Is the ECB too close to the private sector?

Yesterday the FT uncovered a series of meetings between ECB policymakers and the private sector that occurred just before the governing council meetings from which important, market-moving, interest rate decisions resulted. Central banks were made independent from the government to avoid an evident conflict of interests that allowed us to achieve more stable, lower inflation levels. But, how independent are these central banks from the private sector? Is monetary policy independently enacted to deliver low inflation and maximise output, or do the interests of the financial sector influence it? Those questions regained impetus after the FT gained access to the ECB diaries where meetings with the private sector are reported.

Questionable meetings

Meetings with the private sector, in particular with the major players in the banking and financial sectors, are particularly important for the ECB to perceive the main problems affecting its transmission mechanism and this way take the necessary steps to improve it. At the same time, communication strategies are today recognised as a key monetary policy instrument to help the central bank manage expectations and take effective action. But there are limits. Central banks should never discuss material information that is just about to be publicly disclosed. Central banks should observe a blackout period during which its key policymakers are barred from contacting the “outside world” to discuss sensitive matters that can give away clues about policy action and confer an unfair advantage relative to the public. Common sense tells us that central bankers should avoid interaction with the private sector, at least during the run-up to important decision announcements. But the ECB doesn’t seem to share this view.

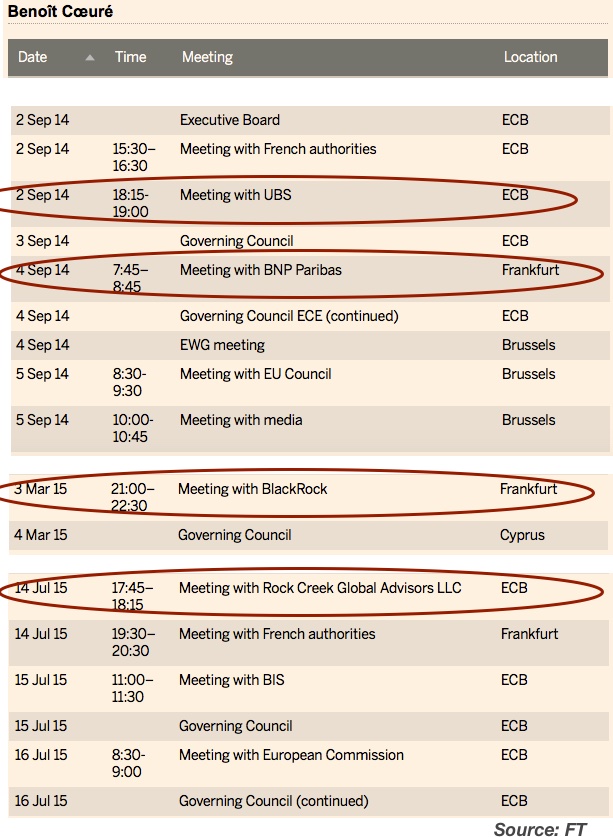

The FT, under the EU freedom and information rules, had access to the ECB diaries covering meetings of the six members of the executive board (who, along with all national central bank governors, constitute the current 25-member governing council). The diaries report their meetings between August 2014 and August 2015. The FT found that some of the ECB policymakers met bankers and asset managers days before major policy decisions. In some cases, the meetings occurred in the middle of a two-day governing council meeting, just hours before a decision was taken, which clearly undermines the transparency of the decision-making process.

For a central bank with 12 governing council meetings scheduled a year (now just 8), it would be easy to blacklist 12 weeks on its calendar when no meetings with the private sector would occur, as there would still be 40 weeks available to schedule such meetings. But still, some members of the ECB insist on scheduling some of these meetings very close to the governing council meetings. Some of them have indeed occurred at particularly sensitive periods when the ECB has taken important decisions, such as cutting its key rates and revealing the details of its €1.1 trillion asset purchase programme. While ECB rules governing the “quiet period” clearly forbid the discussion of sensitive matters in the week before the governing council meeting, they don’t ban them completely, as long as no material information is passed on. Such a legal framework covers the decision process with opacity and ultimately brings the independence of the central bank into question.

The blackout period at the FED and the three-day ban at the BoE

To protect the general public from any unfair advantage a particular bank or entity could gain from a meeting with a central bank’s policymaker before an MPC decision, the rules governing BoE conduct forbid the MPC committee members from talking to media and “other outside interests” on monetary policy matters in the week before a policy decision is about to be taken. The BoE’s code of conduct additionally states that particular care should be taken in the three days immediately prior to the MPC announcement. During that period, MPC officials are barred from talking to journalists or market participants. Banning all kinds of interaction reduces subjectivity and protects market participants. The three-day ban thus increases the transparency of the decision process.

In the US, the Federal Reserve is also subject to a blackout period during the seven days preceding a regular committee meeting. The policymakers at the FOMC must refrain from expressing any views on monetary policy or macroeconomic developments in meetings or conversations with the “outside world” during that period.

In both cases, the main goal is to allow for a reflection period and to avoid information leaks that could result in unfair advantages given to some market participants at the expense of all others.

