Rising Bond Yields Open Cracks In Emerging Markets

One of the most boring realities observed in the financial world is the tendency for reversion. When the price of an asset explodes, it later tends to shrink; when central banks cut their key interest rates, they later tend to hike them; when banks advance too much credit, they later tend to shrink it. The myth that a share price can rise forever or that interest rates can stay permanently near zero is just that, a myth, as it never materialises. The sentiment-driven investor always thinks that this time will be different, just to learn the hard way that it won’t. The boring reality is cyclical. It goes over and over again from north to south and from south to north, always going through the same points, but investors fail to realise it. There are so many examples… just look at the bond market to start with. Yields on European high-grade government bonds have been negative for short maturities and below 1% for maturities higher than 20 years. That is insanely low. If history repeats and the boring cycle is in place once again, then these yields will increase and prices will sink. Prices are often guided by investor sentiment, which in turn, is guided by some external factor. When that external factor ceases to exist, the high sentiment vanishes, and prices return to fundamental values.

For my case today, the external factor is the expansionary monetary policy. Such a policy of decimating interest rates while purchasing assets leads to generalised asset price rises. A wealthier investor becomes more confident and more exposed to sentiment. The rise in wealth leads him to seek riskier assets and in turn attracts other wannabe investors to the market. In fact that is one of the main goals of the central bank: to generate a feedback effect attracting ever more investors while pushing them towards riskier assets – a task it has accomplished rather well.

The financial crisis hit the US severely. In accordance, the Federal Reserve adopted an ultra loose policy, which led to the decline of the dollar, the decrease of yields on safe assets and massive capital outflows in the direction of emerging markets, where interest rates were much higher and returns were promised to be high. The carry trade was simple: borrow in dollars and lend to emerging markets. Between 2008 and 2012, international investors increased their emerging market holdings by 87% to $8 trillion (£5.1 trillion), the BIS reports.

The inflow of money allowed these countries to keep record low interest rates and helped them boost their economies, allowing companies to get cheap funding and create jobs. The inflow per se did not create any real wealth as it is mainly speculative, but allowed central banks to keep lower interest rates while keeping the local currency relatively strong and pushed asset prices higher, increasing corporate equity. Indirectly, wealth could be generated from this.

But while the dynamics seem good, this has led to an incommensurate increase in the amount of leverage taken by companies while delaying some structural adjustments these countries were in need of. A large inflow of capital means higher demand for the local currency and thus enables lower interest rates to remain in place. But these countries often have large current account deficits and some inflation problems that need to be tackled through higher interest rates. If interest rates were to remain low forever in the developed world and capital continued to flow to emerging economies, then problem solved…

But that’s never the case. There is a boring tendency of the financial world to revert to the mean!

Such reversion has already started. During the three quarters that ended in March, investors pulled $600 billion (£382 billion) from emerging markets. The figure is greater than the numbers observed at the peak of the financial crisis. At the same time, in one of those bouts of rationality investors suffer from, they started selling the safer, low-yielding assets and, suddenly, the European bond market experienced a mini crash during the last few days.

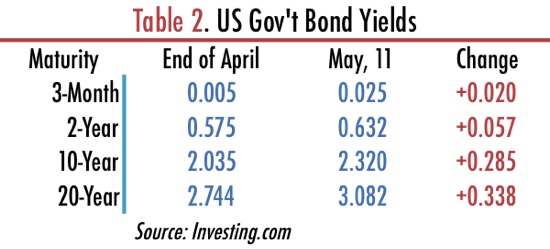

The worst part is that a return to sanity seems to be a contagious disease, as US investors followed their European counterparts and caused a mini-crash in US Treasuries too.

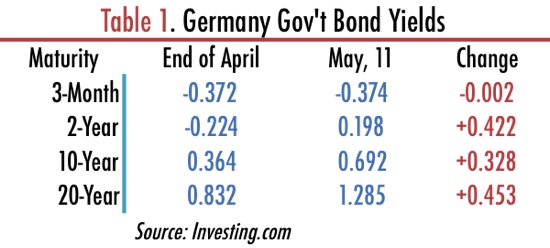

The yield on a German 10-year bond is now 0.692%, almost double its value at the end of April (0.364% at that time). The US Treasury has also experienced turbulence, as the yield on the same maturity is now 2.320%, up from 2.035% for the same period. With a few exceptions, yields have risen for all maturities both for German and US bonds.

