Income Redistribution: A Side Effect of Monetary Policy

The other day I came across a very interesting and challenging research paper about the degree of investor sophistication and its implications on capital income inequality. While the paper attempts to explain the role of information and knowledge on investment attitudes and ultimately on capital income for varying levels of household income, it has quite a few implications for the way monetary policy should unfold. The paper concentrates in providing evidence that the most sophisticated investors earn more capital income than the others, which of course isn’t surprising, but it goes as far as to say that the advent of information technology and the acquisition of knowledge further contribute to increase the discrepancy. Those who have the money to purchase risky assets also have the money to acquire information and knowledge, which in the end will contribute to increase the wealth gap. Investing in riskier assets is then reserved to sophisticated investors, who push unsophisticated investors out of the market and in the direction of risk free assets.

That being true, and considering that sophisticated investors are usually those who have enough resources to invest and to acquire information and knowledge while unsophisticated investors are those with less income; we could speculate that when monetary policy benefits riskier assets, it should further contribute to widen the above wealth gap. At targeting zero interest rates and by purchasing assets, the central bank is maximising the price of riskier assets over the price of riskless ones, which must result in a massive redistribution of wealth from low-to-medium income households to high income ones. But most central banks fail to recognise the issue, many times claiming that there is also a redistribution issue if they do nothing when unemployment rises, because most households would by then be deprived of their main source of income – labour income. Of course that is true, but it is also true that during such difficult times financial assets do tend to crash, and that way also reducing the capital income of high-income households. Both groups seem deprived of their main income sources and there is no clear redistribution issue to justify central bank action as being less evil.

A few decades ago, income inequality was almost always referred to as a problem arising from the difference between developed and emerging countries. Today that gap has been significantly filled while a new one arose: the gap between incomes inside developed countries. Why? I really don’t know the exact answer to that, but I suspect that while governments are raising taxes on the rich and transferring benefits to the poor, always at the cost of rising debt; central banks are doing exactly the opposite, with the excuse that extreme dovishness is a lesser evil. With most agreeing that monetary policy has no real effects in the long run and with the number and severity of financial crisis increasing during the last 30 years; one can only ask himself whether that is a lesser evil, or the evil itself.

The Study

Before proceeding to the exact findings of Kacperczyc and others (2014)*, let me just make a subtle mention to the fact that, even when two groups of individuals have the same access to information and knowledge, if they depart from a situation of wealth inequality, the gap will tend to rise. A very simple example serves as evidence. Let’s say we have two income groups, one with a wealth of £1,000,000 and other with a wealth of £10,000. If both invest in the financial market 10% of their wealth and are able to achieve a 5% profit at the end of the year, while the first would accumulate £5,000, the second would earn just £50. Thirty years later, the accumulated capital gains for A and B would be £432,194 and £4,322 respectively. An initial wealth gap of £990,000 would by then turn into a £1,417,872 gap, which is 43% greater. Thus, no need for group A to really have any advantage in terms of information for it to be ever more successful than B.

Now let’s revert to Kacperczyc’s study. He claims that high-income individuals not only have the compounding effects on their side but they also have and advantage acquiring information. “Intuitively, if information about financial assets and its processing are costly, individuals with different access to financial resources will differ in terms of their capacity to acquire and process information”, it is claimed in the paper. Thus, those with higher income process better information than all others, which unlocks extra profit potential. These sophisticated investors are able to very well time their bets in risky assets. The other investors get the protection given by law that assures them equal access to material information but must rely mostly on unpaid information to take investment indecisions, which is of course insufficient to effectively invest in risky assets. They perceive this disadvantage and allocate their money to safer assets, like time deposits, highly graded government bonds, and money market funds, leaving the equity market for sophisticated investors.

While the above may sound a little too much, the truth is that the authors show evidence corroborating it. There is a growing presence of sophisticated investors in risky asset classes (equities). Institutional ownership of stocks has been growing across the years, much because of the abandonment of the market by unsophisticated investors. In the US, capital income represents 15% of household income, ranging from less than 1% for the lower income households to more than 40% for the higher income ones. This is evidence that an increase in asset prices is of no direct benefit for the poor, who just don’t own assets providing capital income. But the worst part is the fact that not only capital income is more important for the richer but it is becoming ever more important, which corroborates the idea that lower income households may be in fact abandoning riskier assets, even though access to financial markets improved significantly as did the new information technology.

