The end is nigh for the old order in commodities

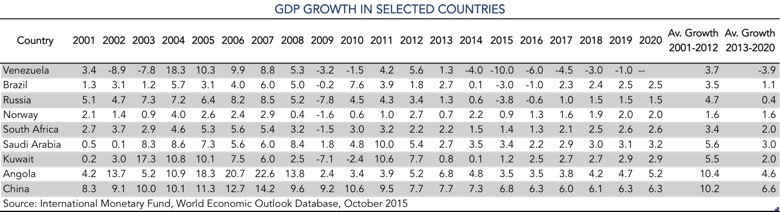

Some thought commodity prices were going to rise forever due to the mismatch between supposedly unlimited demand growth from industrialising nations and limited supply of much-needed and irreplaceable raw materials. Others even believed that a new world order was rising, where a homogeneous group of wannabe industrialised countries would support the growth of the rest of the world, forever. Some even believed that a few inside this group were so strong and different from the others that they should be offered to investors as a special ‘BRICS’ asset class. That world is about to end, as commodity demand is not rising anymore, supply is not as tight as many thought, and Goldman Sachs is about to dismantle its BRICS fund. The world is about to change and what has driven growth up to now won’t continue driving it in the future: China is not going to be the world’s engine anymore, the commodity exporters will have to find alternative ways of fuelling growth, and massive differences among the emerging players are arising, such that they can no longer be treated as a single asset class.

The OECD just released its economic outlook, predicting the world economy will expand 2.9% in 2015 and 3.3% in 2016, which is not only a flat pace but also a downward revision on the previous projected growth of 3.0% and 3.6%, respectively. These projections come on top of the IMF projections, which show the world growing at its slowest pace since the crisis. All reports and predictions point to the same problems: continuing weakness in EM, slower growth in China, declining commodity demand, and slower global trade growth.

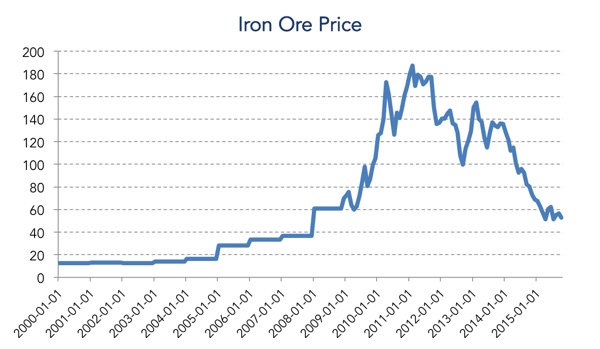

It is difficult to find the root of the current problems because all the above factors join together in a vicious cycle where no one knows exactly what ignites what. That said, the changes observed in China, where the government has been trying to turn the investment-driven economy into a consumer-oriented one, are often mentioned as the main reason behind the sluggish global performance. With China being the second largest economy – and one that has been furiously demanding raw materials to fuel its growth – it is not difficult to foresee the implications of a stall in Chinese infrastructure investment for global commodities demand. With the supply of commodities relatively sticky in the short term, any sudden change in demand would lead to huge price volatility. Over time, if the sluggish demand persists, decisions will be taken to reduce spare capacity, and the burden of the adjustment will be split between price and quantity. But for an industry requiring heavy machinery, huge capital investment, difficult-to-acquire exploration licences, and extreme logistics, it takes time to adjust capacity. Volumes react slowly to demand incentives and the short-to-medium term adjustment falls on prices. This makes prices extremely volatile, particularly when there are sudden changes in the world economy.

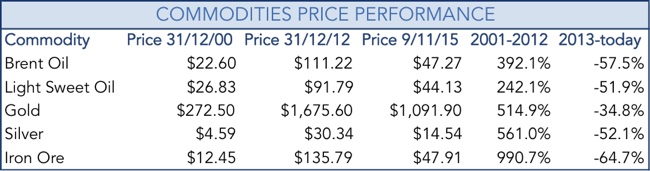

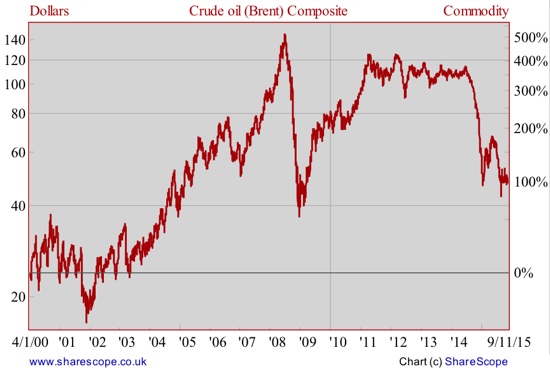

Between 2001 and 2012 commodities experienced an unprecedented boom as the emerging world industrialised. Oil, gold, silver and iron ore are just some examples that reflect the tight supply conditions under periods of rising demand. All of these commodities experienced a price explosion.