An increase in the yields offered by safe assets like US Treasuries and German Bunds leads to an increase in the opportunity cost of holding riskier assets. If the capital that flew away from the US to emerging economies were directed to productive activities, it shouldn’t be a cause for major concern. But it was hot money that flew across borders, making the emerging markets vulnerable to the boring reversion that always occurs. This will trigger an increase in money outflows from Brazil, India, Indonesia, Turkey, Malaysia and many others, as monetary policy is normalised. Pressure will be put on local currencies exposing them to large depreciations that can only be prevented through capital controls and/or large interest rate hikes. These economies will be exposed to a capital outflow-driven recession that will make things even worse than they were before the inflows. In particular, and following the reference made by James Lord (an analyst at Morgan Stanley), there are five countries (the Fragile Five) heavily exposed to a super taper tantrum: Brazil, Indonesia, India, Turkey, and South Africa. All these have a mix of large current account deficits, high inflation, and weak growth, making them ultra vulnerable to rate hikes in the US. They should have learned the lesson from the 2013 taper tantrum and proceeded to reform their economic structures, but that was not the case.

This global rotation seems to repeat every few years… and the unbound creation of credit is always at the centre of the imbalances that flow from country to country. One could say that, to some extent, the monetary policy that saves the US, leads to an emerging market collapse.

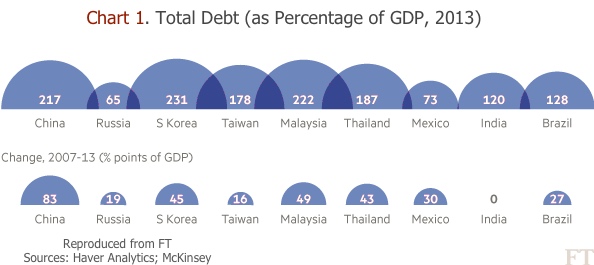

The expansionary monetary policy conducted in the developed world had serious negative consequences elsewhere. Flooded with capital from the developed world, emerging markets were able to keep interest rates below the advised level. With central banks now unable to control credit expansion, the recipe of mixing low interest rates and lack of control over money creation could only be explosive. The total debt held by households, non-financial companies and the government in some of these countries is dramatically high, as shown in chart 3, reproduced from the FT.

South Korea, China, Malaysia and Thailand had a total debt amounting to 231%, 220%, 217%, and 187% respectively in 2013 (which has increased in the meantime). Some of these countries (as well as many others not on the list) have tapped the European and US markets to issue debt. Although most of the loans are at fixed rates, a depreciation of the local currency increases the debt burden, as these are dollar-denominated loans (or euro-denominated). A rising dollar/euro is correlated with a rising likelihood of default. The equity values that served as a basis for many of the past loans will decline. In India, for example, the Sensex index rose 68.8% over the last three years helped by the massive capital inflow. But, with the Fed now expected to start hiking its key rate, the market is already being punished. While still above water for the year, the Sensex is down more than 7% since peaking at the end of January.

Despite what some investors may think, interest rates can’t be kept at the current low levels forever, as the credit creation that follows would sooner or later translate into inflation. If not this year, the Fed and the BoE will have to start to reverse their policies next year and this will push many other central banks to proceed in the same way. For now this is just a threat, which has already left some casualties in emerging markets, but it will be a serious issue over time. Many companies will default on their debt obligations and we will see another emerging markets crisis. This time we have an additional problem: the global commodity bear market. Many emerging markets like Brazil depend on commodity exports. With prices crashing, we may see a quick deterioration of their economic situation. This is the last call to avoid the asset class as a whole and to take some time to reflect on how global monetary policy is leading to disaster.

Comments (0)