Is Brazil set to recover?

Just a few years ago Brazil, Russia, India, China, and South Africa, the so-called BRICS were a top performing block among the emerging markets class, such that they deserved to be treated separately from the others. But the recent international developments have shown that this group is far from being homogeneous, as its constituents are more likely to perform in different directions than in tandem. While Brazil is a resource-based country, heavily reliant on its exports of raw materials, India is an importer of raw materials. This difference is enough to explain why Brazilian equities have been performing so poorly while Indian equities are flying high. The Brazilian economy has been severely damaged by a deteriorating international picture for commodities and an internal political crisis that is pushing the country back to the mid-1990s, when inflation was out of control and the cruzeiro was the official currency. The future is uncertain and the equities market has been suffering; but at a time many analysts predict emerging markets to recover, a question remains: Is there more downside for Brazil, or is it time for a recovery to set in?

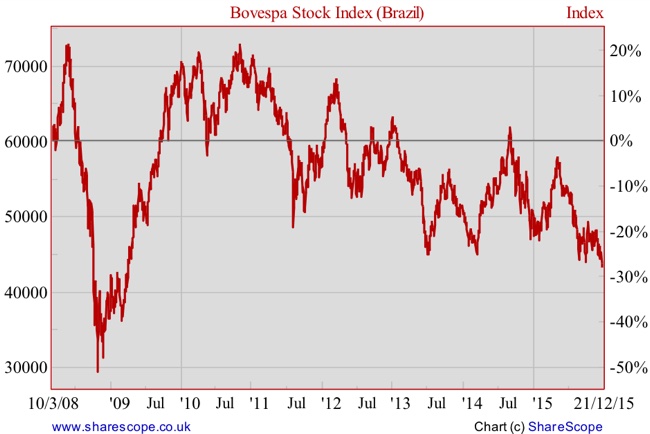

Brazil has been a story of great success in recent years. The country was able to achieve a high degree of stability, with government finances under control, inflation in single-digits, and economic growth above that of most other emerging markets. A country that had always been plagued by political scandals was able to regain the trust of foreign investors and the BM&F Bovespa exchange turned into one of the world’s biggest. The country has been experiencing huge growth and has been able to recover from recessions quickly. We have the recent example of the financial crisis that spread from the US to Brazil. Unlike Europe, Brazil experienced just two quarters of GDP declines (4Q08 -4.1% and 1Q09 -1.9%). The country quickly overcame the bad times and GDP recovered the lost ground in just two quarters, and continued to grow until 2014. But problems started when Ben Bernanke announced the end of easy money in December 2013.

