Tread carefully with Emerging Markets

One year ago the FED was discussing whether it should hike its key rate and thus reverse a policy trend that had lasted for a decade. By then, investors were anxiously awaiting such a move, and even expected a rate hike to be the first of many more to come (albeit gradually) over the course of the following years. The preparations for that particular hike were substantial, as the FED clearly feared the market reaction after so many years of near-zero interest rates.

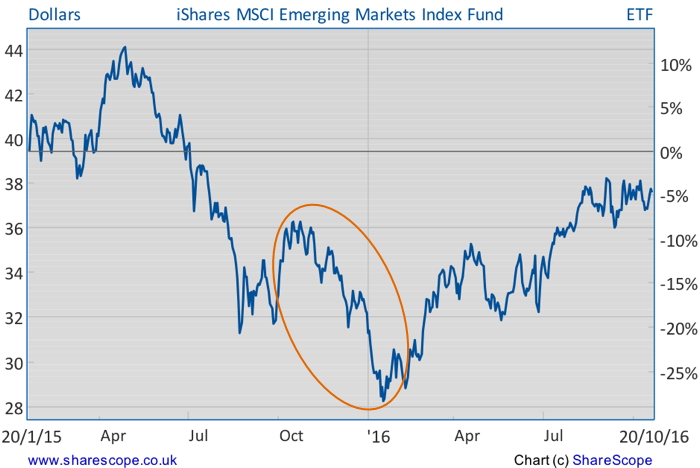

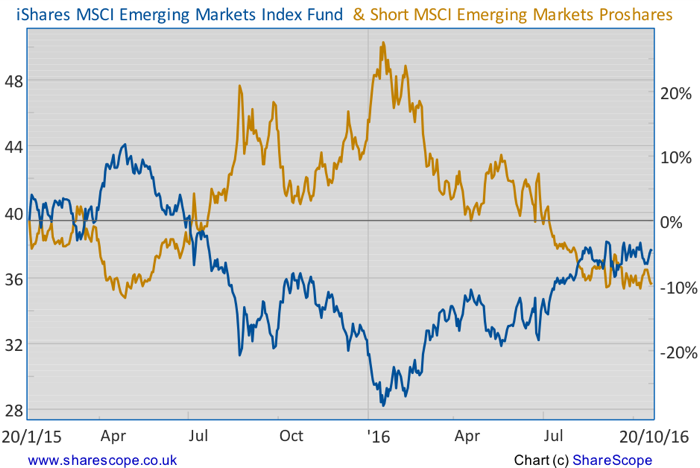

And they were right: the reaction to the change in policy was negative and investors dragged down almost every asset class. Take oil, for example. The price of crude oil halved between October 2015 and February 2016. In the same period the S&P 500 declined 12% and Emerging Markets, as measured by the MSCI EM index, were battered down by 20%.

The tantrum created by the first hike has prevented the FED from moving on to the next hike. A hesitant FED turned a rate hike into such a big deal that everybody is taking a seat for the show.

On the one hand, the delay has allowed equity markets, commodities, and emerging markets to reverse their losses and advance to stellar returns YTD. But on the other hand, such a long delay in rate hikes, along with the hesitation that transpires from policy makers’ comments, has turned a rate hike into a big deal expected to cause shock and awe and impart big moves in every asset class.

The CBOE FED Watch Tool shows an almost 75% likelihood of a rate hike of at least 25bps occurring until December, but I still suspect the market will react negatively to it, as it did last year. If that is the case, past experience suggests it may be time to rotate portfolios.

One asset class that has been doing particularly well but risks being derailed is Emerging Markets. With the dollar already flying high, I feel this asset class may be exposed to trouble.

Data advanced by the FT on Emerging Market bond flows shows that investors pulled out funds from local currency EM bonds in the week of October 19 at the fastest pace since the turmoil experienced at the beginning of the year. These bond funds last experienced significant outflows exactly during the period prior to last year’s rate hike until the first few weeks of January.

While yields and rates of return offered by the developed world are thin, EM becomes attractive for investors who are looking for positive yield on their investments. But, as soon as the prospects for return improve in the developed world, investors pull their funds out and let them flow home again. That happened last year.