With emerging markets demanding ever more commodities, the commodity exporters did very well, particularly those producing oil. Industrialisation is an energy-intensive process. With OPEC effectively controlling supply, the ascent in prices was a natural consequence of the exploding demand. Between 2003-2013 China alone accounted for 45% of the total growth in the world’s oil demand. The iron ore industry experienced a similar picture, where China was also a major player, representing a growing share of world demand. Prices shot up in both markets, and so did the strength of the conviction they would stay high. But what goes up must come down…

Everybody forgot one important thing about these markets: high prices are the best incentive for people to become inventive and imaginative and to find substitute products. When prices remain high for a long time, these incentives materialise into new developments that tend to expand supply and reduce demand. When prices are low consumption is not efficient and no one wants to deploy resources into R&D to find alternatives. But when prices are high for a long time, it pays to deploy resources and expensive technology into the R&D of new energy sources.

At $10 a barrel, oil would eventually be extracted at only one or two sites in the world; at $40-50 we would eventually see the most efficient OPEC members extracting it throughout their countries; at $500 the world would also count on you and me digging at our backyards even if to add just one or two barrels per day. That’s the beauty of price; it can generate supply where it didn’t previously exist!

On the other hand, the prolonged super-cycle experienced by oil convinced countries and corporations of the need to replace concumption over time. Many agreements, aimed at progressively replacing oil with cleaner energy sources, were signed and materialised. We are now in the process of mass producing vehicles that use electricity instead of gas. All the above contributes to lowering demand for oil, in a structural way. Adding the business cycle can only result in a deep price crash whenever the global economy retreats.

There is a generalised sense that OPEC can do something about oil prices, and that in fact the cartel has been able to keep prices high through tight production quotas. But that doesn’t fairly depict the long-term reality faced by OPEC. While there is no doubt OPEC will prompt a price rise whenever it cuts production; there is a moving cap on prices that is not under OPEC’s control. In keeping prices too high for too long, OPEC allowed the world to replace oil with new energy sources and to find alternative ways of extracting it. A nascent shale industry flooded the world with oil and suddenly (almost) turned the US into a net exporter, after decades of being a heavy importer of the vital resource. The truth is, though, that as long as Saudi Arabia can produce at the lowest cost, it can increase production to hammer the competition and then regain pricing power; but the resources needed to regain that power will be ever greater and the pricing power regained ever frailer. While the cap on the last upswing was between $100 – $140 – a price range at which almost the entire shale industry was very profitable – the next cap could be between $60 – $80, as new technology is being developed and is waiting to be deployed whenever prices jump beyond those values.

The International Energy Agency (IEA) has just issued a report that foresees a gloomy future for the oil industry. The agency predicts a rise in demand of less than 1% per year until 2020, and modest growth rates thereafter. Such a pace is not enough to quickly absorb the glut in the market. The IEA believes there is a high likelihood of oil prices staying below $50 for the rest of the decade. If that really materialises we will experience massive shifts in the world and the OPEC cartel may face collapse, as many of its members are already squeezing public finances to the limit. Venezuela, for example, is expected to see its economy shrink by 10% this year. After recording an average annual growth rate of 3.7% during the period 2001-2012, the country is expected to shrink at an average of 3.9% per year in the period 2013-2020. Angola, which used to grow at 10.4% (2001-2012) is now set to grow at a 4.6% pace (2013-2020). This is a problem shared by most commodity exporters.

Prince Abdulaziz recently warned that spending cuts across the oil industry will have a “substantial and long-lasting” impact on future oil supplies and could lead to a price spike. But such a price spike is very unlikely under current global conditions, as demand is lagging well behind. But let’s say such a spike materialises. It would not be long-lasting, as there is a shale industry waiting to enter the fray once again. In the long term, OPEC countries will lose the price control they used to have; in the meantime let them play at ‘last country standing’, and let’s see how deep the Saudi pockets really are…

Comments (0)