The “Quiet Period” at the ECB

Speaking with the public in general or with the banking and financial sector in particular is not wrong in principle. In fact, as I mentioned above, it is desirable and part of the monetary policy toolkit. The ECB traditionally hosts a conference call to announce its policy decisions, during which the President of the ECB discloses the main decisions taken at the bank’s governing council and discusses the underlying monetary and economic conditions. He additionally takes on questions from journalists to help clarify the governing council views and improve the transmission mechanism of the decisions taken. But these communication strategies, as a policy tool, should start exactly at the decision announcement, when they should be strong, and then decline over time until completely disappearing a few days before the next governing council meeting occurs. That has not been the case for the ECB during the period between August 2014 and August 2015.

The ECB rules impose a “quiet period” on its policymakers, forbidding committee members from speaking in public the week before scheduled policy meetings. The rules additionally state that market-sensitive information should not be discussed during this quiet period in bilateral private meetings. But how transparent is a bilateral private meeting just hours before a policy announcement? What kinds of matters other than the policy decision itself are so important as to not be postponed to after the central bank policy announcement? In failing to completely ban such meetings, the current legal framework gives rise to opacity, as the content of such meetings would never be disclosed.

Cœuré and Mersch

According to the diaries the FT had access to, Benoit Cœuré and Yves Mersch (two of the six ECB governing council members) met people from UBS one day before the two-day governing council meeting of September 4, 2014. While one cannot know the exact nature of such a private meeting, we do know that the ECB governing council meeting resulted in a cut to the main refinancing rate from 0.15% to 0.05% and to the standing facilities rates from 0.40% and -0.10% to 0.30% and -0.20%. This was an unexpected move from the central bank, in particular because it pushed its deposit facility rate further into negative territory, at a time central banks were particularly reluctant to cut their rates to negative values. While no one knows the exact content of the meeting between Cœuré, Mersch and UBS officials, it is not difficult to speculate on a few points, such is its proximity to the ECB decision. This kind of doubt should be avoided at all costs.

Even worse is the BNP Paribas case. Earlier on the morning of the interest rate announcement day, Cœuré met with BNP Paribas officials. With the regular governing council meetings scheduled more than one year in advance, one wonders why Cœuré would schedule such a meeting with a private bank. While there is no evidence of wrongdoing, this behaviour raises a red flag.

On March 3, 2015, Cœuré arranged another meeting with the private sector just hours before the governing council announcement. Cœuré had a scheduled meeting with BlackRock between 21:00 and 22:30, while the ECB announced the details on its €1.1 trillion asset purchase programme at 13:30 of the following day.

On July 14, 2015, Cœuré again met with the private sector one day before the governing council scheduled meeting.

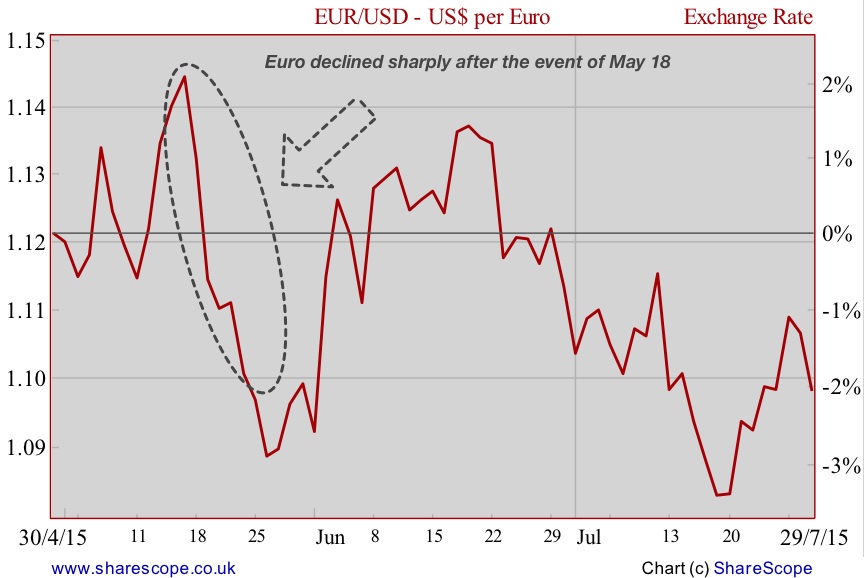

The story does not end here. On May 18 of the current year Cœuré participated in a conference sponsored by hedge fund Brevan Howard. At the conference, Cœuré said that the ECB would front-load some of its government bond-buying in May and June. That material information (which Mario Draghi later dismissed as being not material) triggered a sharp fall in the Euro and contributed to increased volatility in the yields of government bonds. But as the remarks from the meeting were only disclosed on the ECB website the following day, many could have used the information to make a substantial profit.

New rules must be enacted

Some steps must be taken at the ECB to avoid information leaks and to make the whole decision-making process more transparent. While no wrongdoing can be attributed to the action described in the diaries to which the FT had access, there remains a grey area that leads to heavy suspicion which may end in distrust. With so many meetings with banks and other market participants taking place just before the ECB meetings, one starts to question whether the current €1.1 trillion asset purchase programme was implemented because the real economy needs it, or simply because the financial sector likes it.

Comments (0)