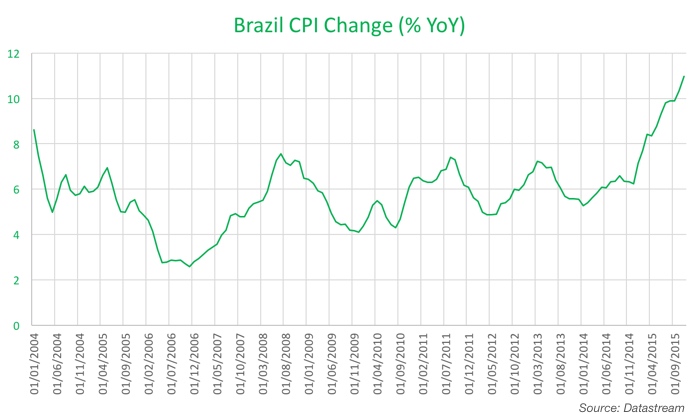

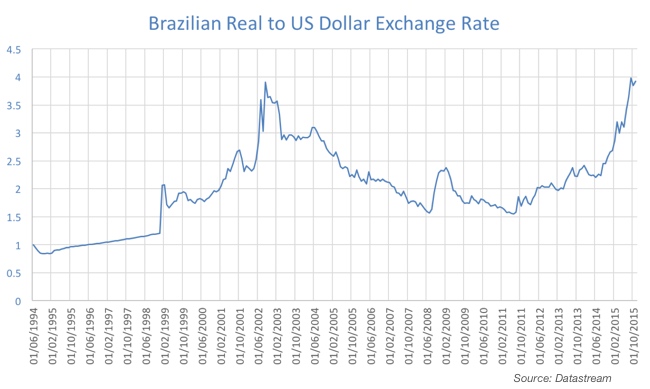

Bernanke’s hint at QE taper in mid-2013 and then the announcement of the end of QE in December 2013 was a major setback for the growth trend in emerging markets. The global economy suffered, and those countries exporting commodities were the most affected. The expectations for monetary policy normalisation in the US boosted the dollar, which pushed commodity prices lower. To sustain the real, the Central Bank of Brazil started hiking its Selic rate in 2013 but was relatively ineffective, as the pressure of a strong dollar on commodity prices led to further deterioration in the Brazilian economy and the real. One dollar could buy 2.36 reais at the end of 2013; it now buys 3.92. As a consequence, inflation shot up from 5.5% to 11.0% during that period. To avoid losing credibility that was tough to establish, the central bank has always been prepared to hike rates without mercy to counter inflation. The reverse of the coin is that monetary contraction comes at times of economic contraction, which further impacts the economic landscape. The Brazilian economy contracted 1.7% during the third quarter and posted a yearly decline of 4.5%. The last three quarters have seen negative growth and there were only two positive quarters in the last eight.

But the Brazilian story is not only about economic deterioration and sluggish global growth; it is also about corruption and political scandal. The scandal behind Petrobras is weighing on Brazil’s confidence. As the New York Times describes it:

“The Petrobras scandal would read as pure tragedy were it not filled with a cast of Hollywood-ready characters and their lavish props. The latter include a huge inventory of gifts — Rolex watches, $3,000 bottles of wine, yachts, helicopters and prostitutes. There were also staggering sums of money, most of it flowing through a network of phantom corporations, some of it hand-delivered by an elderly gentleman who flew around the world with bricks of cash, shrink-wrapped and strapped beneath thigh-high socks and a Spanx-like vest.”

Bribery and corruption scandals are not new in Brazil, but the acknowledgement of the Petrobras scandal was massive. It came at a time of deteriorating economic conditions and from one of the biggest Brazilian companies, which amplified its negative effects on the economy and contributed to a rapid erosion of confidence levels and then to a retreat of consumption and investment. The icing on the cake is the impeachment proceedings of the President Dilma Youssef and the resignation of the Finance Minister Joaquim Levy just a week days ago.

As a result of all the turmoil involving the Brazilian economy, the country lost its investment grade rating from S&P in September. The ongoing deterioration of the political landscape led to another downgrade a week days ago, this time from Fitch. The ratings agency highlights not only the deterioration in past economic conditions, but also more economic pain mixed with a ballooning public debt. Fitch expects the economy to contract 3.7% this year and a further 2.5% in 2016, while it expects the general government deficit to rise above 10% and its accumulated level to reach 70% of GDP this year. The challenge of keeping public finances tight may not mix well with the current unstable political situation, which has contributed not only to the ratings downgrades, but also to the “negative outlook” at Fitch.

In my view, Brazil faces a few challenges that will be difficult to overcome. Rising inflation is a major concern in a country where not that long ago prices were rising at four digits per year. The central bank will preserve its credibility at all costs, even if that means leading the economy to retreat further. From a low of 7.25% in 2012, the SELIC target rate is now held at 14.25%. Further hikes are expected. This will be a blow for the economy in the short term. In terms of the political arena, it remains to be seen whether Dilma Rousseff can survive the impeachment process or if a new election will be needed. But after all, Brazil is a country with sound finances and a credible international position. Public debt is rising and, with the appointment of the new Finance Minister, the necessary austerity measures may be postponed. But at a time when the central bank keeps tightening and when Brazil has a comfortable position in terms of foreign debt and reserves, allowing for some fiscal flexibility to absorb the current shocks may prove fruitful.

The Bovespa equity index has lost 13.5% so far this year. If we take the index in dollar terms the slump grows to a whopping 41.3%. But while I still see many risks in the horizon, this market is a value pick. According to data published by the firm Star Capital, there are two major worthy investments according to CAPE ratios: Russia and Brazil. The first shows a reading of 4.7x, as the country has been battered by lower oil prices and international sanctions. The second shows a reading of 8.0x, which is three times less than for the US market. In a year when momentum strategies will be replaced by value investment, Brazil is an investment to consider. As the dusts settles down, the country is poised to return to growth.

Comments (0)