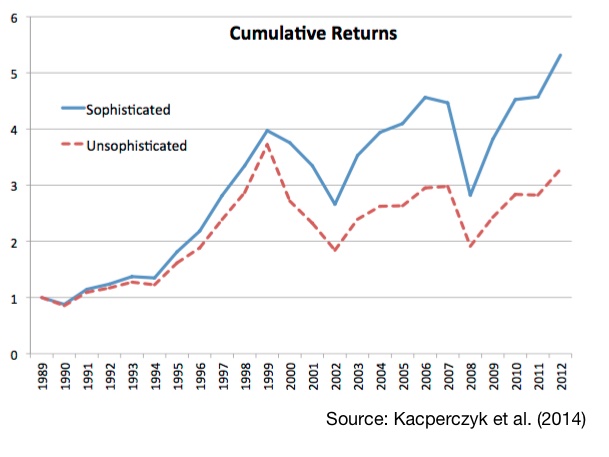

In the model developed by Kacperczyk the inequalities resulting from capital income just accumulate over time, as the extra wealth held by a sophisticated investor just allows him to acquire more information and knowledge than the unsophisticated investor does, this way contributing to a widening gap. The unsophisticated investor isn’t able to achieve the same performance the sophisticated investor does and tends to abandon riskier assets to invest in low income-generating assets. This option represents a cost for unsophisticated investors, in the form of lost upside over time, as depicted in the next chart.

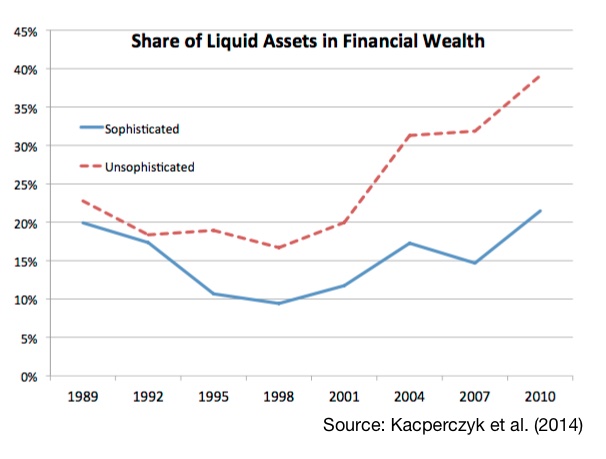

Unlike the scenario I presented at the beginning, where the two groups have no advantage over each other, apart from their initial endowment (£1,000,000 for group A and €10,000 for group B), now we assume they have the same endowment but different access to information. In the simulations conducted by the authors, they found that £1 invested at the beginning of 1989 would turn into £5.32 for a sophisticated investor and £3.28 for an unsophisticated one at the end of 2012. By mixing the information gap with the initial endowment difference, and letting compounding do the rest, we easily understand why unsophisticated investors may gradually abandon the equity market and how that can be costly to them. While sophisticated investors have been changing the composition of their portfolios over time (a U-shaped curve), the share of liquid assets in unsophisticated investors’ portfolios shows a strong positive trend. That means this later group is abandoning riskier assets while the first is trying to time the market.

The authors use their findings to claim that competition in financial services and growth of investment resources is generally seen as positive but that in fact may contribute to widen the capital income gap, as the access to these resources isn’t free, giving a great advantage to sophisticated investors. That is quite a challenging conclusion!

Implications for Monetary Policy

But while the paper tries to explain wealth inequalities based on a widening capital gains gap, there is still an avenue of unexplored terrain. Being true that sophisticated investors are those with higher wealth and that the median household no longer invests in the equity market, then any policy aimed at increasing the price of riskier assets over riskless assets may result in very large redistribution effects. At the same time, the portfolio effect that justifies the asset purchase programmes is at stake. If those who own assets are only the rich then one shouldn’t expect much consumer inflation from such policy. That is because the rich are exactly those who spend less on the margin. At the same time, the poor, who are those willing to consume the most on the margin, will see their capital income reduce with the decrease in interest rates. One should also not expect much here. Before launching a QE programme, and because there is evidence supporting the existence of large side effects deriving from it, a central bank needs to clearly identify how risky assets are distributed across households. If this is an issue in the US and in the UK, where households do own some financial assets, I just can’t imagine what happens in the old Europe where traditionally households don’t own financial assets…

Central banks have no clue on how they can do it… eventually because they just can’t do it. But they want to bet everything they can, and are willing to do it at all costs…

“Non-conventional monetary policy however, in particular large scale asset purchases, seem to widen income inequality, although this is challenging to quantify…Still, a central bank with a clear mandate to safeguard price stability needs to act forcefully when push comes to shove. These distributional side-effects then need to be tolerated”, said Yves Marsh, a member of the Executive Board of the ECB, in a credit conference last year.

Did he mention price stability? Please apologise for his mistake, it should read, “consumer price stability”, because all other prices seem completely out of control. For a coffee to cost the same for you every year, the price of the Apple’s stock must go wild. That’s how monetary policy works today!

Comments (0)