It still expects the FED to start hiking rates in December though.

A more extreme position is that held by Carl Icahn. The billionaire published a 15-minute video, titled “Danger Ahead”, where he expresses a negative view on the future, blaming the FED for exacerbating bubbles. First of all, Icahn believes that low interest rates create bubbles. In fact it is not just a matter of low rates but a full framework where the central bank attempts to inject more liquidity than is required to keep rates near zero. When that happens money flows to the system and needs to head somewhere. In the past, that money flowed to the real estate sector, inflating the bubble that led to the 2007-2009 collapse. But things are not much different now, as the S&P 500 is still 178% above its bottom of March 2009. At the same time, money is also flowing to other assets, as the richest are seeking a yield from their wealth, which cannot be obtained by investing in safe assets anymore. An example of this is the recent auction of the Picasso painting “The Women of Algiers”, selling for $179.4 million. That same painting had last changed hands 18 years ago for just $32 million. The longer it takes for rates to normalise, the more frequent this kind of deal will become. Then, the normalisation will lead to a crash in fine arts markets.

Icahn also pointed to the fact that extreme monetary easing leads to herd behaviour. No one is willing to fight the FED even when one believes prices are too high. Extreme policy action deteriorates normal market functioning and leads to deficient price formation. Investors buy assets just because they believe there will be another investor buying from them at higher prices.

Finally Icahn also pointed to fake earnings reporting from companies and financial engineering, which both help to create the illusion things are better than they really are. Over the last few years companies have been tapping debt markets to repurchase their own shares, contributing to equity price increases without an accompanying increase in the earnings potential.

In the end, there are so many distortions being created that there seems to be no escape from the next financial crisis. But against what the Post-Keynesian models dictate, Janet Yellen seems to know that and prefers to delay the adjustment and keep rates unchanged. Perhaps she simply foresees the same thing that Ludwig von Mises did:

“True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse sooner or later and to bring about a depression.”

Comments (0)