A mix of unfavourable international conditions, lack of substantial growth and eventually some fear, prevented Janet Yellen from further hiking the FED’s key rate during the first months of 2016. Momentum was completely lost when the UK voted to exit the EU and thus the FED had to postpone the second rate hike to the end of the year.

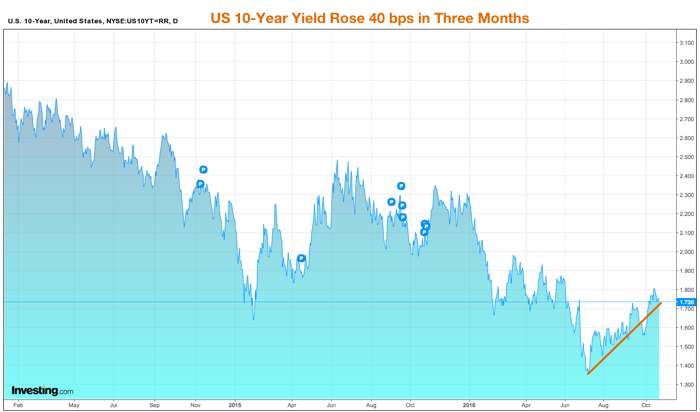

But now that the Brexit vote is over, China and Europe seem to be stabilising, and the US is showing some signs of inflation, there are no further excuses not to increase interest rates. If we look at 10-year U.S. Treasury yields, there was a significant uptick in the last three months. From a yield of 1.35% in July, Treasuries currently offer 1.75%.

The bearish movement in the bond market has been experienced by other developed countries as well, as there is a rising expectation that rate hikes are finally on the horizon, central banks are left out of ammunition, and more importantly, inflation is back. The latest data for the UK definitely points in that direction, mostly due to the crash in the currency.

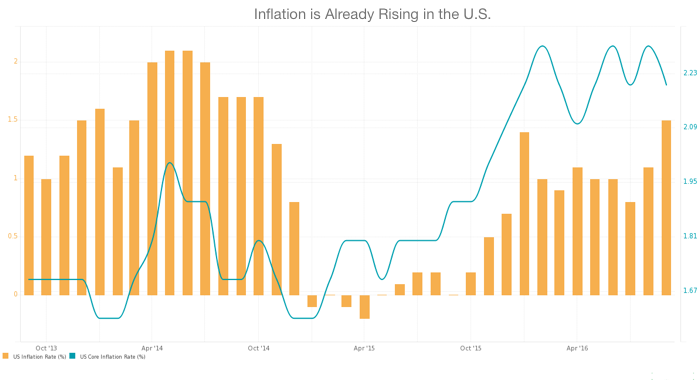

But inflation data in the U.S., if not worrying, is also showing sign of regaining life. The headline number for CPI points to 1.5%, up from 0.0% one year ago, the highest increase since October 2014. The core inflation rate now stands at 2.2%, up from 1.9% one year ago and has been trending higher since the beginning of 2015.

If we were to use the original Taylor Rule to help set monetary policy (as many central banks used to do), we would by now be close to a situation in which the nominal interest rate should be near 4%. That stems from the fact that the economy is near full employment and inflation is now close to its 2% target.

But central banks and many economists argue that we are under a ‘new normal’ and that the natural real rate of interest is no longer 2% but rather 0%. Even so, at a time when inflation is nearing its medium-term target and the economy is near full employment, the nominal rate should be near 2%. The FED currently targets a nominal rate between 0.25% and 0.50%, which is way below the most compliant of the Taylor rules.

I believe the FED will hike its key rate at its December meeting. Such a move will not come as a surprise but will still inflict some harm on a few asset classes. At the same time, I also expect inflation to increase at a faster pace than many are anticipating and press bond yields higher.

That being the case, there’s no doubt the dollar will rise and press Emerging Markets down. A higher dollar makes it more difficult for them to repay the debt they issued in dollars and pushes their currencies lower. At the same time, investors become less inclined to pour their money into these markets. That happened in the past and will very likely happen again.

For this reason, I believe there is an opportunity here to short EM equities. One way of achieving that goal would be to short the iShares MSCI Emerging Markets Index ETF (EEM) or just open a long position in the Short MSCI Emerging Markets Proshares ETF (EUM), with a view to keeping it for a few months.

Comments (0)